We’re back in action after the long Labor Day weekend. I hope you had a chance to relax and enjoy the last bouts of summer.

Turning to financial markets, we have a new brand of tariff uncertainty to consider after a federal court of appeals ruled on Friday that most of the Trump administration’s global tariffs are illegal.

As this is a headline-driven market, investors are reacting in kind this morning. Treasury yields are popping, and major indexes are sinking at the idea of the government having to potentially pay back over $10 billion in dues already collected.

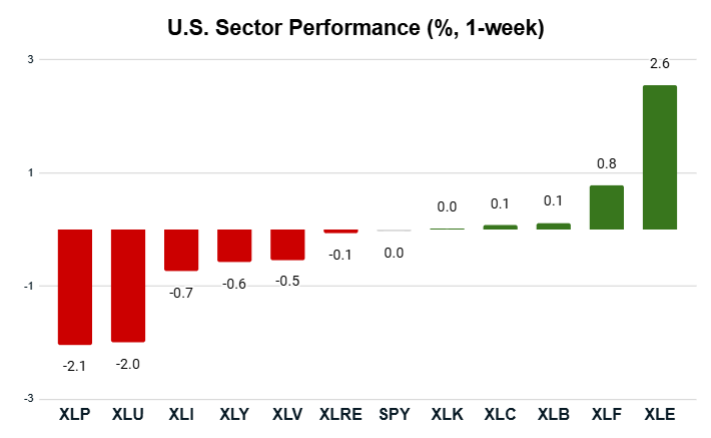

Let’s see how last week’s performance shook out before the latest tariff bombshell dropped:

Key Insights:

- The S&P 500 (SPY) was flat for the week.

- Five sectors outperformed the S&P 500, while six sectors underperformed.

- The energy sector (XLE) led the pack again with a 2.6% gain.

- Consumer staples (XLP) lagged with a 2.1% decline.

We’ve got a tale of two extremes here. The broader S&P 500 index was flat for the week, with a majority of sectors trading within 1% of that benchmark.

And then we have three sectors (XLE, XLU and XLP) that outperformed — or underperformed — by at least 2X.

Let’s look at some of the best and worst performers from these sectors and see what my Green Zone Power Rating system has to say…

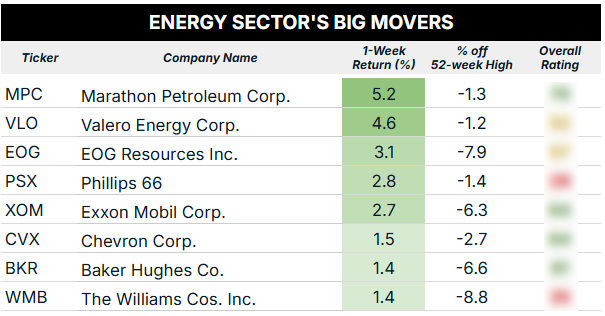

Big Oil Drives XLE Higher

Again, this week’s list of XLE outperformers is chock-full of Big Oil players. President Trump has made it crystal clear that maximizing the potential of American energy, and especially fossil fuels, is a chief goal of his second term.

Below, you’ll find six energy stocks that closed last week within 10% of their 52-week highs and how they stack up in my Green Zone Power Rating system:

As you can see, each of these stocks still has some runway before flirting with their 52-week highs.

With four of the six stocks rated “Bullish” in my system, there’s a solid chance that they can run higher once they hit those thresholds, especially if oil prices can gain prolonged positive momentum. We’ve seen some short-term pops in crude oil futures, but prices are still down double digits in 2025 so far.

If you’d like to find out where they land on my 0 to 100 scale, click here to see how you can join up in Green Zone Fortunes and look up any of these tickers (or thousands of others).

Now let’s move on to the worst performers in the consumer staples sector…

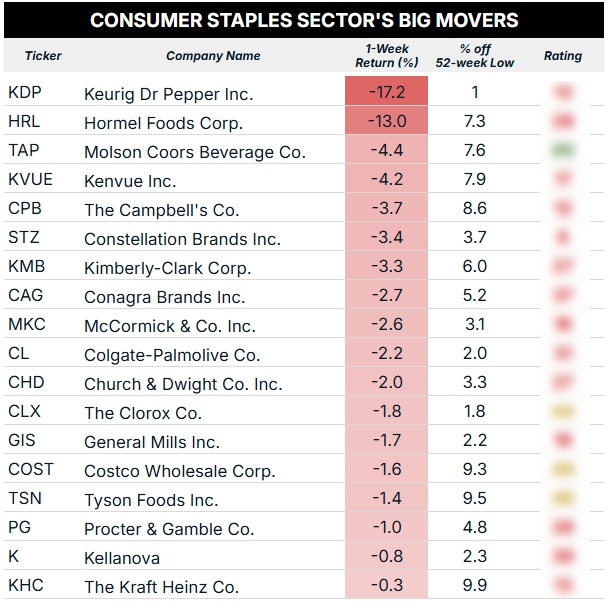

A Long List of Consumer Staples Laggards

The consumer staples sector had a rough time last week.

Here are 18 stocks that closed within 10% of their 52-week lows:

Keurig Dr. Pepper Inc. (KDP) led the pack with a massive 17.2% decline following news that the company was planning to acquire JDE Peet’s, the multinational coffee company based in the Netherlands.

Hormel Foods Corp.’s (HRL) 13% loss wasn’t far behind after the company revised its full-year earnings guidance lower. Inflated commodity costs have hammered Hormel’s margins, with pork prices significantly higher compared to a year ago.

Sudden double-digit moves are always jarring, but I’m more worried about how these stocks look longer term.

Unlike the energy sector, this list of 18 stocks looks brutal on my Green Zone Power Rating scale, with 14 rated “Bearish” or “High Risk” and only one stock rated “Bullish.”

My colleague Matt Clark will explore the consumer staples sector more in tomorrow’s edition, so keep an eye out for that.

To good profits,

Editor, What My System Says Today