Last year, the “Magnificent Seven” dominated the bull market.

These seven stocks (NVDA, AMZN, TSLA, META, GOOGL, AAPL and MSFT) were responsible for a lion’s share of the market’s gains. On average, the Mag 7 gained 60% in 2024, with Nvidia Corp.’s (NVDA) 171% surge leading the charge.

But it’s been more of a mixed bag in 2025. Only a few of the Mag-7 stocks have kept up with or outperformed the S&P 500’s year-to-date 10% gain, while AAPL and TSLA are down 5% and 10%, respectively.

Frankly, this is a good thing. To see major market indexes hitting record highs without relying so heavily on the performance of seven mega-cap stocks means we have a much healthier market overall … one that’s brimming with bullish stocks of all sizes and across multiple sectors.

Of course, it’s still exciting to see big names like the Mag 7 crop back up on our screens, like my Green Zone Power Rating “New Bulls” list.

And that’s exactly what happened this week…

Let’s get into it!

Our Best “New Bulls” List Yet?

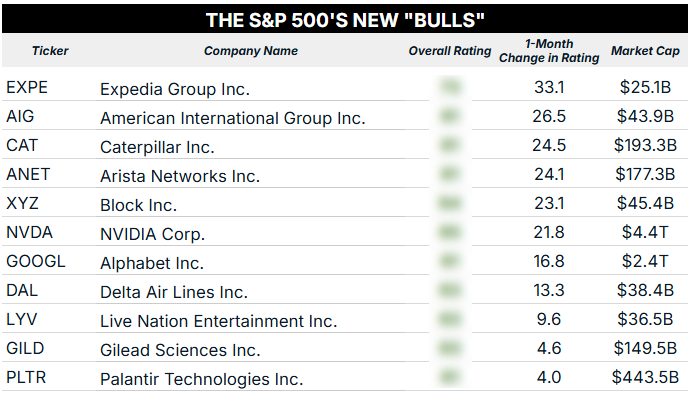

If you need proof of market breadth widening as the S&P 500 trades at record highs, this week’s list should suffice.

As a refresher, the criteria for my “New Bulls” screen are:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

The four biggest ratings movers this week come from a diversity of sectors. We’ve got a discretionary travel stock in Expedia Group Inc. (EXPE), an insurance company in American International Group (AIG), a manufacturing giant in Caterpillar (CAT), and a cloud computing tech company in Arista Networks (ANET).

And right under those, in the fifth and sixth spots, are two of the Magnificent Seven: Nvidia (NVDA) and Alphabet Inc. (GOOGL). Both of these stocks have moved 10% higher over the last month and boast “Strong Bullish” ratings on my Quality and Growth factors.

This might be the best “New Bulls” list we’ve published so far. Not only is it chock-full of stocks that are set to outperform the broader market by 2X over the next 12 months, but it’s proof positive that investors aren’t solely focused on the biggest of Big Tech.

To wrap up today’s analysis, I want to talk about a stock that made it through this week’s screen for the first time ever…

Palantir (PLTR): Up 700% Since March 2024

Artificial Intelligence (AI) has been the mega trend of this bull market, which kicked off in November 2022 with the release of the ChatGPT large language model.

That’s why, in March 2024, I adjusted my approach slightly and recommended Palantir Technologies Inc. (PLTR) to my Green Zone Fortunes subscribers.

This company, cofounded by “Tech Titan” Peter Thiel back in 2002, was developing incredible AI tech primarily for use in the defense sector. And it was flying under Wall Street’s radar while everyone was otherwise glomming onto the already-popular “Mag 7” stocks.

At the time, PLTR wasn’t a classic or obvious “Green Zone” stock. Rather than having the “Bullish” or “Strong Bullish” overall rating we much prefer, it was rated “Neutral,” mostly getting dinged for its low score on my Value factor. Here’s what I wrote at the time:

PLTR is most certainly not a cheap stock.

But here’s the thing … if you wait for PLTR to become a cheap stock before buying it, you will likely be waiting forever.

I say that because the market’s most dominant technology stocks have always commanded a price premium. Consider this…

Google and Amazon have never rated above 50 on my system’s Value factor — never.

As you can see now, 17 months later, I was able to apply an appropriate amount of discretion, critical thinking and historical context to my data-driven system’s warning of PLTR being too expensive to warrant a textbook “bullish” rating. In short, I was highly confident that PLTR’s incredible Growth and Momentum would more than make up for its lofty valuation.

It was a calculated risk that has clearly paid off in spades, considering that my Green Zone Fortunes subscribers are enjoying a 700% open gain in less than 18 months!

What’s more, PLTR has finally crossed the “Bullish” threshold on my Green Zone Power Ratings, pointing to even more outperformance ahead:

To make sure you get my latest guidance on Palantir and the other 25 model portfolio companies we own, click here to see how you can join my flagship service today.

To good profits,

Editor, What My System Says Today