In today’s Marijuana Market Update, I:

- Answer a reader mailbag question about Tilray Inc.

- Pose a question for you to answer.

- Cover key earnings for our watchlist stocks.

Let’s begin with Tilray.

Why Tilray Stock Is Trading Down

Why is Tilray trading down? — Joe

Thank you for this question, Joe.

If you follow the cannabis market, you know that major cannabis player Tilray Inc. (Nasdaq: TLRY) recently merged with another big name: Aphria Inc.

This creates the world’s largest cannabis producer by revenue.

The combined company has a market cap of around $8 billion.

This should be an attractive opportunity for cannabis investors. However, the new company is off to a slow start.

Tilray’s Slow Post-Merger Trading

Looking at Tilray’s stock chart, you can see it traded flat, under $10 per share, in 2020.

The stock popped up to $67 per share in February, but that level seemed way too high for investors to get behind, and so it started to pare down.

Another factor here is the deal with Aphria.

It was an all-stock deal. So after the deal’s announcement, if Aphria’s stock fell, so did Tilray, and vice versa.

Aphria’s Stock Mirrors Tilray’s

You also have to consider that the cannabis market has cooled off.

As federal legalization talks started to taper off — after being ramped up at the beginning of the year — investor sentiment in the market waned.

In April, two key events had a long impact on the stock:

1. Before the merger, Aphria posted quarterly earnings that were well below Wall Street expectations. The company reported a loss of $0.15 per share, compared to expectations of just a $0.05 loss.

That pushed both Aphria and Tilray stocks down.

We can attribute the more recent decline in Tilray stock to its latest quarterly report.

2. Tilray reported a quarterly loss of $0.19 per share, well off the analysts’ estimates for a $0.10 per share loss.

Tilray’s operating loss of $73 million was greater than the $71 million reported in the same quarter last year.

During the first quarter of 2021, Tilray reported revenue declines in both adult-use and Canadian medical cannabis — overall, the company reported an 8% drop in total revenue.

None of this means that the pro forma company is a bad one that won’t reverse its earnings decline. But it goes a long way to explain why Tilray’s stock didn’t take off after its merger with Aphria.

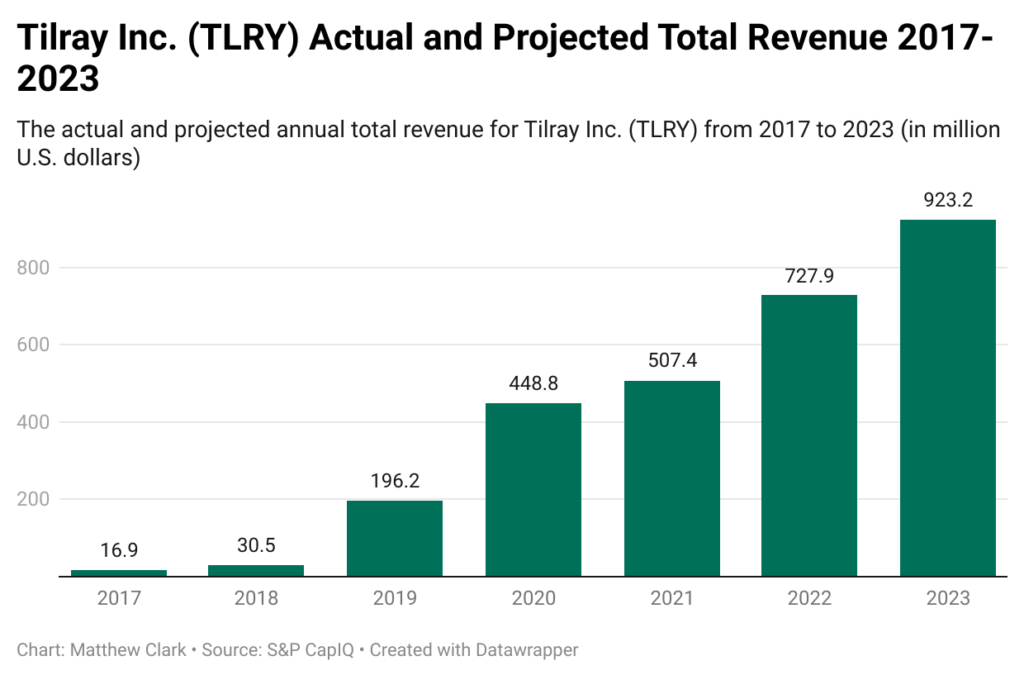

If projections are an indicator, Tilray will be a strong cannabis company in the coming years.

It expects its total revenue to more than double from 2020 to 2023.

The company has accumulated $505 million in total revenue for fiscal year 2021, which ends on May 31.

So, it already beat last year’s revenue by a solid margin.

The question is whether the company can bring down its overall losses with the merger.

A Question for You

Now, I want to pose a question to you that I received from another viewer:

I would love to invest in the recommended pot stocks, but where do you buy them? I have five brokerage accounts, and outside of only being able to buy Canopy Growth and Tilray, they will not sell the OTC-listed stocks on the grounds that the federal government says that pot is illegal. — Robert

That’s a great question, Robert, and one I want to ask all of you.

Comment on our YouTube channel or email me at feedback@moneyandmarkets.com and let Robert (and myself!) know where you invest in the OTC stocks we discuss on the Marijuana Market Update.

Speaking of, I want to talk about some news surrounding our Money & Markets Cannabis Watchlist.

Cannabis Watchlist Earnings Update

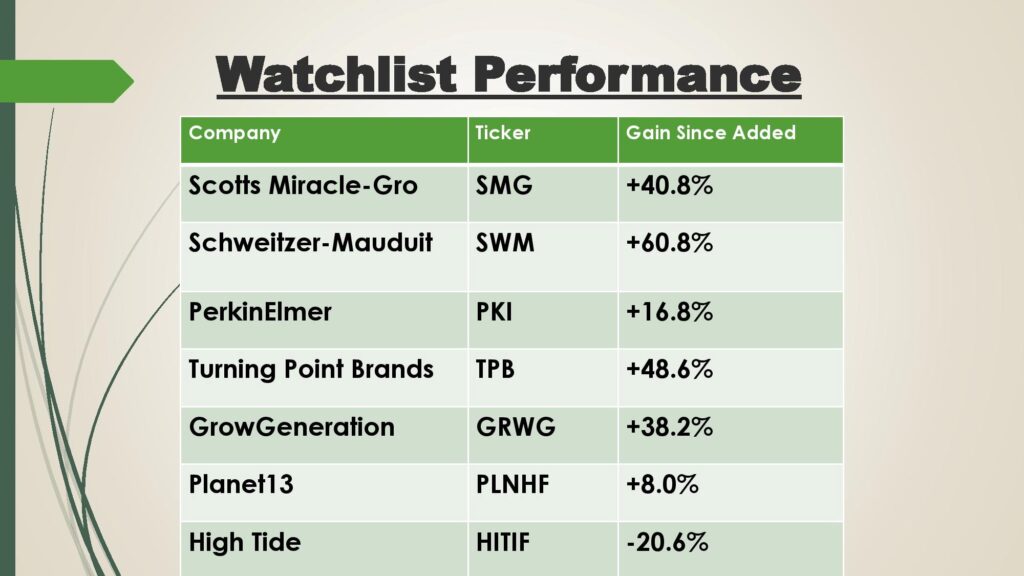

As of Thursday’s close, our watchlist’s average gain is about 31% — the same level it’s been holding for the last few weeks.

Numbers pulled on May 11, 2021.

But there’s news concerning three of our holdings:

- Schweitzer-Mauduit International Inc. (SWM) — The company recently reported its quarterly earnings. Both revenue and earnings per share beat Wall Street expectations as the company reported earnings of $1.02 per share on revenue of $288 million.

- Scotts Miracle-Gro Co. (SMG) — The fertilizer company also released its quarterly earnings and posted revenue and earnings beats. SMG reported earnings of $5.64 per share on revenue of $1.8 billion for the quarter. Some analysts have raised their price target on SMG to as high as $300 per share — a $60-per-share increase over its current price.

- PerkinElmer Inc. (PKI) — Our third-quarter earnings update also beat expectations in both revenue and earnings. The company reported earnings of $3.72 per share on revenue of $1.3 billion for the quarter.

If you have a cannabis stock you’d like me to look at, email my team and me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Green Zone Fortunes co-editor Charles Sizemore also has a weekly series called Investing With Charles, where he breaks down dividend investing each week.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.