High-tax blue states like New York, New Jersey and California continue to get hammered by the 2017 Republican tax law, the Tax Cuts and Jobs Act.

And states like Florida and Texas have the state and local tax (SALT) deduction to thank for an uptick in their populations.

The SALT deduction was part of a GOP-backed tax plan proposed by President Donald Trump and passed by the GOP-controlled House and Senate in 2017.

Here’s a deeper dive into the SALT deduction and what it means for different states:

What is the SALT Deduction?

The change to the tax law in the Tax Cuts and Jobs Act has led to higher taxes for people in places like New York, New Jersey, Connecticut, California and other high-tax states and municipalities.

Under the Republican tax law — which began in 2018 — there was a cap of $10,000 on the amount of state and local taxes a taxpayer could deduct. Before 2018, you could deduct as much of your state and local taxes as you wanted.

Under the Republican tax law — which began in 2018 — there was a cap of $10,000 on the amount of state and local taxes a taxpayer could deduct. Before 2018, you could deduct as much of your state and local taxes as you wanted.

Higher-income taxpayers pay the brunt of state and local taxes — which are used to fund police, fire and public schools. The higher the state and local tax rate, the more it hurts. Hence, if you are in a high tax bracket and live in a state with high state and local taxes, you are getting hammered on your taxes.

Florida-based Certified Public Accountant Nate VandenBerg said he’s seen a noticeable migration of people from the northeastern states, and even from California into Florida.

“Unhappy taxpayers left their accountants’ offices last year with an unwanted and unexpected tax bill from the IRS,” VandenBerg said. “Taxpayers who were accustomed to getting a refund in previous years now owed thousands in taxes due to one culprit — the limitation of the SALT deduction.”

The SALT deduction, under the Republican law, helped offset $1.5 trillion in corporate and personal income tax cuts.

How it Hurts Blue States

Residents of New York, Connecticut, New Jersey, California, Massachusetts, Illinois, Maryland, Rhode Island, Vermont and the District of Columbia had the highest average deduction for SALT.

Here are the average SALT deductions before the SALT cap went into effect in 2018. Figures are according to SmartAsset:

- New York: $21,038

- Connecticut: $18,939

- New Jersey: $17,183

- California: $17,148

- District of Columbia: $15,452

- Massachusetts: $14,760

- Illinois: $12,877

- Maryland: $12,442

- Rhode Island: $12,138

- Vermont: $11,843

By capping the SALT deduction, people can only shield $10,000 in income from taxes, so if you deduct $10,000 from the above totals, you can see how much it impacts taxpayers in those states.

For example, in New York, the average person will pay taxes on $11,038 more of income under the new law than before.

That’s causing people in those states to move elsewhere. According to U.S. Census data, New York, California, Connecticut and New Jersey lost about 455,000 residents between July 1, 2018 and July 1, 2019. That’s on top of the 408,500 those same states lost the previous year.

According to The Cato Institute, families earning $75,000 a year could save around $5,000 a year by moving from a state like New York to Florida. A family making $150,000 could save nearly $10,000 moving from California to Texas.

And because those people are moving out, those states are also losing their tax revenue.

Who’s Winning the SALT War?

There are two states directly benefiting from the SALT deduction cap: Florida and Texas — both states controlled mostly by Republicans and who voted for President Donald Trump in the 2016 presidential election.

Florida has had a Republican governor since 1998 while a Republican has resided in governor’s mansion in Texas since 1994.

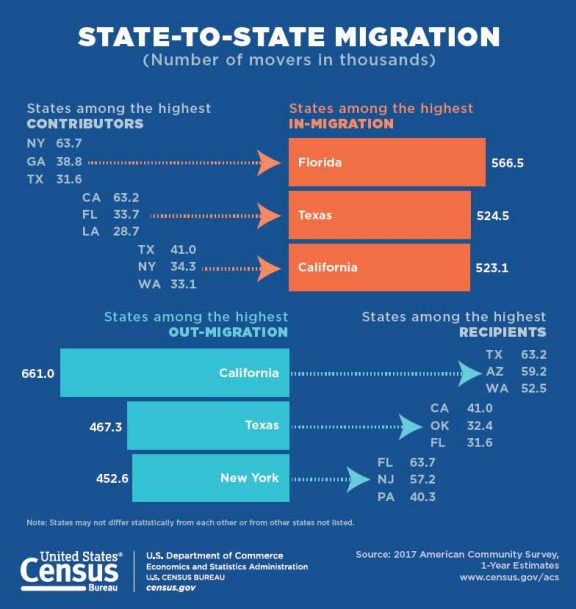

According to Census data, Florida had more than 566,000 people migrate — primarily from New York (about 63,700). Texas picked up 524,500 new residents — mostly from California (63,200) — in 2017.

So the migration pattern is pretty clear. Those in the higher-taxed blue states in the Northeast are moving south while Californians are moving east to Texas.

The biggest reason why Texas and Florida are so popular among taxpayers is that there is no state income tax — taking away a variable in the SALT discussion. Lower overall taxes and no income tax takes the sting away from the SALT cap.

The wealthy are taking advantage, too. Billionaire Carl Icahn is moving his hedge fund to South Florida from New York because of taxes, according to the New York Post. He’s not alone.

Companies like Wexford Capital and hedge fund manager Paul Tudor Jones have moved to Palm Beach County, Florida, because of the lower corporate tax rate of 5.5%.

In December 2019, the Democrat-controlled House voted to temporarily repeal a majority of the GOP tax law cap on SALT deductions.

The bill — which was dead on arrival to the Republican-controlled Senate — would have raised the cap to $20,000 for married couples and eliminating the cap by 2021.

Senate Finance Committee Chairman Chuck Grassley, R-Iowa, told The Hill he had no plans “to revisit the SALT deduction cap.”