Through just 10 months of the fiscal year, the U.S. budget deficit has already surpassed last year’s total, up a whopping 27% as the march toward $1 trillion deficits is gaining speed.

The gap in spending and revenue is up to $866.8 billion over the first 10 months of the fiscal year, the Treasury Department said in its monthly budget report, released Monday. Last year’s $779 billion shortfall was the largest federal deficit since 2012 when the economy was still recovering from the Great Recession.

The fiscal year begins on Oct. 1, and revenue increases of about 3% were nearly enough to outpace an 8% increase in spending. Tariffs imposed by the Trump administration has helped increase revenue by $57 billion in the period. However, along with the increase in revenue comes increased costs paid for by U.S. citizens paying higher costs for the goods affected by the tariffs.

The Tax Cuts and Jobs Act, along with increased federal government spending and an aging population drawing more and more Social Security funds and Medicare spending are the biggest contributors to the budget deficit. Medicare costs rose 11% to $66 billion while defense spending was up $10 billion year over year to $53 billion.

The tax cut lowered taxes on corporations from 36% to 21%.

Republicans, however, contend that the tax reform laws passed at the end of 2017 will spur economic growth and lift revenues.

Corporate income tax revenue rose 3% between October and July, while individual income taxes were up 1%, according to Bloomberg.

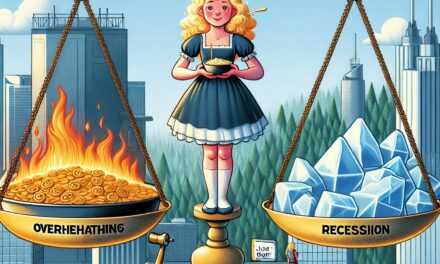

The annual budget deficit is projected to surpass $1 trillion by the fiscal year 2022, according to the nonpartisan Congressional Budget Office. And spending is only expected to increase further over the next two years.

A new two-year budget deal, including the raising of the debt ceiling, that President Donald Trump negotiated with Congress in early August will only further add to the red ink. Spending will be increased on both defense and domestic programs.