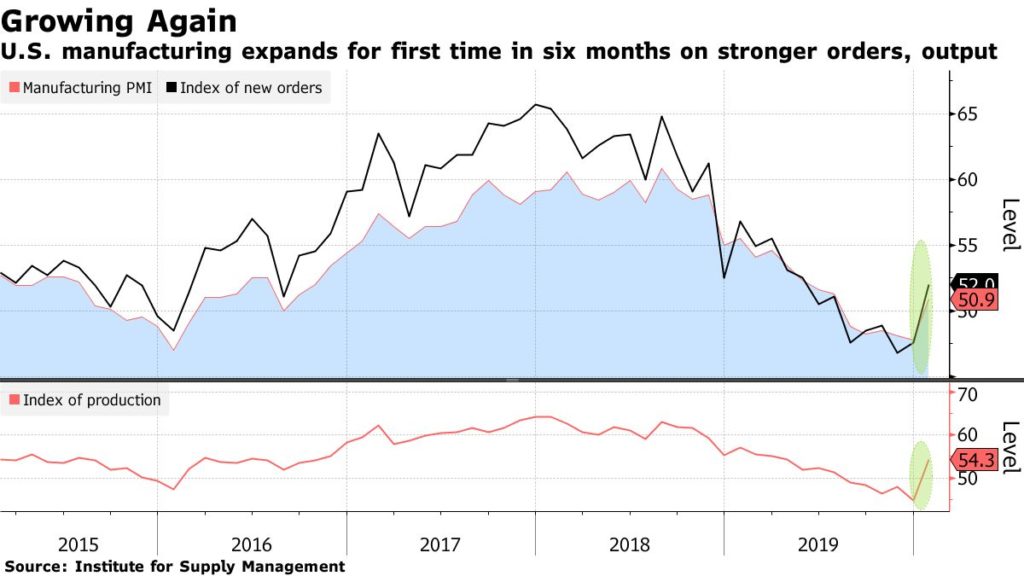

U.S. manufacturing breathed a slight sigh of relief Monday after factory activity rebounded out of a five-month recession streak.

The Institute for Supply Management’s (ISM) latest data shows the index for national factory activity unexpectedly jumped to 50.9 in January, the index’s highest reading since July, and a better than 3-point bump from December’s 47.8 reading. Any reading above 50 is considered an expansion while anything below 50 means the sector is in recession.

Bucking the recessionary trend of the last six months helped stocks fight off coronavirus fears and regain some of Friday’s big losses.

Manufacturing makes up around 11% of the U.S. economy, and the ISM index has been below the 50 mark for five straight months. The index plummeted to 47.2 (which was revised up to 47.8) in December, which was the lowest reading it had seen in over a decade.

The ongoing trade war between the U.S. and China had driven the index down over the last few months, and economists in a Reuters poll expected January to be more of the same with projections of slight rebound from December’s numbers to 48.5.

The world’s two largest economies signed phase one of a new trade deal in December, but there are still tariffs on $360 billion in Chinese imports and the second phase of negotiations could take months.

A sizable jump in orders and production components while employment slowed its contraction a bit are the main factors contributing to the expansion. New orders hit an eight-month high 52, while production soared a six-year best 9.5 points.

The newest reading from the ISM is more in the line with the factory index from IHS Markit, suggesting that the worst for U.S. manufacturers may now be in the past. The IHS Markit factory index actually showed manufacturing was in expansion throughout all of last year.

Tim Fiore, the ISM’s manufacturing survey committee chair, told Bloomberg that “we’re going to have to wait and see” if the PMI will continue its upward trend in 2020.

“Weakness in the inputs for January questioned demand for expansion in February and whether we’re at the beginning of sustained PMI expansion,” Fiore said.

Bloomberg economist Eliza Winger thinks the recent Boeing production halt, and the outbreak of the coronavirus in China, will probably hurt the index as well going forward.

“The reading likely reflects the positive impact of the phase-one trade deal between the U.S. and China,” Winger said. “However, we are expecting the uptick to be temporary as the Boeing production halt and recent uncertainties in response to the coronavirus outbreak may stress global supply chains.”