It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just five minutes.

Let’s get started!

The First Salvo in the Latest Trade War Fired

The game of “will he, or won’t he” regarding President Donald Trump and tariffs has reached an apparent conclusion.

Over the weekend, the White House affirmed that Trump will impose tariffs on Canada, Mexico and China beginning tomorrow.

The move put Monday’s markets around the globe in a risk-off position. The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite opened this morning down between 1.2% and 1.9%.

Bitcoin and ethereum tumbled while the U.S. dollar and oil both saw increases in early morning trading.

This falls in line with how the market reacted to the rounds of tariffs issued during Trump’s first term in office (you can see my analysis from January here).

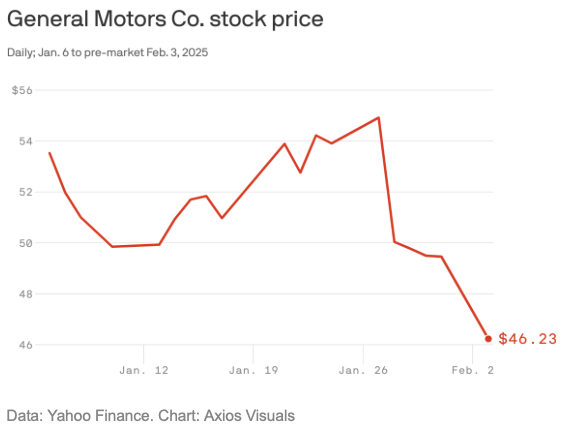

And we’re already seeing negative reactions among stocks in certain tariff-sensitive industries…

American automakers General Motors (GM) and Ford (F) were both down in early trading along with Constellation Brands (STZ), which imports alcohol from Mexico. Chipotle (CMG) was also down as it relies on imported ingredients for its 3,300 stores in the U.S.

This new potential trade war adds to what has been a volatile start to 2025, and we’ll keep tracking these developments closely to see what they mean for your portfolio.

The Other Massive Headline of 2025…

Of course, tariffs aren’t the only thing on investor’s minds.

Just a week ago, we were figuring out what DeepSeek’s supposedly cheaper artificial intelligence model means for the future of the AI mega trend.

When China’s DeepSeek announced it had developed a comparable AI model to OpenAI’s ChatGPT, investors wiped out $1 trillion of Big Tech market cap over two days, and Chief Investment Strategist Adam O’Dell could see that happening again.

But he’s not projecting a massive crash. Instead, he sees huge swaths of Wall Street’s money flowing into another corner of the market.

Stay tuned…

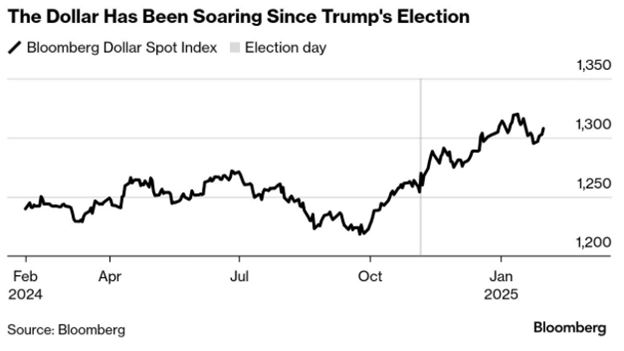

King Dollar on the Rise

The U.S. dollar was already on the rise after the election of Donald Trump.

This new round of tariffs may only make it stronger.

The Bloomberg Dollar Spot Index jumped nearly 1% in premarket trading this morning, resuming a run that started on Election Day.

The index has risen more than 5% since November.

Big banks are suggesting that there is money to be made by buying the dollar.

Analysts with Goldman Sachs project the dollar breaking its long-standing parity against the euro, while JPMorgan said the U.S. dollar could buy nearly 1.50 Canadian dollars for the first time in a generation, according to Bloomberg.

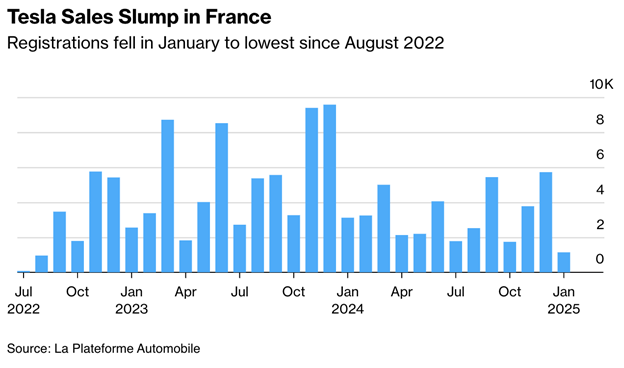

Tesla Registrations Struggle in … France

In 2024, Tesla Inc. (TSLA) experienced its first annual sales drop since 2011, as the electric vehicle manufacturer sold 1.79 million vehicles worldwide.

That was 1.1% down from 2023.

It seems 2025 isn’t starting well for Tesla… at least in France.

In January 2025, Tesla sales plummeted 63% in the European Union’s second-largest EV market, with only 1,141 new cars registered in the country.

That’s the fewest Tesla’s registered in France since August 2022, according to Bloomberg.

Tesla underperformed the overall industry and total EV sales for the month, which dropped 6.2% and 0.5%, respectively.

The company struggled with EV sales across Europe in 2024, with registrations falling 13% — most of which occurring in Germany, where sales fell 41%.

U.S. EV sales results for January are expected to be reported by the Federal Motor Transport Authority on Wednesday.

After the Trade War News, How Bullish Are You for 2025?

With a new trade war now a reality and more planned levies against global superpowers on the docket, are you worried about the state of the bull market?

That’s the topic of our latest Money & Markets poll…

With Nvidia’s DeepSeek-driven rout last week and this latest sell-off in response to President Trump’s tariffs, it’s clear that volatility is going to be high in 2025. But that doesn’t necessarily mean we’re in for a crash. Remember, volatility works on both the up- and downside.

So take a minute to answer one question: How bullish are you for the stock market in 2025?

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets