President Donald Trump is banking on a trade deal with China boosting the stock market ahead of his 2020 reelection bid, and he believes his best path to a second term is through the market and a strong economy, according to reports.

Three sources briefed CNBC that Trump wants a rally as he gets ready to run for a second term, and he’s reportedly decided a new trade deal with China would give his bid a tremendous boost.

Since Trump stunned Hillary Clinton in the 2016 election, the Dow Jones has gained more than 40 percent, the S&P 500 is up nearly 30 percent and the tech-heavy Nasdaq has seen a monster 45 percent boost as of Wednesday morning.

The market also has rebounded from the worst December since 1931. Since December’s Christmas Eve bloodbath that saw the S&P 500 briefly dip into bear market territory, the Nasdaq is up 22 percent, the S&P is up 18.2 percent and the Dow is up 18.1 percent.

Per CNBC:

The president is increasingly concerned that the lack of a trade agreement could knock down stocks, Bloomberg News reported earlier Wednesday. Trump has taken notice of the market’s gains as both sides get closer to a deal, the report added.

U.S. stocks started 2019 strong, with the S&P 500 surging more than 11 percent through Tuesday’s close. Part of the rally has been fueled by investors increasing bets that China and the U.S. will strike a trade deal soon. However, there are growing concerns that a deal is fully baked into the market, possibly limiting any more gains coming from positive trade news.

CNBC learned through sources on Monday that China and the U.S. were in the “final stages” of trade talks that could end this month. Sources also said the two sides are working on a summit at Mar-a-Lago, Trump’s Florida resort, to cap off the negotiations.

Worries over the two countries’ skirmish kept Wall Street on edge for most of last year as investors worried about the impasse’s impact on corporate earnings.

One of the president’s goals in striking a new deal with China is to rein in the U.S. trade deficit, a sticking point of his since he first ran in 2016. The trade deficit keeps growing, however.

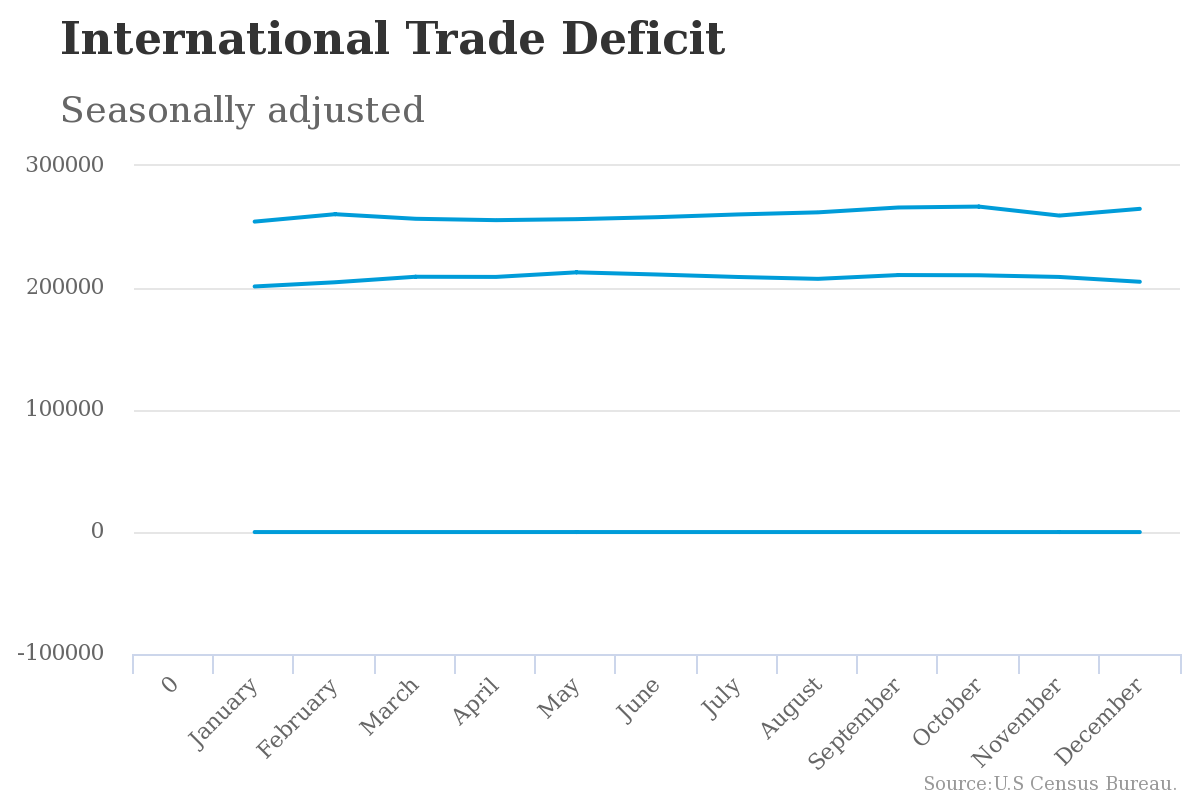

The Commerce Department said Wednesday that the U.S. trade deficit reached a 10-year high in December, hitting $59.8 billion. That number easily surpassed a Refinitiv estimate of $57.3 billion. In November, the deficit was at $50.3 billion.

The department’s report showed the deficit expansion took place amid a 2.1 percent increase in imports to $264.9 billion while exports dropped 1.9 percent to $205.1 billion.

The deficit has widened as a strong dollar makes it harder for foreign countries to buy U.S. goods, while slowing global growth is also hurting demand for U.S. goods.