This month’s payroll data is in, it’s red-hot, and it’s driving markets higher.

This is great news for investors in the short-term.

But as always … I couldn’t help but dig a little deeper into the data. And I found that things aren’t looking quite as optimistic as you might be led to believe.

Click below for the full story:

Video transcript:

Welcome to Moneyball Economics. I’m Andrew Zalin, and as I predicted earlier in this week, Friday will be a rock-and-roll day for the stock markets.

I’m coming to you Friday morning, June 6th. Markets are already up over 1% on the backs of this great payroll data.

I happen to be the number one payroll forecaster on Bloomberg, and I’m going to talk to you about what I see in this data, why the markets are up, and I also want to share with you some concerns I have that there might be some clouds already gathering on the horizon.

But let’s start off with payrolls.

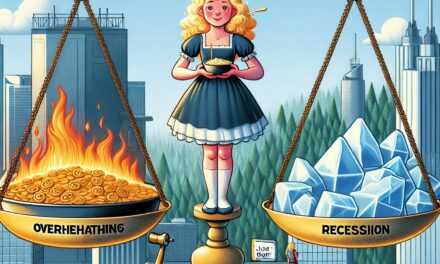

They came out with a magic number of 139,000. Consensus was around 130, as was I coming in a smidge above, but in general, where we all are sitting is a Goldilocks situation.

We’ve got inflation relatively tame, we’ve got payrolls relatively solid. This is Goldilocks because there’s neither an overheating economy nor really a massively cooling economy, and that’s what the markets like to see.

They want to see some sort of stability and strength in the economy — because quite frankly, we’ve been pretty rattled by all these moves that Trump has been making and quite frankly continues to make. But by and large, the markets liked this number because there were no surprises. The fact that it came in a tad above expectations is a positive sign, but nothing too hot, nothing too cold.

When I dive into the data, however, I don’t like what I see and I think this is what the markets are responding to as well. While the overall headline number 139,000 is good, it’s the components that are a little bit challenging. To be honest, almost all of this strength came from exactly two places.

One, healthcare. Now you may have heard me kind of go off the rails on healthcare, but quite frankly, healthcare in America is a forced tax. We guarantee a certain amount of money going into the healthcare system and that grows as the population grows, as payrolls grow, and as a result, there’s kind of like a forced amount of money going into healthcare and they’re going to hire with it. So healthcare for better or worse is always going to be growing.

However, of that 139,000 number, almost 80,000 came from healthcare. That’s a bigger chunk than we want to see. That number, by the way, very consistent for healthcare. They’re kicking out almost a million jobs per year. That’s a big, big driver of payrolls, but again, it’s a forced tax, so I’m not really a big fan of this payroll growth in healthcare.

The second category where we saw growth, restaurants, restaurants kicked out about 30,000 jobs.

Why is that material? Well, this is a one-time event.

Basically, we had a lot of bad weather earlier in the year, and so as a result, people weren’t going out as much and that meant restaurants weren’t hiring as much. Fast forward, weather improved, and so this is more catch up hiring, which means even if healthcare continues to trickle along at about 80,000 per month, this one time 30,000 coming from restaurants, it’s going to go away next month.

So next month it’s looking kind of soft again. In other words, what I’m saying is for all intents and purposes as we drill into the underlying data, hiring is mostly at a standstill. That’s not a positive, and in fact, I think that’s why the markets might be happier than not because again, we’re waiting for the Federal Reserve to make a cut.

So overall headline numbers, yeah, looks fine, but under the surface we’re seeing some significant slowing down in the economy and that is going to motivate the Fed to cut rates and that is why the markets are getting very, very happy.

In fact, a lot of the strength coming in is coming in on high tech. High tech needs a lot of rate cuts. They love that bottom line. I’m looking out on the horizon. I don’t think June is going to be a very strong payroll number, a little early to tell, but there there’s no inflection down. There’s no inflection up, but it’s just slowing down. However, this Goldilocks story that we see when it comes to payrolls and when it comes to inflation, I believe it’s just an eye of the hurricane.

There are storms on the horizon because, and I’ve mentioned it before, inflation will be going up once the tariffs really take hold. It’s just a reality, so inflation’s going to be moving up a little bit. At the same time, we have a lot of layoffs out there that have yet to be counted within this official data.

It did not really materialize very much in this month’s payrolls, and remember, we’ve seen a few hundred thousand people laid off. If you think this economy is so strong that it’s absorbed a few hundred thousand people in just a couple of months, I’m going to disagree with you. I think what’s really going on is we got some unfortunate bookkeeping that’s going to correct this, and so the payroll data going forward is going to start to look uglier.

So what we’re going to be left with probably sometime in late July heading into August, is actually a negative situation wherein the economy’s going to be showing signs of slowdown, payrolls are going to start crumbling, but at the same time, we’re going to have this high inflation number. That means the Fed might not be cutting rates, not just in July, but possibly not in September. The entire market will flip flop and quite frankly, the stock market could come down.

So I’m going to be watching this.

In fact, every week we’re getting jobless claims data coming in, and that really is where we’re going to see signs of problems with payrolls.

What do I mean? Well, again, my concern is what I call the severance package factor. The severance package factor basically says people were laid off, but they’re not showing up in the official records yet because they got these buyouts, these three month or longer buyouts that say, take the money and you won’t sue us.

And as long as they got that money for whatever number of months, the federal government doesn’t count them as unemployed. The federal government doesn’t let them file for jobless claims. A lot of them are white collar workers and in fact, a lot of them are contractors. For example, doge Doge eliminated a lot of contracts, Booz Allen and others.

Well, Booz Allen hired a lot of it people as contractors. Those contractors got fired and guess what? This month in the payrolls, payrolls dropped 20,000.

When you consider the temp workers, those temp workers are probably contractors. So I’m starting to see some of the severance package factors show up, but not really at the level that I would expect it to be if we fired as people think about two to 300,000 workers, all white collar.

So bottom line, today’s payrolls we’re good, good enough to keep the market happy. Weak enough under the headline number to suggest cuts may be coming, but I don’t think cuts are in fact coming. I think the market’s fooling itself and worse, I think we might be getting into a place where stagflation fears reemerge in late July, so net a lot of volatility for now, a lot of belief and strength, and it’s going to take a month for this belief and strength to fade.

And guess what? Then we’re looking at earnings reports, and I think earnings reports are going to look pretty solid. A lot of moving pieces.

I’m going to try to stay on top of them with you, my fellow Moneyball economists. In the meantime, we are in it to win it, and we are. If you’ve been listening to me over the past few months, I said, buy the dips. I said, this economy is strong and it’s going to pull the stock market up with it. So far so good. I’m watching this data for you and hopefully we are going to end the year up 15%. That’s where I got my money on my spy leaps.

In the meantime, Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics