Wall Street and investors around the world have all eyes glued on the G20 summit this weekend as presidents Donald Trump of the U.S. and Xi Jinping of China are set to meet face-to-face to discuss a new trade deal, or at least a pause in the tariffs fight until a deal can be reached.

A ceasefire and especially a new deal would send stocks soaring again after two months of extreme volatility that’s wiped out most of the year’s gains.

Goldman Sachs laid out three scenarios, but said the most likely conclusion will be an escalation of the fight, which will send stocks tanking yet again.

In fact, Goldman sees better than a 50 percent probability that the trade war will get worse.

Talks have been ongoing behind the scenes for weeks now, with speculation Thursday that progress had been made — until news broke that China hawk Peter Navarro is a late addition to the meeting. China considers Navarro a barrier to a successful resolution.

“We currently see ‘escalation’ as the most likely outcome in the next few months, with slightly over a 50% probability,” the note from a Goldman Sachs says.

If the trade war escalates, current 10 percent tariffs on a number of Chinese imports would rise to 25 percent on Jan. 1.

The other two scenarios, which are far less likely, is a pause on the tariffs — or a new deal, which is the least likely to happen. The bank says we likely won’t see a pause until late 2019.

“The chances of a comprehensive deal are pretty low in the near term (10 percent), though rising over the course of 2019,” the bank said. “By late 2019, however, we think it is likely we will have at least reached a ‘pause.'”

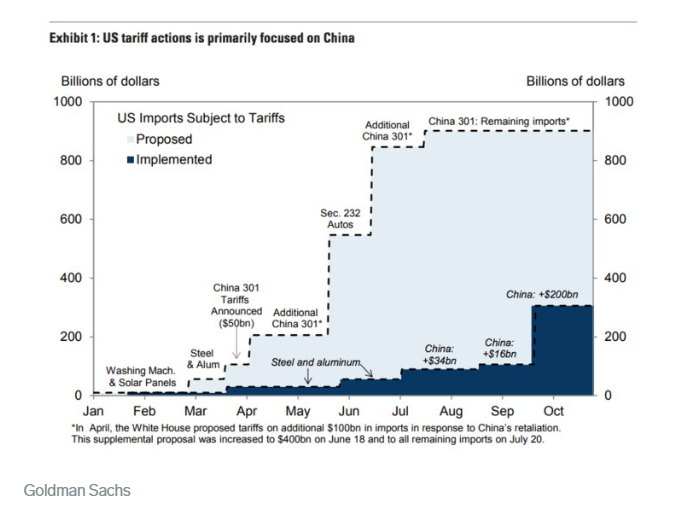

The U.S. currently has tariffs on about half of all Chinese goods imported to the U.S., worth about $250 million total. China has slapped tariffs on $110 million worth of U.S. imports.

If the meeting does not go well, the tariffs on Chinese imports will double to $500 billion or more to all Chinese imports.

China has threatened to retaliate further if that happens and the price of goods will skyrocket.

If there is a pause in additional tariffs, current tariffs would remain in place until a deal is reached but no additional duties would be levied.

A new trade deal, “which we think is unlikely in the near term, would involve complete rollback of the current tariffs,” Goldman said.

Keep scrolling down to read more of the latest news on the Trump-China trade war to see how it will affect the stock market and your investments on Money & Markets.