Money & Markets Daily: The 5

It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just 5 minutes.

Let’s get started!

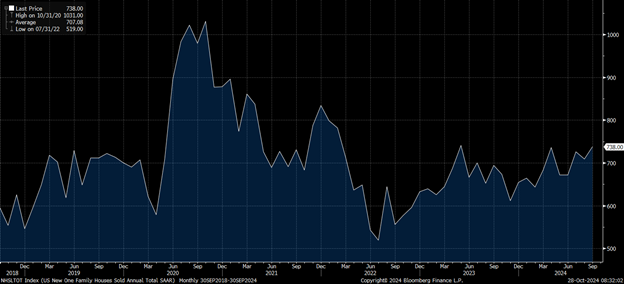

Fed Rate Cut Leads to Housing Boost

New home sales in the U.S. reached a 1-year high in September following a 50-basis point cut in the Federal Reserve’s target interest rate.

According to government data, single-family home sales jumped 4.1% to a 738,000 annualized rate – above the consensus estimate of 720,000.

In addition to lower interest rates, new home builders ramped up offering incentives like mortgage-rate buydowns and general discounts to further boost home sales.

The Fed rate cut also boosted builder sentiment, as noted in an index published by the National Association of Home Builders. The index reached the highest level in four months in October, as hopes persist for future rate cuts by the Fed in its upcoming meeting in November.

Adam’s New 10X Ratings System

Longtime readers know all about the Green Zone Power Ratings system. Chief Investment Strategist Adam O’Dell designed it to find stocks that are set to outperform the market by 3X.

Now, he’s taking it a step further. He’s honed the system down to target stocks with 10X potential.

And with the Fed eyeing another interest rate cut next week, he’s picked a perfect time to put it to the test. He’s discovered “Two Tumbles and a Jump,” a market pattern with an odd name that’s incredibly accurate at predicting the next bull market.

He’s using his new 10X Ratings system to find the perfect stocks to buy before that happens. He’ll have more info in Money & Markets Daily later this week…

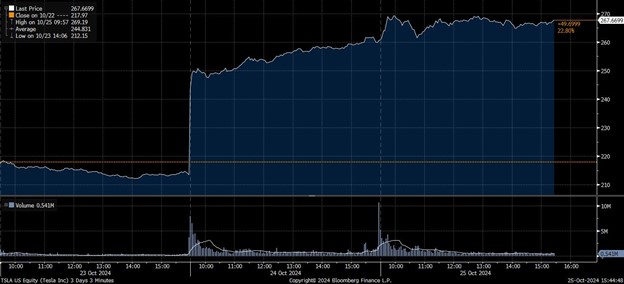

Tesla’s 22% Boom

Coming on the heels of its uninspiring robotaxi event, Tesla Inc. (Nasdaq: TSLA) rolled out its quarterly earnings last week to much bally-hoo.

The electric vehicle manufacturer unveiled a 17% jump in net income and an 8% boost in total revenue thanks to a rise in global deliveries.

A catalyst for the higher net income was increased sales of regulatory credits to other automakers and growth in Tesla’s energy arm.

The result: a 22% one-day jump in TSLA shares:

The rally in TSLA shares carried over to the end of the week as CEO Elon Musk suggested the company could see 20% to 30% “vehicle growth” next year.

One thing to note is that TSLA still rates a “Bearish” 25 out of 100 on Adam’s Green Zone Power Ratings system as the stock continues to be highly volatile and overvalued.

The Next 2 Weeks Are Going to Be Bumpy

Not only is the U.S. in the home stretch of a presidential election, but there will also be a flurry of market-moving news in the next two weeks.

Over the next 10 days, nearly half of the S&P 500 will report earnings, including five of the Magnificent Seven stocks and big players like Ely Lilly, Exxon Mobile and Visa.

The U.S. Treasury Department is also planning to announce on Wednesday that it will keep the size of its debt auctions steady. Bond investors will closely monitor the future trajectory of those auctions.

The Fed’s inflation gauge and employment report will be released on Thursday and Friday, respectively. These numbers will show whether the U.S. economy is cooling enough to justify additional rate cuts.

Of course, we have the presidential election on November 5, followed by the Fed’s November meeting.

Currently, swaps are pricing in an 80% chance the Fed trims back its benchmark rate by an additional 25 basis points.

Pent-up Demand

With interest rates coming down, it’s clear that people are more open to larger purchases again. We see that with home sales spiking above.

Have higher interest rates changed your strategy for buying or financing cars, homes, furniture or any other higher-priced items? Are you sitting on a pile of cash, just waiting for rates to hit a key level before you buy that shiny new boat?

Let us know by emailing Feedback@MoneyandMarkets.com.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets