With the utilities sector being the standout bright spot in the market last week, it begs the question:

Is this “boring” sector totally flying under the radar?

Utilities are critical for making our daily lives cushy and first-world. These companies “keep the lights on,” so to speak…

And while they provide critical services, public utilities aren’t big headline-grabbers like, say, tech and artificial intelligence are.

This doesn’t mean their stocks are any less investable, though. It just takes a little more work to find the truly compelling ones.

And that’s why I run this Green Zone Power Rating “x-ray” each week.

Let’s see what it revealed about the utilities sector this time around…

Utilities Sector X-Ray: Ratings Rotation

At the end of June, my “x-ray” of the utilities sector revealed it was in good standing based on my Green Zone Power Rating system. An impressive 17 of 31 stocks were rated “Bullish” or better, and only eight stocks were “Bearish.”

That picture has shifted quite a bit in just over a month, and today’s exercise shows you just how much my system can adapt to fast-changing fundamentals and price action.

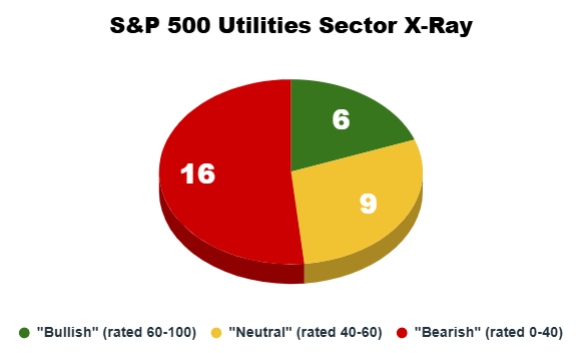

As a reminder, there are three broad categories that stocks fall into:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

Here’s how the utilities sector looks now based on the Green Zone Power Rating system.

Of the 31 stocks analyzed, only six stocks (roughly 1 in 5) rate “Bullish” now, and 16 (more than half) rate “Bearish” — or even worse — “High-Risk” with a greater chance of underperformance over the next 12 months.

It’s not especially common to see such a dramatic shift in a short amount of time, but it makes some sense. It’s almost like the “Magnificent Seven effect” is happening in the utilities sector…

Investors see that utilities stocks are outperforming the broader S&P 500 at a good clip, so they start targeting the stocks that they think will lead the pack. Those stocks, naturally, will carry on their strong Green Zone ratings, while others are downgraded to “Neutral.”

This phenomenon also pushes lagging stocks into “Bearish” territory.

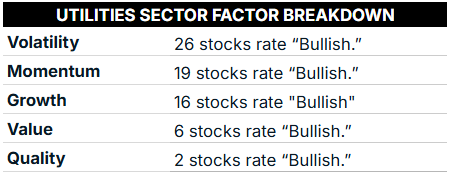

My Green Zone Power Rating factor breakdown supports this argument as well…

Utilities Exhibit Tech-Like Factor Ratings

When looking at the factor ratings of the utilities sector, I’m seeing more evidence of a tech effect here…

Most of the concentration of “Bullish” individual factor ratings lies in Volatility, Momentum and Growth, while very few utilities stocks rate well on Value or Quality.

To broadly define the utilities sector now, I’d say these are growing companies with stock prices that are rising at a steady clip. But investors are paying a hefty premium to own them.

To explore this further, let’s look at the utilities sector through the lens of my Growth factor.

High Growth in the Utilities Sector

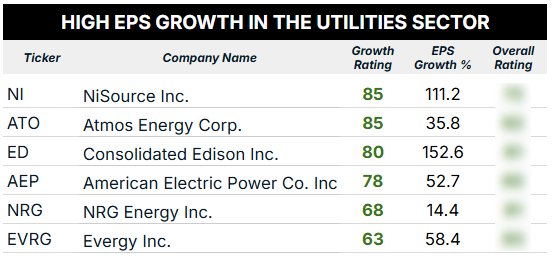

In the screen below, I grabbed the six stocks that currently rate “Bullish” or “Strong Bullish” in the utilities sector, as well as their Growth rating. I won’t reveal their overall rating here, but if you’re a paid-up Green Zone Fortunes subscriber, you can look these tickers up at any time in my system by clicking here and searching for them.

For anyone who isn’t a member yet, click here to learn how you can join the fun and start looking up thousands of tickers in my Green Zone Power Rating system yourself.

Here’s what that screen revealed:

I included quarter-over-quarter earnings per share (EPS) growth here as well because it’s a great measure of a company’s profitability growth.

Overall, those are some knockout growth numbers! Could these be the “Magnificent Six” of the utilities sector? Time will tell…

But again, remember that this is only six out of a sector of 31 stocks.

It’s just more proof that “getting picky” is paying off in this market.

To good profits,

Editor, What My System Says Today