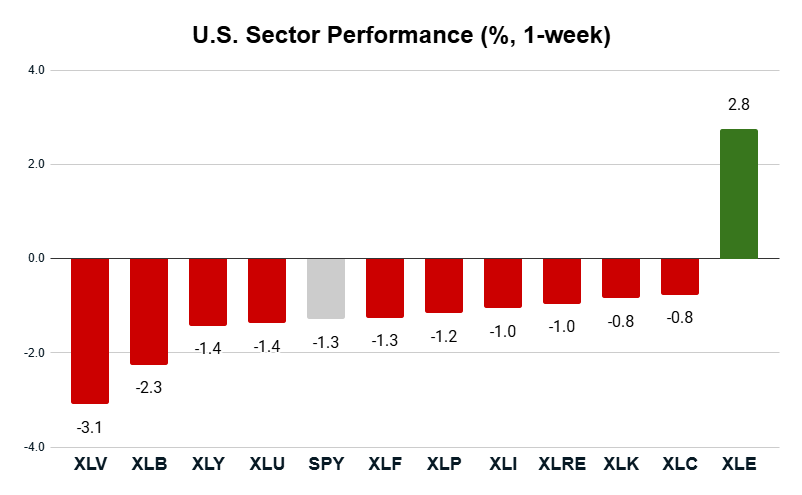

Looking at the sea of red in the chart below, you’ll see investors used last week to take some money off the table — except for in one sector…

As tensions in the Middle East continue to simmer, oil prices are seeing renewed upward pressure, which has been a boon for the energy sector after years of underperformance.

The 2.8% gain from the SPDR Energy Sector ETF (XLE) was the lone bright spot in an otherwise bearish week:

Key Insights:

- The S&P 500 (SPY) closed the week -1.3% lower.

- The energy sector was the only sector with a positive return (2.8%).

- Four sectors underperformed the S&P 500.

- Health Care (XLV) lagged the rest with a 3.1% loss.

When crude oil futures opened for trading last night, prices spiked to just over $78 … a level we haven’t seen since September 2023. But since then, much of that move has reversed, and oil is now back to trading within the $55 to $75 range it’s been in for the better part of two years.

No one knows for sure what comes next, but it’s natural for investors to continue mulling over a potential Iranian response after the U.S. launched attacks on three of Iran’s nuclear facilities over the weekend.

As I mentioned last week, so far investors are betting this conflict between Iran and Israel will remain “contained.” That’s why we aren’t seeing any major selling to kick off this week. In fact, U.S. stock indexes are edging higher.

Let’s dig into our best- and worst-performing sectors and see how some of these stocks stack up in my Green Zone Power Rating system…

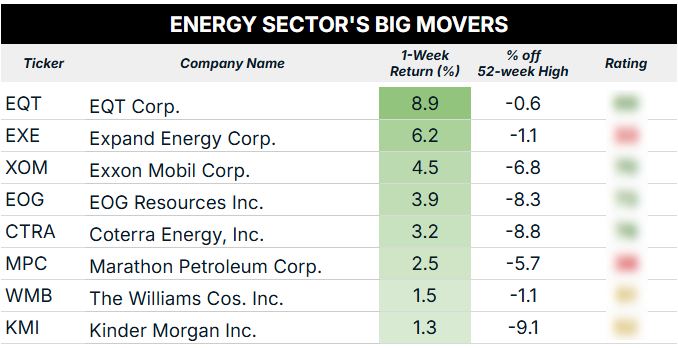

Energy Sector Top Performers

After screening for all S&P 500 energy sector stocks that closed last week within 10% of their 52-week highs, you can see the top performers from last week in the table below:

Right off the bat, this is an incredibly encouraging list if you’re looking for energy stocks that are poised to outperform from here.

Four stocks on the list above (EQT, XOM, EOG, CTRA) rate “Bullish” in my system. If you want to look up each of these tickers to see how they stack up on my six quant factors, click here to see how you can join Green Zone Fortunes and gain full access to my system now.

Of note, EQT Corp. (EQT), Exxon Mobil Corp. (XOM), Coterra Energy Inc. (CTRA) and Marathon Petroleum Corp. (MPC) have all now made this list two weeks in a row.

This kind of sustained momentum is encouraging, especially within a sector that has otherwise been struggling for months now.

A few of these stocks are creeping up on their 52-week high, so I’ll be watching to see if they can hit that point and break higher. But five of the stocks above still have plenty of room to run higher before facing that same test.

Now let’s move over to the health care sector, after it led the pack of losers…

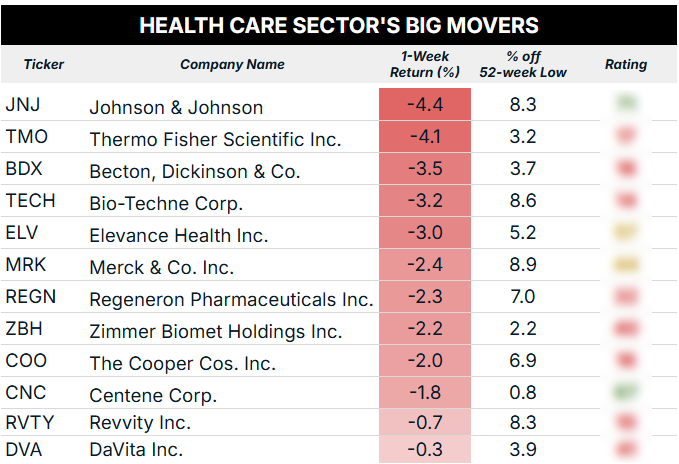

Health Care Sector Lags

As we saw above, every sector outside of energy couldn’t muster a positive performance last week.

And health care (XLV) was the worst-performing of the bunch.

Here’s what my screen of the weakest health care sector stocks revealed:

You’ll notice that none of these stocks had that bad of a week. A 4.4% loss for Johnson & Johnson (JNJ) stings, but that’s easy enough to recover from over the next few weeks or months. That’s especially true for JNJ since it still boasts “Bullish” Green Zone Power Ratings.

However, health care is also a sector where being highly selective really pays off. It’s an incredibly competitive landscape, where one bad drug trial can make or break a company — especially for the smaller players in the space.

Looking at the overall Green Zone Power Ratings of the 12 stocks above, we have:

- 8 stocks that rate “Bearish,” meaning they are set to underperform the broader S&P 500.

- 2 stocks with “Neutral” ratings, meaning they should track the S&P from here over the next 12 months.

- And only 2 “Bullish” stocks that should outperform.

Going off my system, is it really a huge surprise that a vast majority of these stocks underperformed?

Again, if you want to look up any of these tickers yourself, click here for more info on how to do that in Green Zone Fortunes. You’ll also get a chance to see how we’re invested in both the energy and health care sectors. (As I write, our top health care holding is up 82% since adding it to the model portfolio in November 2024, and our top energy stock is up 430%(!) since November 2022.)

Have a great week!

To good profits,

Editor, What My System Says Today