Since starting What My System Says Today back in March, we’ve conducted in-depth “x-rays” of nearly all the major U.S. stock sectors.

However, one sector has quietly snuck under the radar despite beating the broader market by nearly 3-to-1 in 2025.

I’m talking about utilities…

That’s why today I’ll show you how this sector looks through the lens of my Green Zone Power Rating system.

Let’s get right to it!

Extreme Bullishness in the Utilities Sector

Last week, I showed you how the Energy Select Sector SPDR Fund (XLE) was more bullish than you might expect, given that the sector is still in “repair” mode after many years of lagging the market.

And for sure, there’s still plenty of volatility to watch out for in that corner of the market as investors digest what’s going on in the Middle East. Just yesterday, the energy sector gave up much of the gains it made last week as oil prices sank following a weekend rally up to $78 per barrel.

If last week’s analysis looked promising for energy, this week’s Green Zone Power Ratings breadth analysis of the Utilities Select Sector SPDR Fund (XLU) looks downright incredible.

Year to date, XLU is up 7.9%, almost tripling the S&P 500’s 3.3% gain. And looking at the numbers below, you can see why there’s a broader bullish trend in the utilities sector.

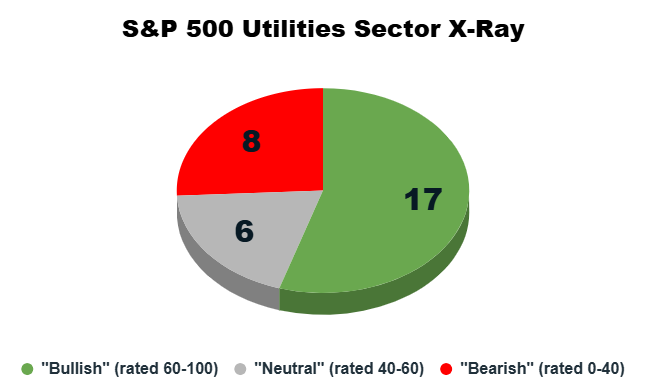

As always, stocks within the sector can broadly be categorized into one of three buckets in my Green Zone Power Rating system:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

The pie chart below effectively “x-rays” the 31 utilities sector stocks in the S&P 500, asking how many of them currently rate Bullish, Bearish or Neutral.

Check it out…

“Bullish” utility stocks currently outnumber bearish ones by more than 2-to-1, and they outnumber “Neutral” stocks — the ones that should track the broader S&P 500 — by almost 3-to-1!

If that’s not a green flag to go hunting for new opportunities in the utilities sector, I don’t know what is.

Let’s see how these stocks stack up on my individual Green Zone Power Ratings factors…

Strong Momentum and Growth

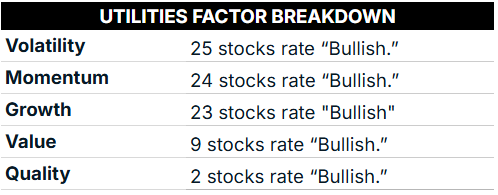

Looking at these 33 mid- to large-cap utilities stocks, we’re seeing a definite trend that tracks with recent price action:

To see that 74% of utilities stocks that we’re analyzing here rate “Bullish” or better on Volatility, Momentum and Growth is very promising for the coming weeks and months.

At the same time, targeting high growth and positive price momentum comes at a price, which is partly why only nine stocks (29% of the 33-stock group) rate well on my Value factor.

Lastly, only two stocks rate well on my Quality factor, which means it will pay to examine a company’s financials more closely to ensure the business is sound and worth investing in.

The last thing you want to do is chase positive price action, only to be left holding the bag when investors get spooked by evidence of poor-quality businesses.

With that as a framework, let’s focus on the good by looking closer at one of my key growth metrics, earnings per share (EPS) growth.

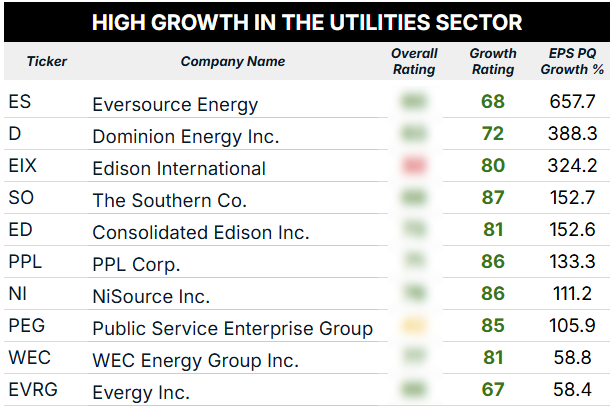

Below, you’ll see the 10 best stocks in the utilities sector based on earnings per share growth from the previous quarter (the far-right column in the table).

Eversource Energy (ES) is dominating the rest of the list here with 657% EPS growth compared to the previous quarter, but you’ll see ES is actually the second-lowest rated stock on my Growth factor in the table.

Bullish growth is bullish growth, but I wouldn’t buy into the stock expecting a repeat performance when it reports second-quarter numbers on July 30.

Instead, I’m looking at stocks like The Southern Co. (SO), PPL Corp. (PPL) and NiSource Inc. (NI) since they have impressive EPS growth while also boasting better overall ratings.

Overall, I would definitely keep the utilities on your shortlist of sectors to keep an eye on as 2025 continues.

To good profits,

Editor, What My System Says Today

P.S. My team and I are putting together the finishing touches of our latest monthly issue of Green Zone Fortunes, meaning now is a perfect time to join us.

This month, I’m doing something a little different. You see, we’ve had some incredible success with our strategy, and I’m confident some of the stocks we’re already holding have plenty of room to run even higher … so I’m raising my recommended “buy up to” prices on a handful of open positions, including a utilities-sector stock that rates bullish on momentum, quality, growth and value … and is already up over 80% since our original August 2024 entry.

If you’re looking for a Green Zone Fortunes “stock starter pack,” click here to see how you can join before I ship the June issue directly to inboxes in the coming days.