When it comes to earnings, analysts’ estimates of future profitability are an essential part of the equation.

These estimates are typically revised as the quarter presses on.

However, in the end, a stock’s performance relative to its quarterly earnings is somewhat dependent on how those actual earnings compare to the estimates.

If a company beats expectations, that is a good sign. This means it was more profitable than analysts had expected.

Likewise, if it can’t beat expectations, it means the company was not as profitable; therefore, the stock may face headwinds coming out of an earnings report.

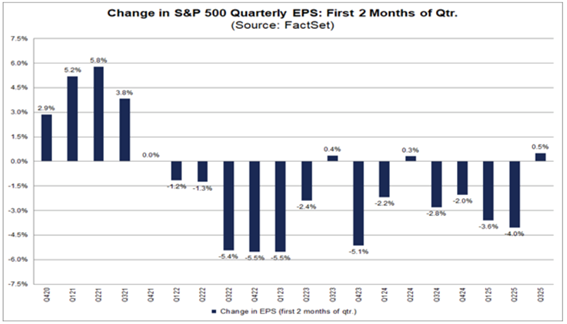

Analyst estimates are typically low in a typical quarter. According to FactSet, analysts initially expect earnings for S&P 500 companies to be 1% lower during the first two months of any quarter.

However, for the first two months of the third quarter of 2025, it’s a different story:

Analysts have actually raised their earnings per share (EPS) estimates by an average of 0.5% — the highest since the third quarter of 2021.

This means analysts are shrugging off concerns about inflation and tariffs.

On a sector level, the most considerable EPS increase is in the information technology sector (+4.4%), followed by energy (+4%) and communication services (+2.6%).

The health care sector had the most significant decrease in EPS estimates at -7.2%.

If these estimates hold, it could be a very good quarter for the broader S&P 500.

Now, let’s analyze potentially “bullish” earnings for next week.

“Bullish” Earnings to Watch

These stocks are expected to beat their previous quarter’s EPS, and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

As earnings season starts to wind down, the number of S&P 500 companies reporting decreases. For this week, I included all the stocks in our universe on the screen.

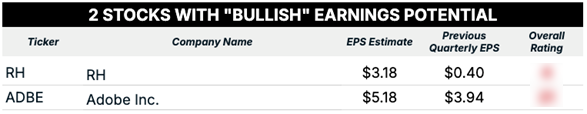

Here are the two companies that made the list:

My focus here is on Adobe Inc. (ADBE), the company that became known for its suite of creative editing software.

In the second quarter of 2025, Adobe delivered record revenue of $5.87 billion — 11% year-over-year growth — with EPS of $3.94.

Analysts are betting on a big quarter of revenues tied to Adobe’s new Firefly creative AI design tool.

Firefly allows users to create images and videos using simple, everyday language.

The app was released in March 2023, but its web applications were not released until February 2025.

It’s taken Adobe time to fully monetize the app, and Wall Street is banking on this being a breakout quarter in that regard.

I think Adobe beats expectations and, perhaps, sets another record for quarterly revenue.

The biggest question is how that will impact the stock’s “Bearish” rating on Adam’s Green Zone Power Rating system.

Matching or beating expectations could power this stock higher.

Now, we’ll look at potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

As with our “bullish” screen, I opened the door to all companies, in and out of the S&P 500, this week.

Here is the one company that passed this screen:

The Kroger Co. (KR) has been a solid market performer, outpacing the S&P 500 by nearly 2-to-1 in the last 12 months.

With tariff and inflation concerns, it started to shed 60 unprofitable stores across its footprint over the summer.

Kroger also started aligning its supply chain in Texas and Louisiana to anticipate potential higher costs of goods and services.

It’s not time to ring the alarm bell for KR just yet, as the company remains profitable and rates in the top 20% of stocks in the Green Zone Power Rating system.

However, in a time when the market is rewarding consumer staple stocks, a decline in earnings could spell temporary pain for KR stock.

I think Kroger Co. will come in below the previous quarter, as it will take time for these store closures and supply chain realignments to positively impact the company’s bottom line.

That’s all I have for you today.

Make sure to enjoy your weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets