Loans.

Some people need them, and some people avoid them like the plague.

I am one of the latter people. I somehow managed to make it through college without taking out a single loan, which I still am grateful for today.

But for others, loans are essential for school, a car purchase or even starting a business.

Upstart Holdings Inc. (Nasdaq: UPST) set out to partner with banks and credit unions to make consumer loans more accessible.

For school, employment and anything in between, Upstart was the answer.

However, Upstart’s stock tanked over the last year and hasn’t shown any sign of upward movement.

And now it’s one of the many companies planning layoffs.

That’s not good news for its stock or the company.

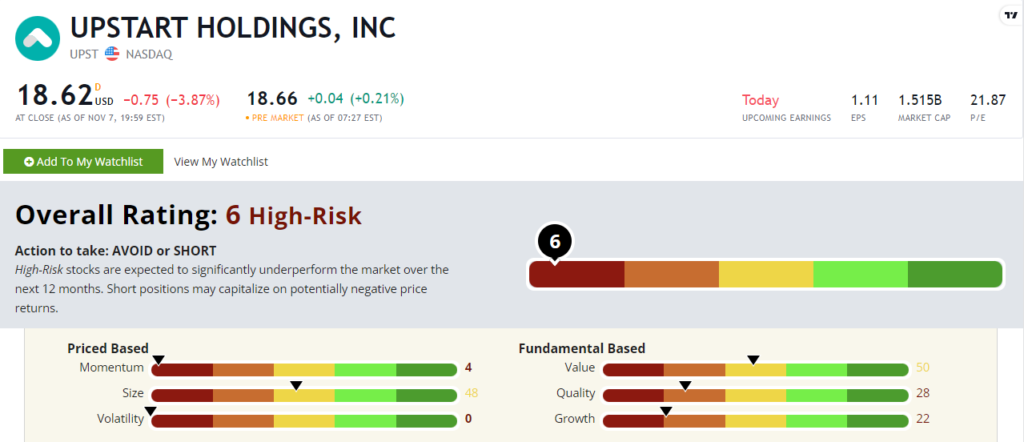

Upstart stock rates a “High-Risk” 6 out of 100 on our proprietary Stock Power Ratings system.

Let’s look at its recent layoff news and what that means for the company.

Upstart’s Latest Layoffs

Upstart is a lending company that uses both artificial intelligence technology and humans to process loan applications.

And now executives have announced the company will eliminate 140 hourly employees due to a “reduction in the volume of loans on our platform.”

The Federal Reserve’s interest rate hikes are doing nothing to help the company.

Here’s why.

Upstart’s institutional investors see interest hikes on their capital payout as the federal funds rate rises.

It’s clear that investors will want loans with higher yields for protection as funding grows more expensive.

Because there is a lag period, Upstart has been unable to raise its loan yields.

For Upstart, the future looks grim.

Until an economic shift stops the Fed from hiking rates, Upstart is in for a challenging ride.

Let’s take a look at UPST’s current ratings.

Upstart’s Stock Power Ratings & Miserable Momentum

There is no denying Upstart has had a rough go in this shaky market.

UPST’s stock has seen no positive momentum in quite some time, but I will get to that in a second.

UPST’s Stock Power Ratings in November 2022.

Overall it scores a “High-Risk” 6 out of 100 on our ratings system.

It’s worth noting that it rates in the red on 5 of our 6 factors.

The only factor it scores neutrally on is size. With a market cap of $1.5 billion, Upstart is still a massive company, but not the largest in its industry.

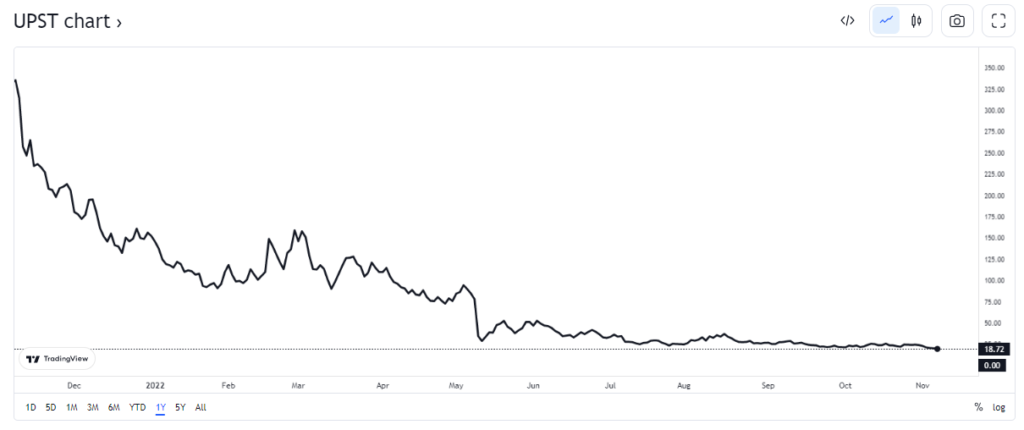

To understand how Upstart’s stock is holding up this year, let’s look at its momentum.

Source: TradingView.

As evident in the chart above, Upstart’s stock has crashed due to inflationary and broader market pressures.

As I write this, it closed at a new 52-week low on November 11.

It’s lost almost 95% of its value since hitting its 52-week high of $342.51 in November 2021.

Upstart’s stock movement is facing a massive downward trend that shows no sign of slowing.

This earns Upstart a 3 on our momentum factor.

The Bottom Line

Upstart scores a “High-Risk” 6 out of 100 on our Stock Power Ratings system.

Stay tuned: Tomorrow, I will discuss HOOD, another tech company that is “High-Risk.”

But our system has much more in store for you!

To get one highly rated stock you should consider investing in or some more to avoid — check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why.

All for free!