Matt here. Welcome to the Earnings Friday edition of What My System Says Today.

I’ll get into bullish and bearish earnings in a bit, but I wanted to start today with the one word Wall Street hates.

It’s a word that sends investors scrambling and stocks down almost every time it creeps up in headlines.

The word is “uncertainty.”

When there is uncertainty around a company’s performance, future guidance or even the impacts of government policy, investors get twitchy.

But that hasn’t stopped “uncertainty” from being one of the most common words in corporate earnings calls this quarter.

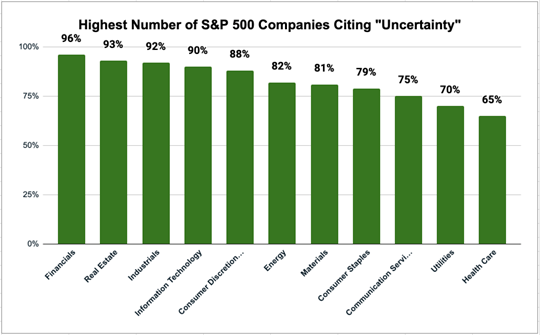

Searching for the word “uncertainty” in the conference call transcripts of all the S&P 500 companies that conducted earnings calls from March to May, found that 381 companies (84%) mentioned it at least once.

That’s the second-highest instance in the last decade, only behind the first quarter of 2020, when we were in the early days of the COVID-19 pandemic. Let’s review a company that mentioned the word 12 times in its earnings call this week…

Target (TGT) Whiffs on Earnings and Revenue

One earnings report I was keeping an eye on this week was Target Corp. (TGT).

In my note last week, I mentioned that all six stocks with “bearish” earnings potential were in the retail sector, including Target.

According to our screening, Target was expected to report earnings per share (EPS) of around $1.69 … down from $2.41 in the previous quarter.

It was much worse than that as the retail giant clocked EPS at $1.30, more than 21% lower than expectations.

Target’s quarterly revenue came in at $23.8 billion, 2% lower than expectations.

Target management laid some of the blame on its rollback of diversity, equity and inclusion (DEI) policies and the consumer boycott that followed.

Of course, declining consumer confidence and tariff uncertainty were also mentioned, but management specifically highlighted DEI.

Let’s see which companies could face a bearish earnings swing in next week’s holiday-shortened trading week.

Speaking of Slumping Sentiment and Uncertainty…

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Our screen brought back two companies:

Dell likely makes the list because of continued exposure to retaliatory tariffs by the Trump administration.

The company derives 75% of its total revenue from hardware sales.

According to Morningstar, based on the portion of that hardware impacted by tariffs, Dell would need to raise its global pricing by 11% to make up for the losses.

The bigger surprise on the list is Ulta Beauty Inc. (ULTA).

Estimates suggest a 31.4% decline in quarterly earnings when the luxury beauty retailer reports next week.

Ulta is especially vulnerable to economic downturns and slumping consumer sentiment.

If discretionary spending takes a hit, so too do sales at Ulta, and that could drag its “bullish” standing in Adam’s Green Zone Power Rating system down. It boasts especially strong ratings on the Quality and Growth factors. (To look up ULTA’s complete ratings — as well as the rating on thousands of other tickers — click here to see how you can gain unlimited access to Adam’s system now.)

I’ll be watching this earnings call to see how management factors all of this into not only its current earnings picture but its forward outlook.

Ulta has already tried to overcome these headwinds by making price adjustments and focusing on digital sales over in-store sales.

“Bullish” Stocks to Watch

The last part of our analysis focuses on companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are six important companies set to report this week:

These six companies all have the potential to surpass their previous quarter’s earnings per share.

Some quick takes about this list:

- Every stock rates “Bearish” or lower on Adam’s Green Zone Power Ratings system.

- Salesforce Inc. (CRM) is the only stock that rates above 46 on our Growth factor, with a 99 out of 100.

This tells me that five of these six companies are coming off a quarter with struggling sales and/or earnings, meaning they have a long runway for improvement this quarter.

Adam’s Green Zone Power Rating system does not “predict” earnings; instead, it incorporates earnings into the ratings once they have been reported.

I will be curious to see how potentially positive beats on earnings will impact the overall ratings of these “Bearish” companies.

That’s all from me today. I hope you all have a great long weekend!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets