Last week’s market-leading performance by technology stocks puts the sector within spitting distance of “new highs” territory…

Shares of the SPDR Technology Sector ETF (XLK) peaked on February 19, before dropping a full 29% into the April 7 lows.

From there, the technology sector ETF has since rallied 39%, leaving it less than 1% below its February high.

While the so-called “Magnificent 7” stocks have been noticeably missing from my top-performers screen during this recovery rally … some make an appearance today.

First, though, let’s see how the various market sectors performed last week against the backdrop of the ongoing trade talks between the U.S. and China as the 90-day tariff clock ticks down.

Here’s how last week shook out:

Key Insights:

- The S&P 500 (SPY) closed the week 1.7% higher.

- 8 of 11 major sectors showed a positive gain for the week.

- Seven sectors underperformed the broader S&P 500.

- The tech sector (XLK) led the market with a 3.2% gain.

Consumer Staples (XLP) lagged the rest with a 1.4% loss.

So with the tech sector leading and consumer staples (XLP) lagging, it would appear bullish sentiment is alive and well.

Let’s have a closer look at these sectors and see what my Green Zone Power Rating system says about their best- and worst-performing stocks…

Mag 7 Stocks Lead Tech Higher

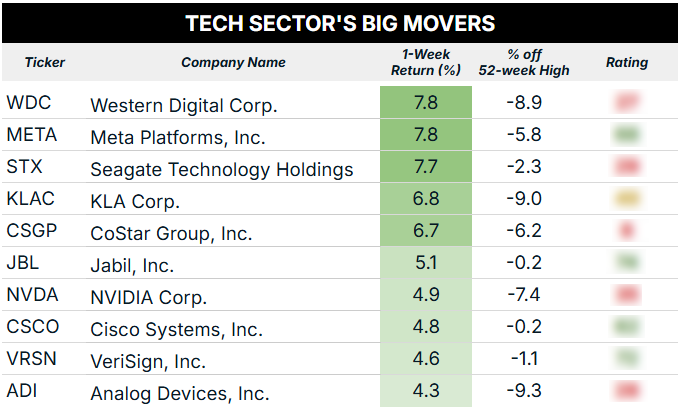

After screening for all S&P 500 tech sector stocks that closed last week within 10% of their 52-week highs, you can see the top performers from last week in the table below:

As I mentioned, the Mag-7 stocks have failed to meet the criteria of my bullish “big movers” scan in recent months, mainly because they were all well off their 52-week highs.

That’s changed this week…

Meta Platforms Inc. (META) gained an impressive 7.8% last week and is currently just 5% off its highs.

Meanwhile, NVIDIA Corp. (NVDA) shares gained 4.9%, bringing the stock within 4% of its February peak.

The market’s optimism in one of these stocks is confirmed by my system’s “Bullish” rating, while the other is not.

I’ll also point out that two of the Mag-7 stocks are still a long way away from their highs, with Apple (AAPL) shares still off by 21% and Tesla (TSLA) shares still down 39%.

All told, I’m seeing a divergence in the performance of this group of widely-watched titans. That creates something of a “mixed message” for the tech sector as a whole, but opportunities exist in the group’s highest-rated stocks.

This once again shows that investors can find plenty of solid, outperforming stocks with the right tools. (To look up any of these stock ratings now, click here to see how you can access my system.)

Now, let’s turn our attention to last week’s underperforming sector: consumer staples.

Last Week’s Laggard: Consumer Staples

Here’s what my screen of the weakest consumer staple sector stocks revealed:

The first thing that really stands out to me here is that none of these stocks rate well on my Green Zone Power Ratings system. Every stock lands in either the “Neutral” or “Bearish” bucket, with three stocks (BF.B, STZ, CAG) even landing in the “High-Risk” bucket.

Said another way: None of these 10 stocks is currently poised to beat the market in the months ahead.

Brown-Forman’s 15.7% sell-off can be attributed to tariff uncertainty. During its quarterly earnings call on Thursday, the producer of the popular Jack Daniels whiskey and other spirits forecast declining annual revenues due to less consumer demand and higher production costs.

My system was already sounding the alarm on this “High-Risk” stock.

Other stocks on the list had more muted losses, but there is definitely a trend in related sin staple stocks, with companies like Constellation Brands (STZ) and Molson Coors Beverage Co. (TAP) also making the list above. This is something worth keeping an eye on…

Have a great week!

To good profits,

Editor, What My System Says Today