Each week, I share my “New Bulls” screen so that you can see precisely which stocks are improving within the Green Zone Power Rating system.

Because when a stock turns “Bullish” in my system — or even in some cases, “Strong Bullish” — that means it’s well positioned to outperform the S&P 500 over the next 12 months by a multiple of 2X or 3X.

My system screens thousands of stocks from all over the market, boiling down thousands of data points into a short list of stocks with incredible potential.

More than just the individual stocks and ticker symbols — this exercise also gives us unique insights into which broader trends are currently driving the market in real-time.

And I’ve spotted two trends within this week’s data that I think deserve a closer look.

Let me show you why…

A Big Earnings Boost for TJX

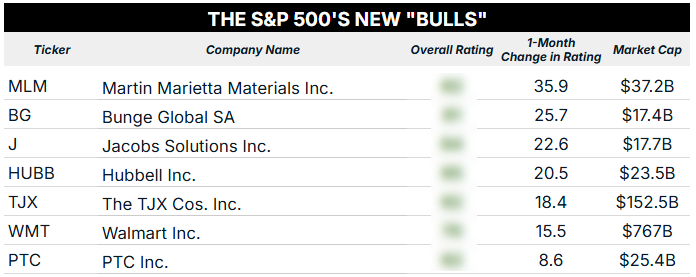

Seven S&P 500 stocks passed my two Green Zone Power Rating thresholds to show up on this week’s “New Bulls” list:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

Here’s what I found when running the screen:

TJX Cos. Inc. (TJX) has been on our radar after it landed on our list of bullish earnings calls to watch earlier this month.

My colleague, Matt Clark, pointed out that increased foot traffic at discount retailers should be expected as shoppers contend with ongoing inflation. And as he mentioned last Friday, that trend has been a boon for TJX:

TJX is still rated “Bearish” in our Green Zone Power Rating system, but I believe this strong earnings report and subsequent price action will move its rating higher.

Well, Matt was right on the money! TJX’s overall rating has jumped 18 points higher and is now “Bullish.” That points to more outperformance for the stock ahead.

Stay tuned for more earnings insights from Matt in tomorrow’s edition of What My System Says Today.

Seeing Walmart Inc. (WMT) crop up on this list is another sign that investors are homing in on the retail space as consumers contend with higher prices. The Big Box retail stock has gained 26% over the last year, handily beating the broader S&P 500’s 15% gain over the same period.

Let’s move on to a trend I’m seeing outside the S&P 500…

A Promising Trend Outside of the S&P 500

We have another long list of “New Bulls” outside of the S&P 500 this week as 29 stocks passed my screen and turned “Bullish” in my system:

One of my go-to investment resources, Bespoke Investment Group, pointed out an incredible stat in a recent piece of research. Last Friday’s Powell-fueled market rally was strong across stocks of all sizes, but it was especially felt within the small-cap space, where a full 1,878 of 1,966 stocks currently tracked by the Russell 2000 index closed the day higher.

Looking at the list above, 11 of the 29 stocks (37%) are considered small caps with market capitalization between $250 million and $2 billion. Another 10 stocks (34%) fall into the mid-cap range ($2 billion to $10 billion market caps).

This isn’t a huge surprise considering we’re looking at stocks outside of the large-cap S&P 500, but it’s still encouraging to see so many smaller stocks entering “Bullish” territory in my system. 12 of those tickers above have improved by more than 20 points on their overall rating!

We’re seeing more and more evidence of rotation into smaller stocks after mega-cap tech led the charge for so long … and I’m all for it!

If you want to see how the Green Zone Power Ratings for these stocks look in greater detail, click here to see how you can gain full access to my system with a Green Zone Fortunes membership.

That’s a wrap for me this week. Enjoy your long holiday weekend!

To good profits,

Editor, What My System Says Today