It’s impossible to keep up with everything going on in financial markets and the economy these days. That’s where The 5, a new feature for Money & Markets Daily, comes in…

Let’s start your week off right by exploring the most significant trends and opportunities you need to know now.

The Fed’s “Inflation Gauge” Just Hit a 3-Year Low … Time for Champagne?

Inflation cooled off in May, clocking in at 2.6% on a year-over-year basis.

That’s the lowest annual rate in more than three years and down 0.2 percentage points from April.

Stripping out volatile food and energy only pushed the core personal consumption expenditure index up 0.1% from last month.

All of the latest figures were in line with market estimates.

Why it’s important: PCE is one of the main gauges the Federal Reserve uses to track inflation.

Last month, the Fed scaled back its projections for future rate cuts, but the latest slowdown to inflation could provide leverage for a rate cut in September. (Rates are already coming down in the Eurozone as well, with a 0.25% rate cut from the European Central Bank earlier this month.)

Inside the numbers: Expenditures on health care ticked up 0.7% in May, while housing and utilities climbed 0.4%.

Declines came in recreation services (-0.3%) and transportation services (-0.6%). This data is consistent with a recent TransUnion survey that found Americans were cutting back on spending where they could.

Up next: The government’s monthly employment report is due on July 5 and will show how income growth is holding up compared to expenditures.

The Rent Is Too Damn High (Especially in Europe)

Some of you may remember Jimmy McMillan.

Back in 2010, McMillan — a Vietnam War veteran — was running for Governor of New York when he repeated a phrase that turned him into an internet legend.

During a gubernatorial debate, McMillan famously spoke those six words.

“The rent is too damn high.”

Now, while we in the U.S. may not be happy with our monthly rent, it pales in comparison to what people will pay in one tiny European nation.

For the low, low price of $30,000 per month, you can get … are you ready for this … a 1,200-square-foot apartment in Monaco.

And that’s not top-tier living, either. While it has a great waterfront view, you’ll also contend with a windowless bathroom and a very small kitchen.

For that same amount, you can rent a 3,100-square-foot apartment in Manhattan equipped with massive windows overlooking Central Park.

Want something more sensible?

A 1,100-square-foot luxury rental in Monaco will cost just $19,000 a month, compared to $9,200 for a similar pad in notoriously expensive New York City.

McMillan was right.

The rent is certainly too damn high … and not just in Monaco, either…

Rents Are Trending Higher in America, Too

While renting in Monaco may be out of reach for most of us, the rental picture in the U.S. isn’t getting much better:

According to property data firm Redfin, median U.S. rents jumped 0.8% in May to their highest level in more than a year.

One of the big reasons is supply and demand.

The construction of new multifamily housing fell below the 10-year average, and demand for rentals, especially among young Americans, continues to rise.

Those pivoting from homebuying to rental because of high interest rates and home prices are finding it difficult to locate affordable housing.

In fact, median rents increased by double-digits in cities like Washington, D.C., Cincinnati, Chicago, Minneapolis and Virginia Beach.

Why it matters: Higher rents speak to the status of the broader housing market in the U.S.

Buying a home will continue to be a stretch with higher interest rates and home prices.

Inflation has already pushed many Americans’ budgets to the breaking point, and the longer rents and home prices remain high, the more pressure it will put on finances.

Know Your Worth: Bing Edition

Microsoft’s search engine (Bing) is often lumped into discussions of the Big Tech company's failed products such as Zune, the Windows Phone, Vista, Millenium Edition, Microsoft Bob (the list goes on and on).

When Bing first launched in 2009, investors thought the new search engine might dethrone Google.

Fast-forward to today, and Bing is scraping by with a measly 3.64% share of the search market. It just never caught on.

But that doesn’t mean Bing is a failure. Not by any stretch of the imagination…

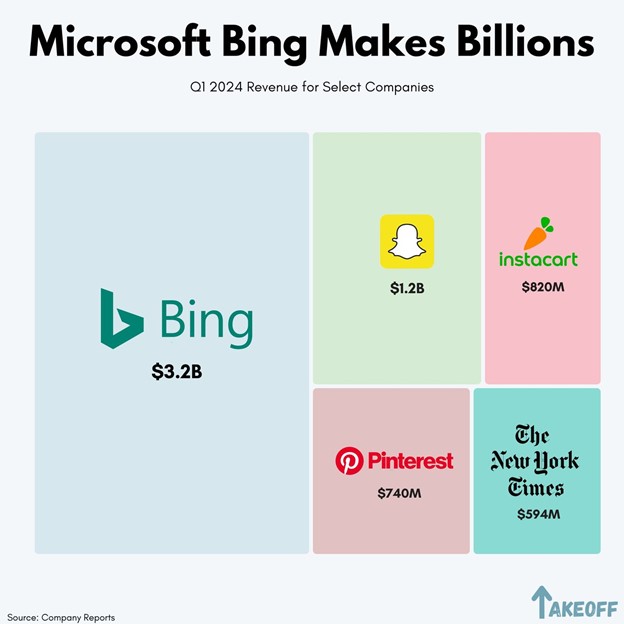

Because Take Off, a tech analyst site, found that Bing made Microsoft $3.2 billion in the first quarter this year — more than Snapchat, Instacart, Pinterest, and the New York Times combined:

The search engine business can be very lucrative, even if you’ve only got a small slice of the pie. Bing brought in more than $12 billion in ad revenue last year alone.

Goes to show — appearance isn’t always reality.

(That’s especially true when it comes to AI investing.)

A Look at Warren’s Will

Death is a part of life. And the older we get, the more important it becomes to prepare for our own passing.

Now 93 years old, Warren Buffett is one of the wealthiest men in human history. And he sat down for an exclusive interview with The Wall Street Journal to talk about how his massive fortune will be handled in his absence.

It’s the dictionary definition of “morbid curiosity,” but taking a peek at Warren’s will gives us some insights into who the Oracle of Omaha is as a person.

For example, there won’t be any Succession-style battle for control of his company.

Instead, his children will have to unanimously decide which charity receives the bulk of Buffett’s wealth. “I feel very, very good about the values of my three children, and I have 100% trust in how they will carry things out.”

What about you?

Send a quick email to Feedback@MoneyandMarkets.com to tell us which charity YOU would choose to receive Buffett’s wealth.

We’ll feature the most compelling answer here next week.

— Money & Markets Team