As a kid, I loved our weekly trips to the neighborhood grocery store.

Now … not so much.

I’m content sitting on my couch, opening my phone and doing my grocery shopping online.

And I’m not alone.

In 2020, online sales accounted for 8.1% of all grocery sales in the U.S. That figure is expected to reach 20.5% by 2026 … if not sooner.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” grocery stock that capitalizes on the online grocery shopping boom:

- It’s a major grocery store chain in the Northeast with a growing online presence.

- The stock recently hit a 52-week high despite the broader market turning down.

- It’s in the top 2% of all stocks we rate.

Here’s why the grocery stock I have for you today will continue its strong performance in 2022 and beyond.

The Online Grocery Push

Working from home wasn’t the only trend that gained momentum during the COVID-19 pandemic.

Social distancing and lockdowns pushed more Americans to shop online … even when shopping for groceries.

The online grocery market got a huge boost in 2020. And, as this chart shows, the trend is growing:

Before the pandemic, Americans spent $62.2 billion buying groceries online in 2019. That figure grew 54% to $95.8 billion in 2020 as the pandemic surged.

Now forecasts suggest those sales will reach $187.7 billion by 2024 — a 96% increase from 2020!

Bottom line: The convenience of online grocery shopping is here to stay.

Grocery Stock With Quality, Momentum: Weis Markets Inc.

No matter the state of inflation, grocery stores are popular stocks because these companies sell items we cannot live without … like food.

Weis Markets Inc. (NYSE: WMK) is a major grocery store chain in the Northeast.

The Pennsylvania-based company operates 197 stores in Pennsylvania, Maryland, Delaware, New Jersey, New York, West Virginia and Virginia.

These are some of the most densely populated areas in the U.S. And that’s reflected in WMK’s impressive numbers.

Despite being more regional, WMK's revenue growth has been strong and steady:

In 2018, Weis Markets introduced its Weis2Go online ordering service that allows customers to place their grocery order online and then pick it up.

Since the launch, WMK’s total annual revenue has jumped 20% to $4.2 billion in 2021! And it continues to show signs of growth as online ordering gains traction.

Now let’s look at how this grocery stock has performed.

WMK Hits 52-Week High Despite Market Downturn

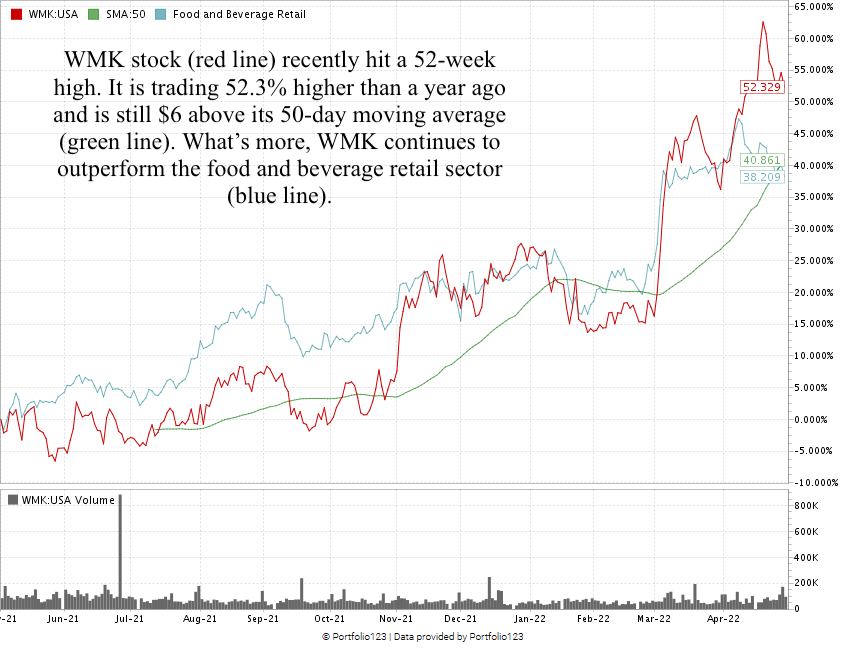

WMK hit its 52-week high of $85 per share on April 20. Broader market headwinds have affected the stock, but it remains around 52% higher than a year ago.

The stock continues to outperform its food and beverage retail peers — which are only up 38.2% over the same time frame.

Weis Markets Inc. Stock Rating

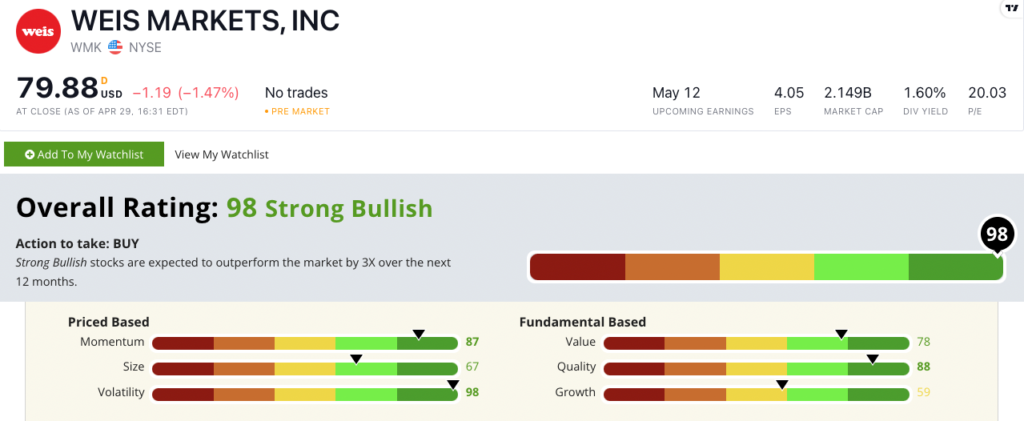

Using Adam’s six-factor Stock Power Ratings system, Weis Markets Inc.’s stock scores a 98 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

WMK rates in the green on five of our six rating factors:

- Volatility — In the last 52 weeks, WMK hit a new 52-week high with little downside. Weis scores a 98 on volatility.

- Quality — While the food and beverage retail sector has negative returns on assets, equity and investments, Weis is in the green on all three metrics. WMK scores an 88 on quality.

- Momentum — Since this time a year ago, Weis’s stock price has been on a steady upward climb. WMK scores an 87 on momentum.

- Value — WMK scores a 78 on value, with a price-to-sales ratio of 0.51 compared to its sector peer average of 1.1. Weis’s price-to-book value ratio is 1.76, while the food and beverage retail industry average is 2.3.

- Size — With a market cap of $2.14 billion, Weis is right in the middle of the pack on size, where it scores a 67.

WMK earns a ”Neutral” 59 on growth, but its quarter-over-quarter sales growth rate is 8%, and its earnings-per-share growth rate is 16.4%. It is right on the cusp of rating in the green here.

Bottom line: We have to buy groceries, no matter what the rate of inflation does in the future.

With more Americans shopping for groceries online, chains with a strong online presence are poised to capture even more market share and sales in the future.

This is why WMK is a must-have for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.