I was scrawny in high school.

Since then though, years of eating fast food while traveling from sports venue to sports venue caught up with me.

About five years ago, my doctor told me if I continued that lifestyle, I would have serious health issues as I got older.

It was an eye-opener.

So I dedicated myself to eating healthier.

The Organic Trade Association predicts the value of the U.S. organic packaged food market will increase 44.3% from 2018 to 2025.

Additionally, organic food made up 6% of all food sales in the U.S. in 2020 — a number that’s risen every year since 2008.

I’m pleased to say I’ve found a way we can profit from this trend.

Today’s Power Stock is United Natural Foods Inc. (NYSE: UNFI), a $2.2 billion natural and organic food distributor.

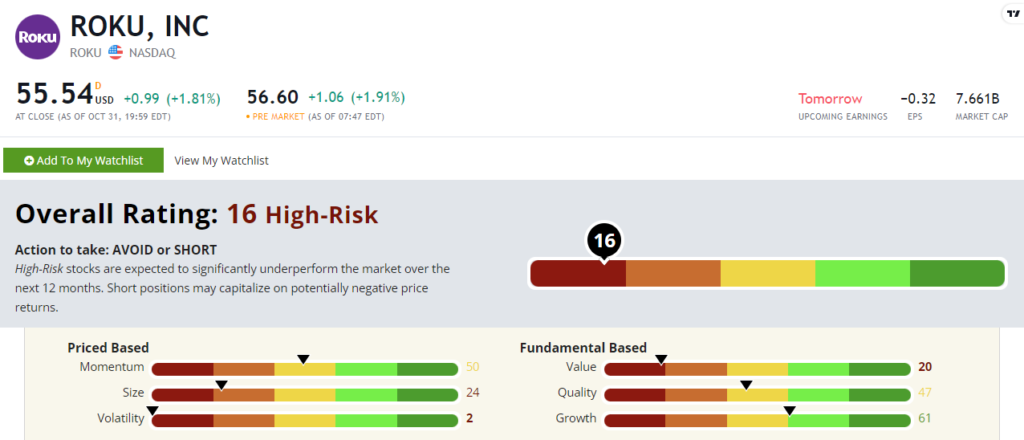

UNFI’s Stock Power Ratings in October 2022.

United Natural markets more than 5,000 natural and organic products across 200 categories.

It has distribution centers all over the U.S. … ensuring products get to stores quickly.

UNFI stock scores 86 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

UNFI Stock: Outstanding Value + Solid Momentum

United Natural recently closed out a great second quarter.

High points include:

- Net sales of $7.2 billion — a 9% year-over-year increase … and the second-highest quarter for sales since 2018.

- Its fiscal year sales in 2022 were $28.8 billion — a $1.9 billion increase over 2021.

As you can see, UNFI has strong bottom-line growth.

It shines as a value stock … scoring a 90 on that factor.

Its price-to-earnings ratio is less than half the food and beverage retail industry average. Even better, the company’s price-to-sales ratio is 0.08, compared to the industry average of 0.31!

On quality, UNFI’s returns on assets, equity and investment are all green, while its peers average negative returns.

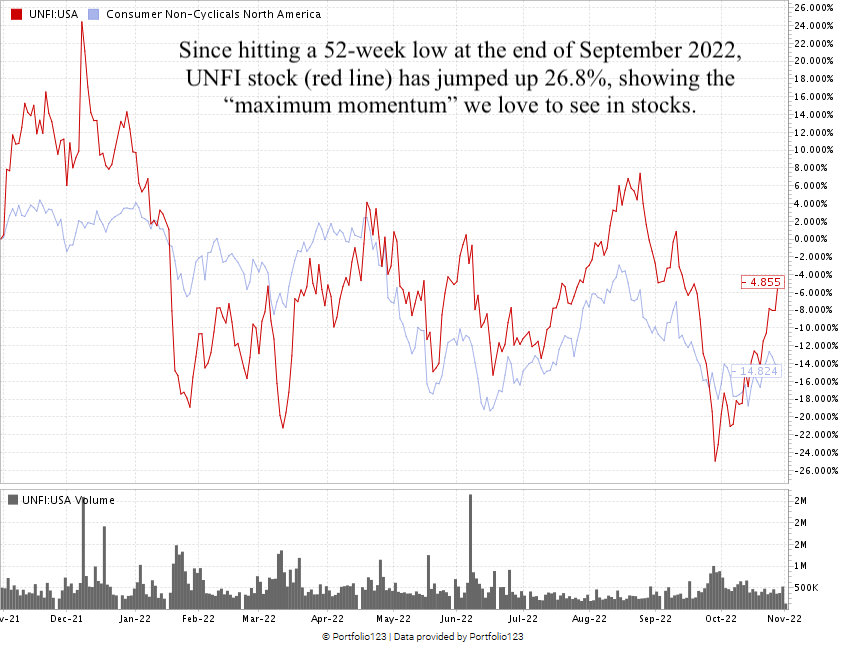

After hitting a 52-week low at the end of September 2022, UNFI stock jumped 26.8%.

Created November 2022.

It’s showing the “maximum momentum” we love to see in stocks.

I’m confident it will shoot even higher.

United Natural stock scores an 86 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

We all should want to be healthier.

I made the decision five years ago … lost more than 50 pounds … and never felt better.

A leader in providing natural and organic food, UNFI is a strong contender for your portfolio.

Stay Tuned: Perfect-Rated Banking Stock for Your Portfolio

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a terrific growth stock — a commercial and personal bank that rates a perfect 100 on our Stock Power Ratings system.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.