Things are a mess at the Federal Reserve.

President Trump is not happy with current Fed Chair Jerome Powell regarding reported expense overruns related to renovations at the Fed’s Washington, D.C. headquarters.

Two Fed governors also took the unprecedented step of dissenting from the ranks during last month’s Federal Open Markets Committee (FOMC) — the meeting that determines things like rate cuts and hikes.

Regarding rate cuts, Trump is hounding Powell because rates haven’t been cut since December last year.

All of this has spurred the president to find a way to replace Powell before his term ends in May 2026.

While Wall Street doesn’t really care about most of this turmoil, it does have its sights set on a rate cut when the Fed meets next month.

Today, I’ll give some insight into how to play what could be coming down the road.

If Bond Traders Say So…

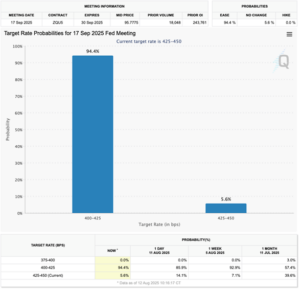

The CME FedWatch tool is a popular gauge of how Wall Street is interpreting the future of fed funds rates.

It essentially estimates the likelihood of the Fed raising, lowering or maintaining rates at its next meeting.

Estimates Call For Rate Cut

As of this morning, the latest estimates suggest a 99.9% chance of a 25-basis point rate cut during the Fed’s September policy meeting.

This is up from 86% on Monday and just 57.4% a month ago.

What’s even more interesting is that the chance for additional rate cuts in October and December also went up:

- The chance for another 25-basis point cut in October went from 55% on Monday to 70.5% this morning.

- December‘s probability went from 45% on Monday to 60.3% today.

These 30-day options traders are starting to bet heavily on, not just one rate cut, but three before the end of the year.

The reason those bets are getting bigger is simple … the numbers are looking better.

The FOMC is data-driven in its dual mandate of 2% inflation and maximum employment.

Yesterday, the July Consumer Price Index (CPI) — one of the Fed’s key inflation guides — came in cooler than expected.

While consumer prices ticked up to 2.7% on an annualized basis, this was less than the expected 2.8%.

This indicated that Trump’s tariff war did not have as strong an impact on consumer prices as expected.

That report alone helped the Nasdaq Composite and S&P 500 indexes close at record-highs yesterday. Early trading this morning looks bullish as well.

Couple the CPI with lighter-than-expected jobless claims, and fed funds futures traders got what amounts to a green light to keep placing bets that a rate cut is coming.

Now, let’s look at what sectors of the market benefit from lower rates…

It’s Not All About Big Companies

Multiple sectors benefit if and when the Fed cuts its benchmark rate:

- Consumer Discretionary — Rate cuts signal a stronger economy and spur people to buy those items they’ve been holding off on (think, televisions, computers and automobiles). With costs lowered, it’s much more attractive to borrow money for big purchases.

- Technology — Tech companies rely heavily on borrowing money to fund growth and development. When benchmark rates go down, so do borrowing costs, making it cheaper to access new capital.

- Financials — Lower interest rates mean more borrowing activity for banks. The drawback is that lower rates also mean a shrunken net interest margin because the banks aren’t getting as much interest on loans. However, increased activity can offset the lower margin, leaving banks to profit more.

- Real Estate — Want to buy a house, but you’ve been sitting on the fence? Lower interest rates mean lower mortgage rates, which tends to push fence-riders off and into the housing market.

Other sectors, like utilities and homebuilders, also see a benefit from lower benchmark rates.

However, I’ll focus on one group of stocks I mentioned last week … small caps.

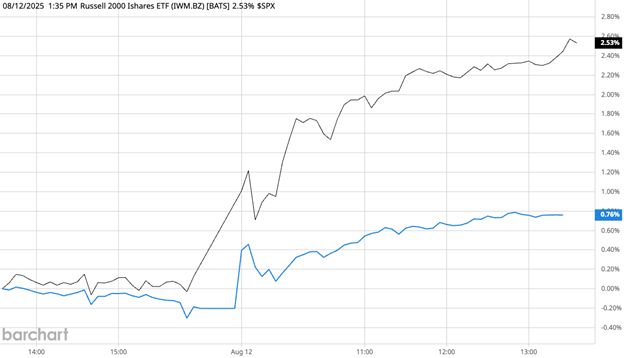

The small-cap Russell 2000 was down 0.4% since the start of 2025 through last week, while the S&P 500 rose nearly 8%.

I said then that small-cap stocks could be poised for a breakout if they hold above their 200-day moving average.

Well, the Russell 2000 has done that and more:

Small Caps Outgain S&P 500 On Heels Of CPI

Yesterday, after the CPI report dropped, the iShares Russell 2000 ETF (IWM) rose 2.5% through midday trading … more than 3X the S&P 500.

That’s because if there is a basket of stocks benefitting from a Fed rate cut, it’s small-cap stocks.

Small caps rely heavily on debt to get their business off the ground. Like with tech companies, when interest rates fall, borrowing costs follow suit, making access to financing much more attractive.

Reduced borrowing costs can also lead to increased profitability, making small-cap stocks much more attractive to investors.

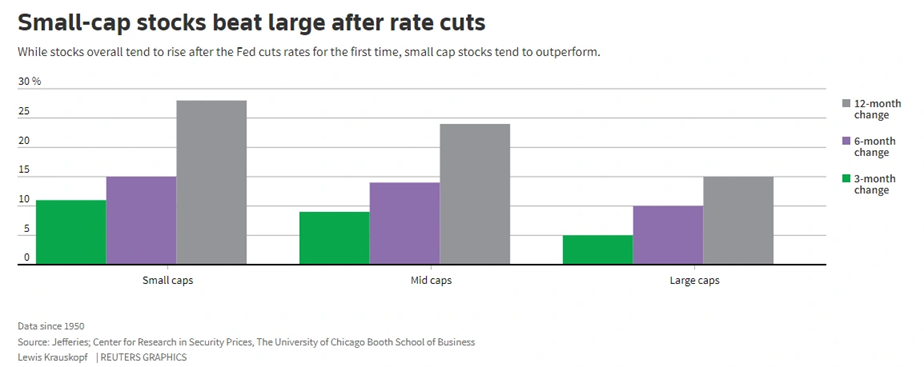

Investment firm Jefferies found that since 1950, small-cap stocks have beaten mid- and large-cap stocks in terms of returns after a rate cut.

Twelve months after an initial trim, small-cap stocks climbed 28%, mid-cap stocks jumped 24%, and large-cap stocks rose 15%.

It’s the same story over shorter periods (i.e., 3 months and 6 months).

The bottom line is that if/when the Fed starts cutting rates, I expect to see a significant resurgence in small-cap stocks.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. If you’re curious about how small-cap stocks look in our Green Zone Power Rating system currently, click here to see how you can join Adam’s flagship investing service, Green Zone Fortunes, today. With your subscription, you’ll have free rein with the system and can look up thousands of stocks to see how they stack up for current market conditions.