President Donald Trump always has his eye on the stock market, turning equities into a sort of report card for how his policies are doing. His first year in office saw huge gains but the second year started sending mixed signals over the fourth quarter, in large part due to his ongoing trade war with China, which has made things extremely volatile.

Jan. 20 marked the two-year anniversary of Trump’s inauguration. In that time, stocks rose to record highs, making him one of the most successful Republican presidents judging by market gains.

The Nasdaq soared 29 percent since January of 2017, marking the tech-heavy index’s best rally ever under a Republican president.

But 2018 has been rough, putting a dent in the big lead Trump had built. Trump’s two-year performance on the S&P 500 ranks him the tenth best percentage out of 23 presidents dating back to Herbert Hoover, and fifth best among 11 Republican presidents.

Per MarketWatch:

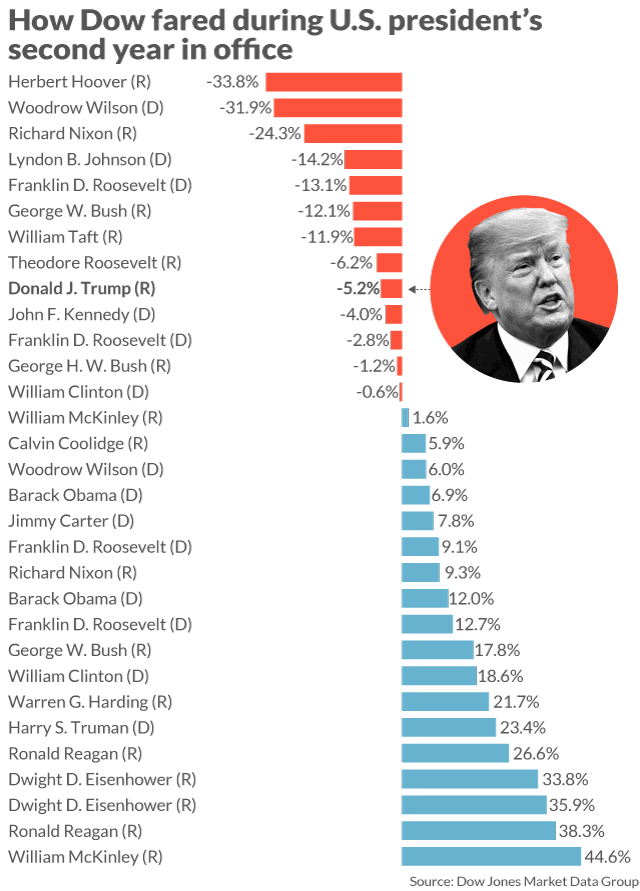

Between Jan. 20, 2018 to Jan. 18 this year, the S&P 500 SPX, +0.22% fell 4.97% compared with average gains of 5.43% during a similar time frame while the Dow Jones Industrial Average DJIA, +0.70% shed 5.24% versus a rise of 5.48% and the Nasdaq COMP, +0.08% dropped 2.44%, sharply underperforming the average advance of 6.87%.

A combination of concerns about the Federal Reserve raising interest rates and Trump’s handling of trade negotiations with China has been blamed in part for taking a toll on a market that otherwise benefited from a robust economy, deregulatory efforts and a large corporate tax cut, underscoring the dramatic contrast in its fortunes from one year to the next as the following data show.

Dow

Second year in office (-5.24%):

- 5th worst percentage loss for a Republican president (out of 17)

- 9th worst percentage loss for any president (out of 31)

- The worst second year in office (regardless of term) for a president since Bush from 2002 – 2003

First two years (+25.21%):

- 6th best percentage gain for a Republican president (out of 17)

- 11th best percentage gain for any president (out of 31)

- The best first two years in office (regardless of term) for a Republican president since Reagan from 1985 – 1987

- The best first two years in office (regardless of term) for a president since Obama from 2013 – 2015

S&P 500

Second year in office (-4.97%):

- 4th worst percentage loss for a Republican president (out of 11)

- 8th worst percentage loss for any president (out of 23)

- The worst second year in office (regardless of term) for a president since Bush from 2002-2003

First two years (+17.98%):

- 5th best percentage gain for a Republican president (out of 11)

- 10th best percentage gain for any president (out of 23)

- The best first two years in office (regardless of term) for a Republican president since Bush from 2005 – 2007

- The best first two years in office (regardless of term) for a president since Obama from 2013 – 2015

Nasdaq

Second year in office (-2.44%):

- 4th worst percentage loss for a Republican president (out of 7)

- 5th worst percentage loss for any president (out of 12)

- The worst second year in office (regardless of term) for a president since Bush from 2002-2003

First two years (+29.19%):

- 2nd best percentage gain for a Republican president (out of 7)

- 5th best percentage gain for any president (out of 12)

- The best first two years in office (regardless of term) for a Republican president since Reagan from 1985 – 1987

- The best first two years in office (of a first term) for a Republican president on record

- The best first two years in office (regardless of term) for a president since Obama from 2013 – 2015

Stocks have partially recovered from the gut-wrenching selloff in late 2018 to punch higher in January. But it will be difficult for equities to reclaim the glory days of Trump’s first year with the global economy starting to show signs of fatigue while corporate earnings growth have slowed. Fears of a prolonged trade tensions with key trading partner China as well as the fallout from the partial government shutdown might also cap the market’s upside for now.