If you’re bought anything in recent months, you’ve noticed prices were higher.

The official Consumer Price Index for July showed inflation popping by a full 5.4% over the last 12 months.

And producer prices, which are often a precursor to consumer prices, are rising at an even faster clip. The Producer Price Index (PPI) was up 8.3% in the 12 months through August.

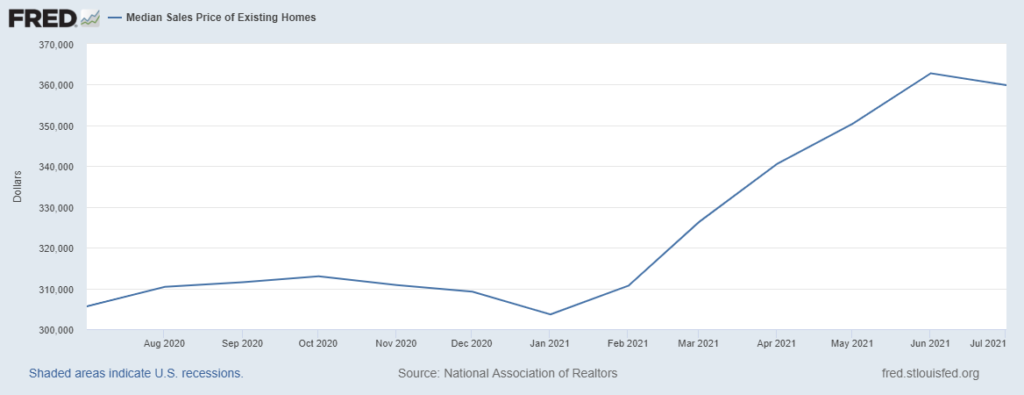

The numbers are crazier when you look at certain high-profile pockets of the economy like housing. The median price of an existing home sold in July was 17.8% higher than the year before.

Home Prices Soared to Start 2021

At that rate compounded, a house would double in value in a little over four years.

Federal Reserve Chair Jerome Powell believes the inflation is “transitory” and the result of a perfect storm of pandemic-related supply disruptions, higher-than-usual demand due to government stimulus, virus fatigue and a lack of spending options.

Is This Transitory Inflation?

I’ll admit, I was skeptical.

Once inflation gets out of the bottle, it’s hard to stuff it back in. The Fed under Paul Volker had to get downright nasty and engineer one of the worst recessions in decades when the economy finally broke the last bout of inflation in the early 1980s.

Today, with labor in extremely short supply, we looked uncomfortably close to a wage inflation spiral in which rising wages led to rising prices which in turn led to even higher wages and even higher prices.

But here’s the thing. The market is agreeing with the Fed. As unlikely as it seemed just a few months ago, inflation might actually be transitory.

How Hedge Assets Have Reacted

Let’s start with that most iconic of inflation hedges: gold. Between 2013 and 2019, the gold price barely budged. It was stuck in a long trading range.

Let’s start with that most iconic of inflation hedges: gold. Between 2013 and 2019, the gold price barely budged. It was stuck in a long trading range.

But then, it started trending higher in 2019 and then exploded higher in the early stages of the pandemic as investors ran for safety.

And that was it. Gold has been trending lower since August of last year. If investors are concerned about inflation, that concern isn’t manifesting itself in higher gold prices.

Gold is just one data point and not enough to draw conclusions.

Let’s look at industrial metals. The S&P GSCI Industrial Metals index bottomed out at 259 in March of 2020. It then rocketed as high as 483 by May of this year. Since then, the index – which includes aluminum, copper, lead, nickel and zinc – has mostly traded sideways, in a range.

Commodities markets are volatile and subject to short-term fluctuations. It’s hard to conclude the direction of inflation based on a year’s worth of commodity price movements, particularly given the general “weirdness” of post-COVID supply chain problems.

But what about bonds?

Well … even bonds appear to tell the same story. The 30-year U.S. Treasury bond is highly sensitive to inflation assumptions. Its yield has fallen throughout 2021. In March, the bonds yielded 2.5%. Today, they yield 1.9%.

More inflation may still come. I can’t definitively say it won’t. But let’s just saw the market isn’t pricing it in at the moment.

And inflationary markets are easy to invest in. You buy-and-hold gold, real estate and growth stocks and ride it out.

Likewise, a deflationary market is easy to invest in. You buy bonds and high-yielding dividend stocks and ride it out.

But what do you do in a market with no clear inflation trend?

My recommendation is to stay tactical and focus on shorter-term trading. Your inflation outlook doesn’t matter if your time horizon is measured in days, weeks or even months.

P.S. My colleague Adam O’Dell will release details of his new Wednesday Windfalls strategy live on September 23. During the live event, he’ll show you how a simple two-day trade has beaten the market by 51 times over the last six months. To sign up for the live event, click here.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.