In this week’s Marijuana Market Update, I tackle Tilray Inc.’s (Nasdaq: TLRY) recent merger and what it means for its stock going forward.

Last week, I asked for your feedback on how your cannabis investments.

I love reading your success stories based on our Cannabis Watchlist and weekly videos!

While poring through your responses, one cannabis company kept popping up.

Dieter from Switzerland emailed me at feedback@moneyandmarkets.com.

He asked:

I’ve been following you for a couple of weeks, and I am thrilled about your very valuable recommendations on different U.S. companies around the cannabis market. Thank you!

Still, I am wondering why you have not stressed on Tilray Inc. Their shares have incredibly jumped up over the last few weeks.

What is your assessment of this?

On YouTube, William commented:

Tilray & Aphria merger! They are the king of cannabis.

They are doing a partnership with Budweiser; they own Sweetwater Brewery, and they have major contracts in Europe for medical marijuana.

Jon emailed me and asked:

Hey Matt! Love the videos. Great information. But I’m curious why you haven’t added Tilray to your watchlist on Money & Markets. Love to hear what you think! Jon.

Thank you, Dieter, William, Jon and everyone else who took the time to write in! Keep those emails coming.

About Tilray Inc.

Tilray Inc. (Nasdaq: TLRY) is a jack-of-all-trades cannabis company. It researches, cultivates, processes, distributes and even markets cannabis and hemp products.

In December, Tilray and Aphria Inc. (Nasdaq: APHA) announced a merger.

Aphria, a Canada-based cannabis producer and distributor, is overpaying for Tilray by about 9%, which isn’t necessarily bad.

That puts the new company in direct competition with Canopy Growth Corp. (NYSE: CGC) — the largest cannabis company by market value.

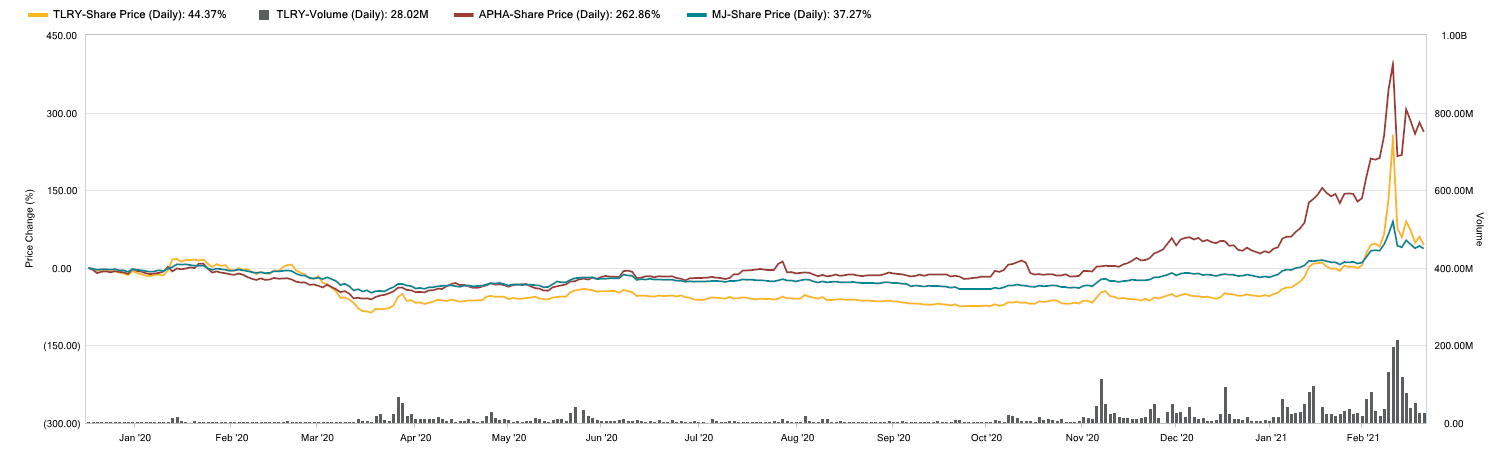

Investors pushed both Aphria and Tilray stock up more than 250% after the merger announcement.

TLRY (Yellow) and APHA (Red) Saw 250% Growth After Merger

But I’m worried about both stocks.

For one, Aphria and Tilray have no assets within the United States outside of Sweetwater Brewery.

That’s likely because cannabis is still a Schedule-1 controlled substance in the U.S.

There’s also Reddit, the internet forum that keeps making headlines thanks to the ongoing GameStop Corp. (NYSE: GME) trade.

Reddit users mentioned Tilray stock and Aphria, which led retail investors to pile into both company’s shares.

That’s great in the short term. But like we saw with GME, it can lead to more stock volatility and big sell-offs.

My advice: Exercise caution before buying into one or both of them.

Watch my latest Marijuana Market Update here for more on Tilray’s future.

Cannabis Watchlist

Now, let’s look at our Cannabis Watchlist on Money & Markets.

We are still in a good place, with average gains at 40%, despite the recent pullback on some cannabis stocks.

Here’s a quick breakdown:

- Schweitzer-Mauduit International (NYSE: SWM) — The company reported its quarterly earnings last week, and we benefited. Sales jumped to $1 billion in 2020 — up 5% from 2019. For the fourth quarter, sales hit $279.4 million — up 17% from the same quarter a year ago. Officials also noted operating cash flow of $161.6 million and free cash flow of $128.3 million, both increases. That’s helped fuel gains to 62%.

- Planet 13 Holdings (OTC: PLNHF) — The Nevada-based cannabis company started construction on its massive new superstore in Orange County, California. This stock was down as much as 11% early on but is now up almost 21% since January.

- Scotts Miracle-Gro Co. (NYSE: SMG) — A blowout in quarterly earnings pushed this traditional fertilizer producer up more than 29% since it was added to the watchlist in September 2020.

- GrowGeneration Corp. (NYSE: GRWG) — This pure cannabis play has been our best performer over the last several weeks. The company has been on a buying spree and recently acquired one of the largest hydroponics suppliers in San Diego. GrowGeneration stock is up 65% since November 2020.

- Turning Point Brands Inc. (NYSE: TPB) — This is another strong performer on our watchlist. The company board recently raised the stock dividend from $0.05 to $0.055 per share, which is good news if you are already in this position. Turning Point has risen 64% since October 2020.

- PerkinElmer Inc. (NYSE: PKI) — I am a bit concerned about PerkinElmer Inc. as the stock price continues to fall. It’s still up around 5% since September 2020, but I think the recent pullback is a good opportunity to buy shares. I’ll let you know if that situation changes.

As always, my team and I love the feedback we’re getting on our YouTube channel and through email.

Feel free to send comments, questions and stocks you want us to examine to feedback@moneyandmarkets.com — or leave a comment on YouTube!

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.