You can’t keep a tech bull down for too long … at least not in this market!

Yesterday, I walked through how the tech sector led the market higher last week, so now I want to see how the component stocks in the sector are positioned, according to my Green Zone Power Rating system.

Let’s dig in…

Tech Sector X-Ray

We always start our sector analysis with a simple two-step process.

First, we want to note the general direction of the tech sector’s trend — is it “up” or “down”?

Looking back, we know the sector was stuck in a downtrend between February and April. But more recently, the sector is up almost 40% from its April lows and has reclaimed its “uptrend” status.

Next, we’ll judge the individual stocks within the sector, which is generally called breadth analysis. If a majority of individual stocks within a sector are sending a “bullish” message, there’s a good chance we can trust the bullish uptrend we’re seeing more broadly.

I’m also watching how investors react to many of these tech stocks as they flirt with new highs.

I noted yesterday how a couple of stocks in the Magnificent Seven are within 10% of their 52-week highs. Will we see a new break higher, or will people take more money off the table after this impressive two-month rally?

For now, we’ll analyze the tech sector as it stands currently.

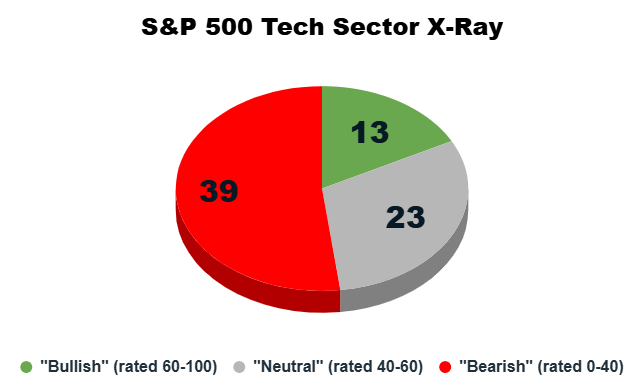

First, we’ll consider my Green Zone Power Rating system’s Overall rating for each of the tech sector’s stocks, which can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

The pie chart below effectively “x-rays” the 75 tech sector stocks in the S&P 500, asking how many of them currently rate Bullish, Bearish or Neutral.

Have a look…

The technology sector isn’t as bearish as some other sectors we’ve analyzed recently, but a full 52% (39 tech stocks) in the S&P 500 currently rate “Bearish” or “High-Risk” in my Green Zone Power Rating system.

And with only 17% (13 stocks) rated “Bullish” or “Strong Bullish,” being more selective is going to pay off.

Now, let’s look at individual Green Zone Power Rating factors to see what we can learn about the sector’s characteristics…

Tech Investors Target High Momentum, Poor Value

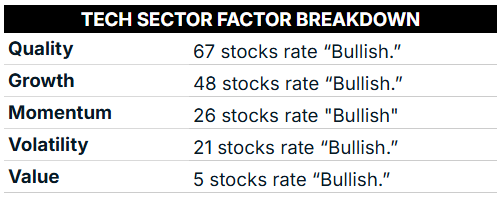

We looked at the tech sector’s Overall Green Zone Power Ratings above. Now, we’ll drill down into five of my system’s individual factors. We’ve left size out of the analysis because all of these stocks rate poorly there due to large market caps.

We’re simply asking: “How many S&P 500 technology stocks rate ‘Bullish’ (60 – 100) on Momentum, Volatility, Value, Quality or Growth?”

This analysis gives us a feel for the dominant characteristics of the sector’s component stocks.

Listed in order, from the factor with the most “bullish” stocks down to the factor with the least number of bullish stocks, here’s how “Big Tech” shapes up today:

We analyzed the tech sector back in April at the tail end of the tariff-driven sell-off, when market conditions weren’t nearly as favorable as they are today.

But it’s worth reviewing my analysis again since the ratings makeup of the sector hasn’t changed much since then:

These are quality businesses, yes … but the valuations of these businesses have gotten out of hand — their stocks are “expensive!” As a whole, I expect the broader technology sector will face headwinds until investors begin to feel there are at least “fairly” valued stocks, if not “bargains,” to be had.

While we’ve seen incredible price action in tech since April’s tariff pause, these stocks are still trading at a premium. Only five stocks are rated “bullish” on my Value factor. That’s slightly worse than my April screen, when seven stocks made the cut.

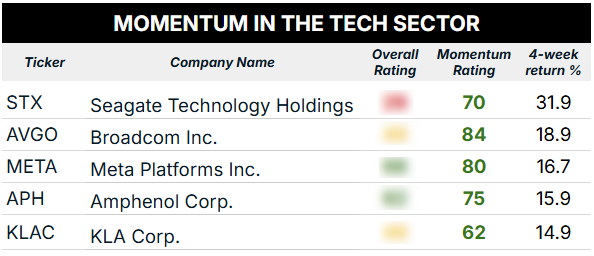

Since that’s not seemingly stopping anyone from bidding the stocks to even higher prices, I thought I’d close today’s analysis with a focus on near-term momentum. Below, you’ll find five stocks that rate “Bullish” on my Momentum factor and that have had the best price action over the last four weeks.

This is momentum in action (valuations be damned!)…

Of note, Seagate Technology Holdings (STX) has led the charge with a 31% gain over the last four weeks; however, the stock rates “Bearish” overall in Green Zone Power Ratings, largely due to its poor Growth rating (33) and lofty valuation metrics, which earn it a Value rating of just 21 out of 100.

Meanwhile, only two stocks in the list above are rated “Bullish” overall on Green Zone Power Ratings.

If you want to look up any of these stocks for yourself in my system, click here to see how you can join Green Zone Fortunes and gain full access to the ratings now.

You’ll also find out how we’re investing in the tech sector’s bullishness (and it’s not just buying the “Mag 7”).

Otherwise, have a great Tuesday!

To good profits,

Editor, What My System Says Today