Federal Reserve Chair Jerome Powell warned us.

The Fed will continue to fight inflation.

And it’s going to be a painful battle.

Powell implied in a recent speech that interest rates won’t come down until inflation falls to a reasonable level.

This is an admirable goal. But economic pain is a side effect.

Higher interest rates make it more difficult for businesses to expand. This leads to fewer jobs.

Many retailers and other low-margin businesses rely on credit.

Higher rates make it difficult to continue operating.

That means more layoffs.

Fewer jobs and more layoffs means higher unemployment.

History shows that’s the case.

What History Can Tell Us About the Next Recession

In the past, higher interest rates have led to higher unemployment.

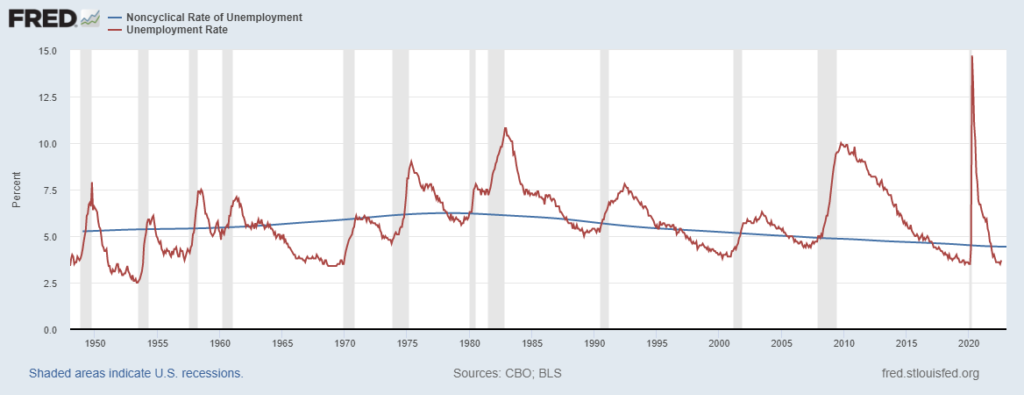

The chart below offers a way to forecast how high unemployment can reach.

The Fed’s Estimated Unemployment Rate

Source: Federal Reserve.

The blue line is the Fed’s estimate of the noncyclical unemployment rate. This is known as the natural rate of unemployment.

In theory, if unemployment falls below that level, inflation could accelerate.

In practice, the unemployment rate, the red line in the chart, is almost always below the noncyclical rate.

It tends to move above that rate when the economy faces a recession.

In the past two economic downturns, the rate crossed above the natural rate as the recession started.

In previous cases, the crossover occurred after.

Unemployment Rates in Previous Recessions

In the high-inflation 1980s, the unemployment rate moved more than 4.5% above the natural rate.

In the global financial crisis of the mid-2000s, it peaked at 5% above the natural rate.

The gap between the two lines tends to be less than 2%.

Now the natural rate is around 4.4%.

Our best-case scenario is a rate of about 4.5%.

But that’s not plausible.

If we have a normal recession, the unemployment rate could move above 6%.

In an extreme crisis, the rate could top 9%.

Bottom line: Powell is fighting to avoid an extreme crisis.

But there’s no sign of success yet.

Click here to join True Options Masters.