In 2024, the United States ran up a $295.4 billion trade deficit with China — the largest deficit with any single trading partner in the world.

So, it stands to reason why trade with China has been in the crosshairs of the Trump administration.

The deficit was the motivating factor behind President Trump’s triple-digit reciprocal tariff issued in April (since paused).

While we won’t know the true impact of these trade levies for months, we can glean some insights from certain data points.

For example, a bulk of this imbalance comes from electrical equipment and machinery. Year to date, the U.S. has imported $14.4 billion worth of goods in this industry, while only exporting $2.5 billion… for a trade deficit of $11.8 billion (more than half the total 2025 trade deficit with China).

Seeing this made me curious…

I wanted to see how investors are feeling about American companies with increased revenue exposure to China, particularly those in high-tech industries.

Here’s what I found…

Chinese Tariffs Aren’t Hurting Stocks … Yet

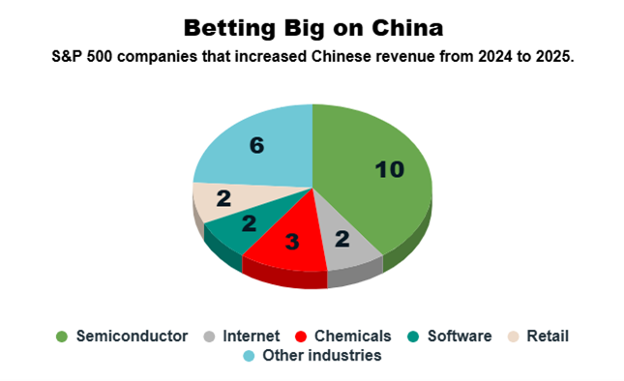

To start, I screened for any companies in the S&P 500 that have increased their revenue coming from China in the last year. In theory, these companies could be in trouble ahead if permanent tariff rates weaken Chinese demand for U.S. goods.

The screen gives us a list of 25 companies across a wide array of industries.

It’s not entirely surprising that the largest share of these companies — 10 of 25 — are in the semiconductor industry, as those chips are necessary to build things China exports frequently (think smartphones, televisions and computers).

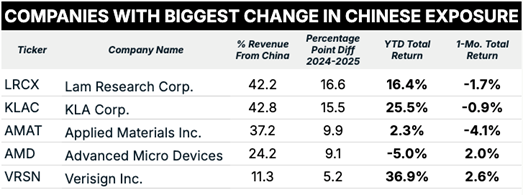

From there, I broke the list down by the percentage of revenue each company receives from China and sorted it to show the companies with the largest year-over-year increase.

Finally, I calculated the year-to-date and 1-month total return for the top five stocks on the list.

Here are those results:

The top four are semiconductor tech companies, while the fifth on this list, Verisign Inc. (VRSN), is an internet company.

The average change in percentage of revenue for these five technology-centric companies is 11.2 percentage points. That is three times greater than the broader list of 25 stocks above, which averaged 3.5 percentage points.

Meanwhile, the year-to-date returns of these five companies average 15%, compared to a 7.4% average for all 25 companies.

For reference, the S&P 500 has returned around 12% in 2025.

The takeaway here is that despite Trump’s trade war standoff, the market hasn’t punished companies that have increased their revenue exposure to China — not yet, at least.

In fact, the potentially negative effect of decreased trade doesn’t appear to be priced in, as three of these five companies have stronger returns in 2025 than the benchmark index.

Are investors making a mistake here?

According to Adam O’Dell’s Green Zone Power Rating system, four of those five stocks I highlighted above are rated “bearish” or worse, meaning they are set to underperform the broader market from here. In fact, the only stock that’s “bullish” in Adam’s system on that shortlist is VRSN.

If you want to check the ratings on any of these stocks (or thousands of other tickers), click here to see how you can gain unlimited access to Green Zone Power Ratings by joining Adam’s flagship investing service.

That’s all from me today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets