Well that was a fun week, wasn’t it? On June 5, the world was rejoicing at the greatest monthly jobs report ever in the history of the United States as 2.5 million new jobs were created. Except they actually weren’t because the Bureau of Labor Statistics underestimated the unemployment rate in May by three full points.

It didn’t matter. For a few days there was euphoria in U.S. equities. The Nasdaq topped the magic 10,000-point mark, leading the way to a new all-time high. I remind you that the last time the Nasdaq led us to an all-time high in equities was Y2K, but who cares about history, right?

We’re in the middle of erasing it after Thursday’s stock market rout, and who wants to be a party pooper anyway?

Well, that guy was Jerome Powell, Chairman of the Federal Reserve who Wednesday announced no policy changes despite the stock market demanding he take interest rates negative and pick more fruit from the Magic Money Tree.

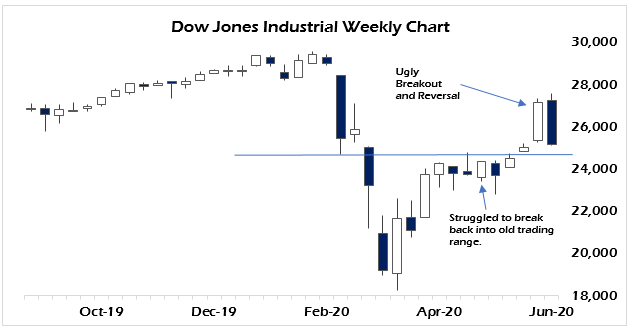

He didn’t do that, and the result was the mother of all one-day corrections and a nasty stock market rout. The Dow Jones led the way down, dropping 1,861.82 points, or nearly 7%. And in doing so wiped out not only the blow-off top of the rally from early this week, but it also put the index through a massive outside reversal signal to the downside (see chart).

But the writing has been on the wall for weeks that this rally was tired.

Since the March low, the Dow Jones has been the laggard of the three major U.S. stock market indexes. And that was a warning that this wasn’t a broad-based rally supporting those fabulous employment figures from last week.

It meant this was a retail-mania rally led by people cooped up in their homes day-trading Tesla (Nasdaq: TSLA), sending it to a ludicrous $1,000 per share, rather than serious institutional traders putting down long-term roots in major positions.

And once the market became exceptionally bullish and Powell wouldn’t grant anymore party favors, the balloons quickly popped.

It’s imperative that you realize the Fed had no other option but to stand still. I don’t envy Powell and I don’t blame him for doing nothing. It was actually the right play for right now.

The best weapon the U.S. has in a world that is quickly growing tired of its foreign and domestic policies is a rising dollar.

The reason for this is that the world is short dollars and needs them badly. What Powell has done here is ensure that by starving the world of dollars and only providing domestic liquidity support through the repo markets and to the U.S. Treasury, he’s putting the rest of the world behind the eight ball.

And that will cause the dollar to do what it should have been doing for the past month — rising.

Look what else happened during Thursday’s stock market rout. The major rally unfolding in the euro also reversed. European stock markets were also sold hard. But the euro didn’t get a bid with all that selling; instead they were buying dollars.

So watch now as Powell just shifted the burden onto Christine Lagarde and the European Central Bank as we approach the Brexit cliff edge on the June 30, when the U.K.’s deadline to ask for an extension to the trade talks ends.

At that point, the EU goes into apoplexy, right as the dollar strengthens and U.S. stocks correct back into less ludicrous valuations.

Moreover, with political unrest continuing to sweep across the U.S. in the wake of the death of George Floyd, there is little hope for a V-shaped economic recovery. And that means the same for the rest of the world, as I said last week.

But if you’re like me and you think the stimulus money is a mirage, the weaker dollar is a reflection of loosened dollar hoarding and supply constraints are meeting up with the policy of massive monetary inflation, then bet on the much more likely L-shaped recovery that will be easy to mask with the studious application of seasonally adjusted statistics and the ab reactions of algorithmic trading.

The latest Initial Jobless Claims for this week came in with another 1.54 million added to the rolls. So you can massage the statistics for a while, but eventually you have to accede to reality.

I knew this market was in trouble earlier this week when oil refused to rally on OPEC+ announcing it would keep existing production cuts in place. Then the Fed didn’t act and there was a major and unexpected crude oil inventory build at Cushing.

Was it 1,861 points worth of bearishness in those news items? Sure, over a few weeks in something approximating a normal market, but we don’t have normal markets.

The Fed has made sure of that.

In fact, free markets are gone and all that’s left is the gyrations of dying capital markets unsure of where to park money because there is a lack of leadership at the central banks, in the capitols and the governor’s mansions.

Confused policy, a nation at war with itself, a paralyzed president and unprecedented demand and supply disruptions will eventually lead to the kind of schizoid behavior we’re witnessing right now.

From here until the election (and probably into 2021 as no matter who wins there will be lawsuits) the volatility will be a lot higher than it’s been.

The next wave of financial and political dislocation is about to hit us and Thursday’s stock market rout was the wake-up call we all needed.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.