It’s impossible to keep up with everything going on in financial markets and the economy these days. That’s where The 5, a new feature for Money & Markets Daily, comes in…

Let’s start your week off right by exploring the most significant trends and opportunities you need to know now.

They Say It’ll Be the End of Trump…

Both Democrats and Republicans agree that this week’s debate will be a blowout victory.

What they disagree on is who will come away victorious.

Trump supporters are eager to see another ferocious performance from the former president, exposing Biden’s alleged cognitive decline on a national stage. Meanwhile, Biden’s supporters hope the president can end Trump’s chances for good.

In reality, the debate will simply be another dog-and-pony show (or, in this case, donkey-and-elephant). The real investing windfalls will come from a subject that neither candidate dares mention.

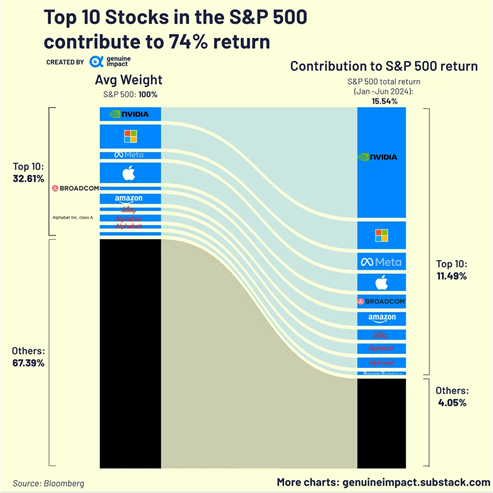

Chart of the Week: A Top-Heavy Market

If you need more proof that this bull market favors the massive mega-cap stocks, the chart below from Genuine Impact says it all.

Just 10 stocks out of 500 account for 32% of the S&P 500’s weight currently, and those 10 have contributed almost three-quarters of the index’s 15% gain year to date.

That’s great for those 10 mega-cap companies, but what about the other 490?

Adam O’Dell touched on the pros and cons of passive index investing last week. While it’s been incredible to watch Nvidia Corp. (Nasdaq: NVDA) soar higher, other mega-cap stocks like Tesla Inc. (Nasdaq: TSLA) are a drag on that performance when investing through a broad fund like SPY.

That’s why it pays to doublecheck a stock’s Green Zone Power Ratings before pressing “buy.”

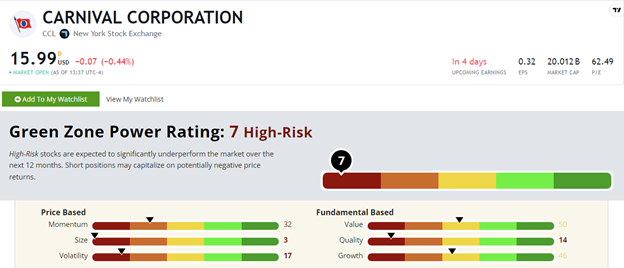

Earnings to Watch: Carnival Corp. (NYSE: CCL)

It’s summer, and that means cruise season…

The luxury cruise industry is still recovering from pandemic closures, and some companies seem to be doing better than others.

Budget liner Carnival Corp. (NYSE: CCL) has been stuck in a volatile trading pattern for the last year, trading as high as $19.74 and as low as $10.84. Overall, the stock has gained 0.5% since June 2023, lagging the broader market’s 25% gain.

Zooming out, the stock is still down 69% from its pre-COVID peak in January 2020.

Carnival reports earnings on Tuesday before the bell. It has surprised to the positive side in each of the last four quarters, but Green Zone Power Ratings says to stay on the sidelines for now.

2 Big Upcoming Economic Reports

The U.S. economy will be a major topic during Thursday’s debate, but before the gloves come off, there are a couple of economic reports to watch.

On Tuesday, the Conference Board will release its latest reading on consumer confidence. This simply tells us how Americans feel about the state of things. Confidence ticked higher in May following three straight months of declines.

Why does it matter? A confident consumer is willing to spend, and that’s a strong tailwind for future stock market growth.

Watch out for the new home sales data from the U.S. Census Bureau on Wednesday as well. The U.S. housing market has stalled out as higher interest rates are forcing potential sellers to stay put and potential buyers to lock in mortgage rates that have almost tripled since the summer of 2020.

Home sales for April clocked in at a seasonally adjusted annual rate of 634,000, which is 7.7% lower than the same month in 2023.

Why does it matter? This is the mother of all logjams in the American economy. It’s also presenting potential opportunities in homebuilder stocks…

Is Buffett Wrong for Selling BYD Shares?

Any time Warren Buffett makes a move, we pay attention. The Oracle of Omaha has us trained well…

Last week, Buffett made headlines after trimming Berkshire Hathaway’s position in BYD (OTC: BYDDY), China’s largest electric vehicle maker, to 6.9% from 7.02% of the company’s total shares.

That’s not a big deal until you realize it equates to 1.35 million shares!

EV makers are trying everything to keep demand high (as Chief Research Analyst Matt Clark touched on recently), but it’s clear this is a tough and highly competitive market.

We’ll likely never know the exact reason for Buffett’s move, but we can see that BYD rates “Neutral” in Green Zone Power Ratings. That means it should track the broader market from here.

— Money & Markets Team