I’m always looking for great investment opportunities to share with folks — no matter what the market is doing.

It’s one of the reasons we created my Stock Power Daily on Money & Markets.

Monday through Friday, I give you one top-rated stock within our Stock Power Ratings system.

I also go a little more in-depth on Tuesdays to show another company I have high conviction in based on our powerful system.

Today, those two paths collide.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” consumer cyclical stock I recommended in August to Stock Power Daily readers:

- It increased its annual sales by 30% over last year.

- Its stock is up nearly 10% from when I recommended it in August.

- It became a top-rated stock on our Stock Power Ratings system — again!

Here’s why this cyclical consumer stock will continue its strong performance through this shaky market.

Eggs Are a Staple

I cook a lot at home for my family.

One staple ingredient I use most is eggs.

I crack at least a dozen eggs every week.

Last year, Americans consumed an average of 284 eggs per person. I did the math, and that comes out to more than 92 billion used in one year alone!

And the U.S. Department of Agriculture expects that number to increase to 288 this year.

That’s great news for the industry’s revenue:

The chart above shows the increase in global revenue from eggs.

From 2020 to 2027, Statista expects the industry revenue to jump 58.1%.

Bottom line: This is a market that’s starting to take off.

To find maximum gains, now is the time to get in.

Cal-Maine Foods Inc. Breakdown

As you can see from the chart above, the egg market is on the rise.

Even with high inflation, eggs are something we can’t replace.

Cal-Maine Foods Inc. (Nasdaq: CALM) is a Mississippi-based egg producer.

CALM produces and sells eggs to grocery stores and food service companies.

Let’s look at how this egg stock has performed.

CALM Stock 3.7% Off 52-Week High

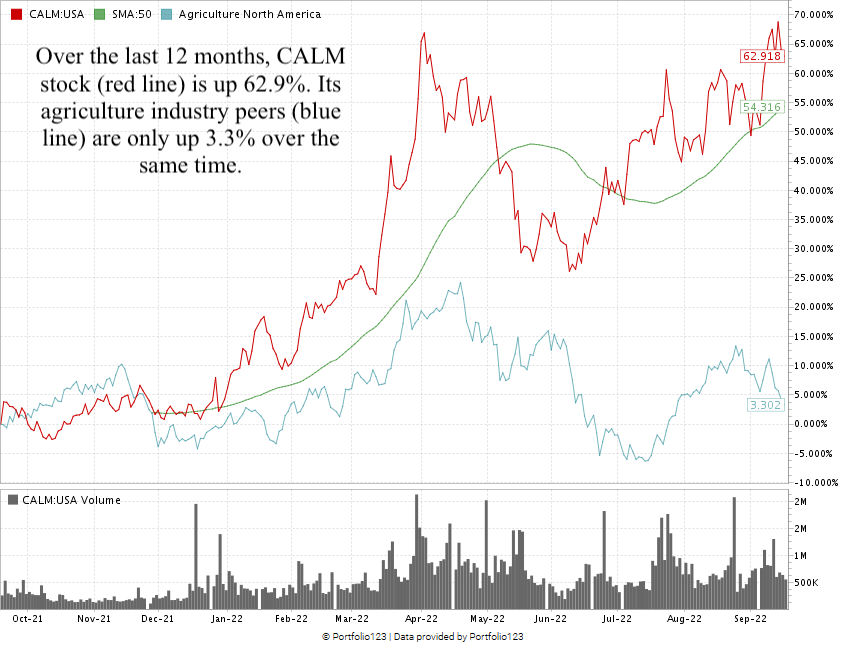

Over the last 12 months, CALM is up 62.9%.

It’s blowing past its agriculture industry peers, which average 3.3% gains during the same time.

Since I recommended this to Stock Power Daily readers, CALM has climbed almost 10%.

I have strong conviction this egg stock is only going higher.

Cal-Maine Foods Inc. Stock Rating

Using Adam’s six-factor Stock Power Ratings system, Cal-Maine Foods Inc. stock scores a 100 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least 3X over the next 12 months.

Cal-Maine Foods Inc.’s Stock Power Ratings on September 19, 2022.

CALM rates in the green on five of our six factors:

- Growth — CALM scores a 99 on growth, with a prior-year quarterly sales growth rate of 69.5% and an earnings-per-share growth rate of more than 999%.

- Volatility — The stock’s upward trajectory has come with little downside since June. It scores a 98 on volatility.

- Momentum — Since I first recommended this stock to Stock Power Daily readers, Cal-Maine stock is up almost 10%. It’s 3.7% away from its 52-week high. CALM earns a 95 on momentum.

- Quality — Cal-Maine’s return on equity is 12.5%, compared to the industry average of negative 14%. Its net margin is 7.4%, while the industry average is negative 222.8%. CALM scores a 95 on quality.

- Value — CALM’s price-to-sales ratio is 1.55, compared to the agriculture industry’s average of 4.4. Cal-Maine earns an 82 on value.

CALM earns a 46 on size, but its market cap is $2.8 billion, which is still a good-sized stock for strong gains.

Bottom line: The demand for eggs isn’t going away anytime soon.

Cal-Maine is a global leader within the industry worldwide.

This is why CALM, a top-rated egg stock. is a strong performer for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.