Tell me if you’ve read this one before:

HHS Calls for Easing Restrictions on Marijuana, Sending Cannabis Stocks Higher

That’s a headline that hit my feed after positive industry news broke on Wednesday.

I opened up my Fidelity account … and sure enough, my position in Canopy Growth Corp. (Nasdaq: CGC) was up 13% by the time markets closed that afternoon. It’s 40% higher than it was five days ago, even!

Now my position is down 97% instead of 98.5%. (Yup, I bought CGC at its February 2021 top.)

I’m not here to blast that headline or cannabis investors. I would love for this rally to become the cannabis bull run we’ve all been waiting for.

But as Matt Clark repeated in his Marijuana Market Potcast of yore, cannabis stocks need federal legalization before we can consider this a long-term investable industry.

Until that happens, it’s a bit like throwing darts blindfolded.

That’s why we have Adam O’Dell’s proprietary Green Zone Power Ratings system. We can plug tickers in to see if they are set to beat the broader market over the next year or not.

Just look for that search bar at the top of this page.

Let’s get into it…

The Biggest Name

I’m sticking to the bigger companies in the industry for two reasons:

- They are more established in U.S. markets.

- They actually are large enough to rate in Green Zone Power Ratings. (Companies below a $250 million market cap aren’t rated.)

The cannabis industry is highly competitive as legalization spreads across the country, and that means plenty of companies are vying to be the next big name. But we want to avoid the next MedMen…

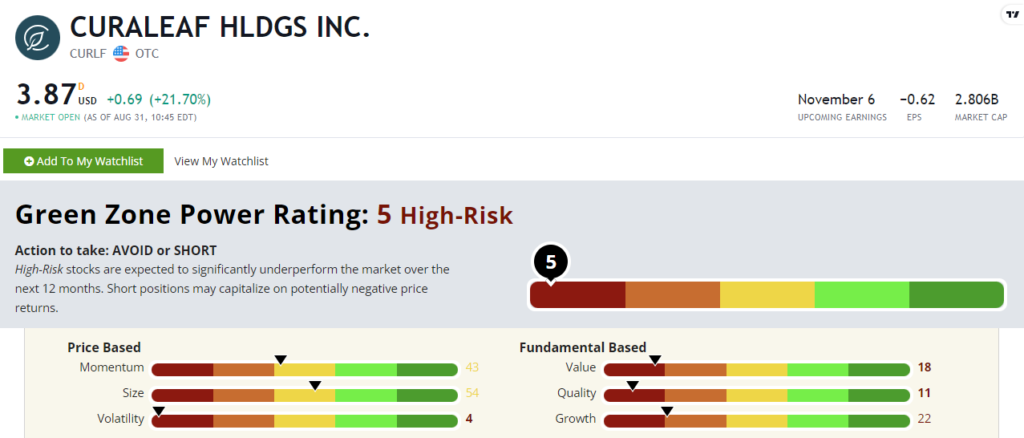

That’s why I’m starting with Curaleaf Holdings Inc. (OTC: CURLF), which rates a “High-Risk” 5 out of 100:

Curaleaf, established in 2010, is now serving 10 countries across Europe and North America.

Its $2.8 billion market cap helps boost its Size factor score to 54, and its recent price gains have helped its Momentum jump to 43.

But those fundamental factor scores are what we need to focus on. With low Growth (22), Quality (11) and Value (18), this has all the markings of an unsustainable and overextended rally.

To hammer this home, I want to focus on one metric: earnings per share (EPS). In the second quarter of 2023, CURLF reported -$0.07 EPS, and that still missed analyst expectations of -$0.04. It’s not uncommon for companies to lose money as they target growth, but to miss an already low bar is a big red flag.

This company has established itself in the cannabis industry, and short-term momentum is hard to ignore. But we want to find sustainable stocks to invest in.

If you plug other cannabis tickers into Green Zone Power Ratings, you’re likely to see similar metrics.

With that said, I did find a company that is taking a different approach in the industry. And it’s the top cannabis-related stock our system tracks.

A Different Angle

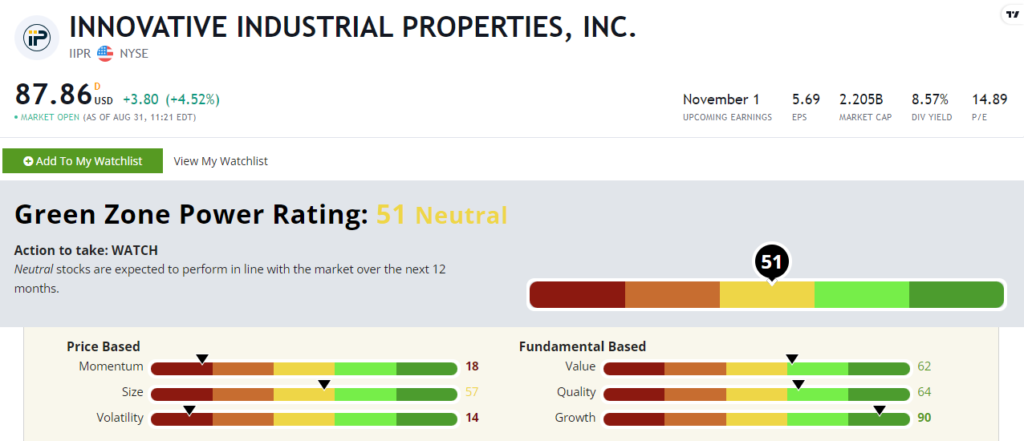

Matt has talked about Innovative Industrial Properties Inc. (NYSE: IIPR) a few times over the years.

IIPR is a real estate investment trust that essentially leases property to a long list of state-licensed cannabis operators. It owns 108 properties in 19 states with invested capital of almost $2.4 billion.

And its Green Zone Power Ratings look much better than most of its peers:

IIPR rates a “Neutral” 51, which means it’s expected to move in line with the broader market for the next 12 months.

And you can see much healthier fundamentals with this stock. It rates a 90 on Growth, 64 on Quality and 62 on Value.

Looking at that same EPS metric, the company reported $1.44 EPS, which still missed expectations by $0.50. But at least it’s in the black. Revenue and net income were both up year over year as well.

IIPR isn’t a screaming buy right now, but Green Zone Power Ratings shows you there is much less risk compared to some of its cannabis peers.

I’ll admit, as someone who has been tracking the cannabis industry and waiting for that big breakthrough, I was excited when the news dropped this week.

But the reality is we are still a long way from broader cannabis legalization. Until that happens, I’m putting my money to work elsewhere.

Have a great long weekend!

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. I highlighted two stocks that don’t look so hot in Green Zone Power Ratings right now. That’s only two of more than 6,000 stocks Adam’s system rates. In fact, he just added a 100-rated stock to the Green Zone Fortunes model portfolio. For information on how to access his latest high-conviction recommendation, click here.