With the widespread disappearance of pensions in the private sector, the average worker is generally stuck footing the bill for their retirement, and we often hear they just aren’t saving enough.

But there’s an even bigger risk than an inadequate savings account, according to a recent article by Quartz: the tremendous amount of risk to finance retirement and the only options to reduce that risk has never cost more.

Per Quartz:

It is true we don’t save enough. But that is always true. But by most measures, retirees are not actually worse off than previous generations. Those wonderful gold-plate pensions of years past have mostly disappeared in the private sector, but not that many people had them. In fact, between Social Security and higher rates of savings because of 401(k)s, poverty in retirement is at its lowest levels.

The fact that most of us are on our own — with many getting some help from employer matching 401(k) accounts — saving when working and spending in retirement includes a lot of risks. There’s always the risk that the stock market could crash, the risk of out-living your money or have a serious health even drain your funds.

The trick is to reduce the risk by hedging investments or insurance, which both have become so expensive — all thanks to rising interest rates.

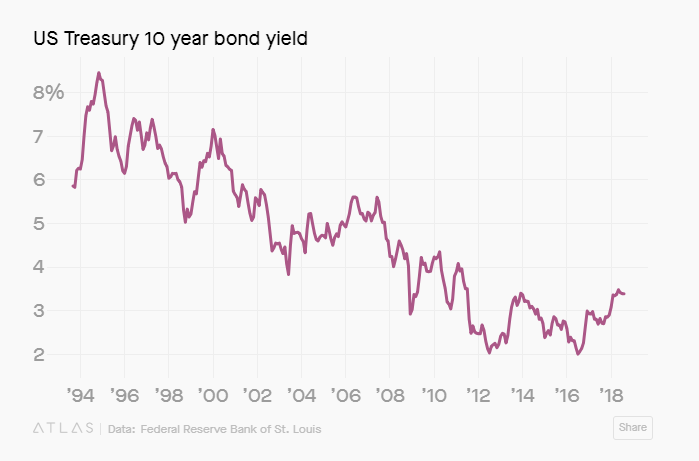

Hedging involves balancing your exposure in stocks by investing in low risk assets, like bonds. This is also how pension funds de-risk. As bond yields fell over the years, hedging has never been more expensive because low risk assets offer such a low return. This means we either have to save more to make up for lower returns or accept more risk in our portfolio.

Insurance is another option. For example, you can buy an annuity, a type of insurance product which makes regular payments during your retirement. But low rates make annuities very expensive. Insurance companies base their prices for annuities on interest rates, the market rate for a regular stream of income. Twenty-five years ago when a 10-year bond yielded 6%, $500,000 would buy you an income of $40,000 a year for 20 years, now with rates at 3%, it only buys you $31,000.

It is often assumed that low interest rates boost the economy by allowing companies to to borrow on the cheap, but there are costs when low-risk assets get too expensive. It makes pensions more expensive for states, cities and the few companies who still offer them. It also outs low-risk retirement out of reach for many households, especially as the Baby Boomers hit retirement age. With less money available, retirees are more nervous to spend their savings for fear they’ll run out — especially when, not if, the markets crash again.

Interest rates are starting to creep up, and that poses costs for employers and home buyers. But it also offers benefits, mainly that low-risk will be more affordable.

Editor’s Note: Personal finance expert Ted Bauman reveals how you could receive a $3,250 reward each year from the IRS for stashing away your money. This tax short cut is not only legal; the IRS both supports and encourages it! Find out more here…