Of all social media platforms, Twitter is the most visible. It’s the platform of choice for presidents, journalists and celebrities.

And it’s designed to stir up controversy.

Yet for all the noise, Twitter Inc. (Nasdaq: TWTR) is still a small fry in the world of social media. Twitter had 186 million monthly active users as of the end of last quarter.

That’s nothing compared to Facebook Inc.’s (Nasdaq: FB) 2.7 billion in monthly active users. More than a third of the entire world population uses Facebook at least monthly.

Alphabet Inc.’s (Nasdaq: GOOGL) YouTube isn’t “social media,” per se, but the platform has over a billion monthly viewers. And even boring, stuffy LinkedIn boasts 260 million monthly active users.

In social media, size is critical. Networks are only valuable when a lot of people use them. And while Twitter is large enough to have critical mass, it seems destined to play perpetual second fiddle to Facebook.

That might be changing if we believe the rumors. Along with Microsoft Corp. (Nasdaq: MSFT), Twitter is in the running to acquire Chinese-owned TikTok, the social media platform that has soared in popularity, especially with younger audiences.

The Trump administration isn’t comfortable with a Chinese-owned company with potential ties to the government gathering information on U.S. citizens. It has demanded that the popular video-sharing app be sold to an American buyer or have its U.S. operations shut down.

Buying TikTok would be a game changer for Twitter stock. Thus far, its own forays into video via Vine and Periscope haven’t amounted to much. (If you have no idea what Vine or Periscope are, you just proved my point.)

But the deal is by no means done. TikTok has been valued as high as $50 billion, whereas Twitter’s market value is only $30 billion at current prices. So, Twitter isn’t exactly in a position to write a check. All the same, it will be interesting to see how this plays out.

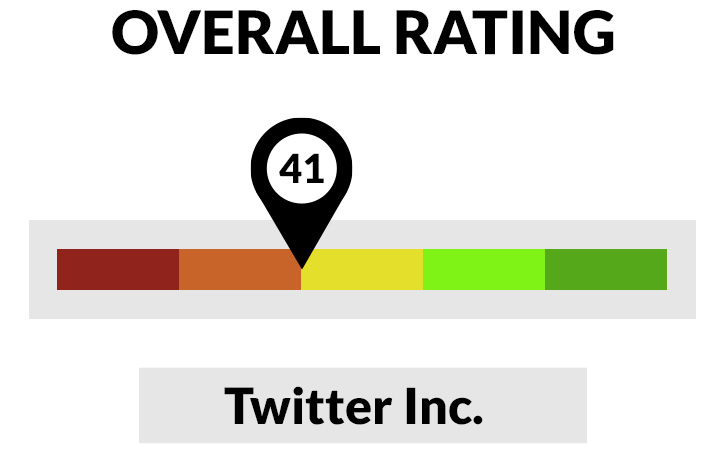

In the meantime, let’s see how Twitter ranks using Adam O’Dell’s stock rating system.

How Twitter Stock Ranks

It’s not great. Twitter’s overall ranking is just 41, putting in the bottom half of all stocks we track.

- Quality — Twitter rates high in terms of quality, scoring a 74. This is driven by its high profit margins, which are rated 95. Only 5% of stocks have fatter margins. Twitter’s conservative debt load also helps (rated 83).

- Growth — Twitter is also a solid growth stock, rating at 64. This is driven by growth in its net income, which came in at 69. Sales growth was average, at 56.

- Momentum — Twitter is in the middle of the pack when rated for momentum, scoring a 56. That’s telling when you consider how well tech stocks have supported this market since the pandemic started. Twitter hasn’t enjoyed the momentum that other major tech names have.

- Volatility — The stock is barely above average in volatility, at 54. Remember, a higher volatility rating in Adam’s system means the stock is less prone to big swings.

- Value — Twitter isn’t cheap, rating a 29. That’s not surprising. You won’t find many tech names rating highly here. Twitter’s price-to-earnings ratio ranks relatively high, scoring a 63. But this is also skewed by the total destruction of profits outside of the tech sector during the early months of the pandemic. Twitter ranks much lower on price-to-sales, scoring just 8. That means 92% of the stocks in our universe are better values based on that metric.

- Size — And finally we get to size. Twitter is a large company by market cap, rating a 5. Smaller companies tend to outperform over time, and Twitter is larger than 95% of others.

If you think the TikTok deal might work out, Twitter is an interesting play. Otherwise, there’s no compelling reason to buy this one when better tech names are available.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.