The 2020 coronacrash marked a turning point for small-cap value stocks.

In the two years prior to the February 19, 2020 “top,” the SPDR S&P 500 Growth ETF (NYSE: SPYG) trounced the returns of the SPDR S&P 600 Small-Cap Value ETF (NYSE: SLYV) … gaining 33% versus a measly 2.3%.

This large-cap growth ETF is dominated by names you’ll recognize. Its top holdings are Apple (11.4%), Microsoft (10.6%), Amazon (7.8%), Alphabet aka “Google” (7.4%), Facebook (4.2%) and Tesla (2.9%).

Meanwhile, the SPDR Small-Cap Value ETF (SLYV) is far less concentrated. No single stock takes greater than a 1% allocation. The top holdings are largely regional banks whose names you wouldn’t recognize off-hand.

But get this …

Small-cap value stocks have been beating the “FAANGs” since the late March (2020) coronacrash bottom.

Shares of SPYG are up 69% since March 23, 2020 … but SLYV is up 106%!

Some ETFs Diversify Better Than Others

I’ve done an ETF “X-ray” on SPYG and SLYV, using our Green Zone Ratings model. It shows you which of the two ETFs rates best overall. It also reveals the “flavor” of exposure you’re getting with each (spoiler: they hold true to their names).

But first, let’s see how an investment in this small-cap value ETF (SLYV) can give you more diversified exposure to overlooked industry groups, such as regional banks, in this era of the technology- and FAANG-centric headlines.

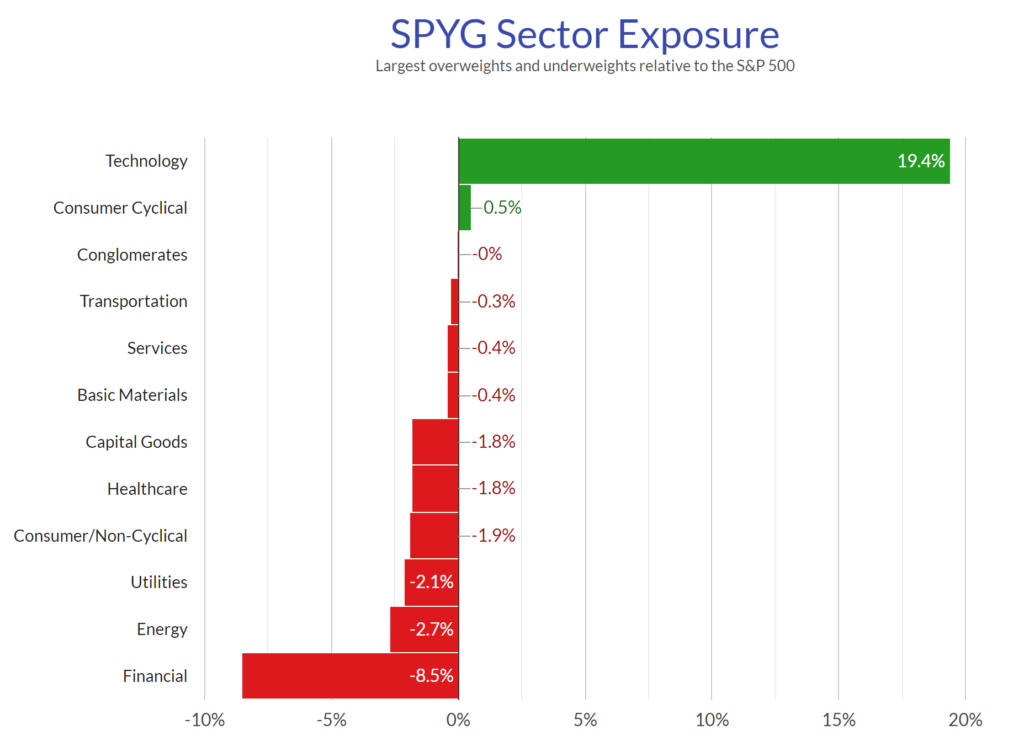

Here’s a chart of the over- and under-weight sector exposure of the large-cap growth ETF (SPYG):

No surprise … it’s predominately technology.

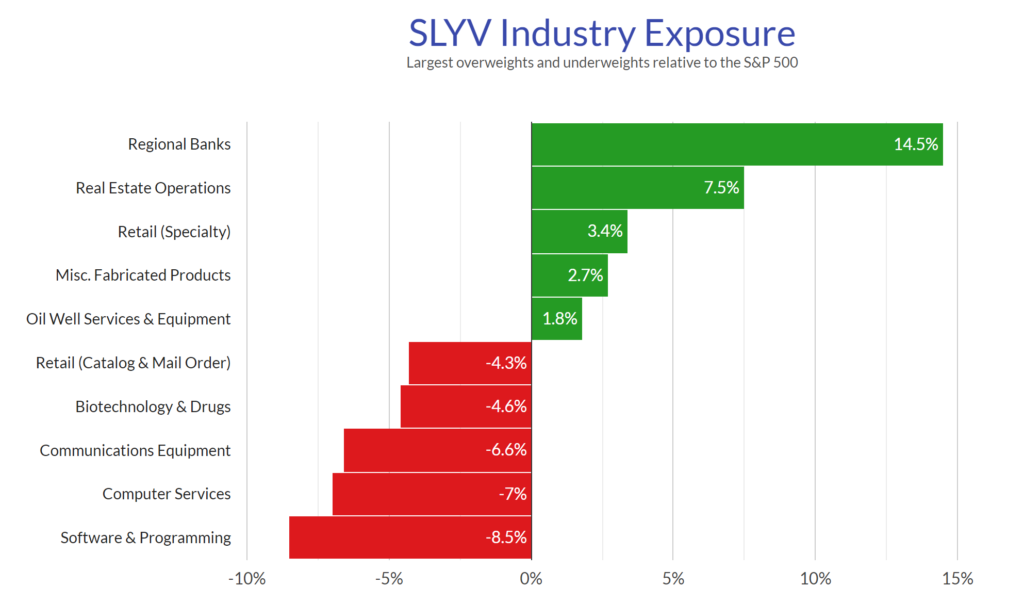

And here’s the industry group exposure you get with the small-cap value ETF (SLYV):

You can see the increased focus on regional banks in this small-cap value ETF, in lieu of the big tech names that dominate the large-cap growth ETF.

My partner Charles Sizemore and I think that’s a great thing.

See, we aren’t bearish on the technology sector as a whole. But a lot of the big-tech growth names have been bid up to unsustainably high valuations in recent years.

Investors have overlooked smaller companies in the financial and industrial sectors. That leads to far cheaper valuations in those names and, thus, likely stronger returns ahead.

Now let’s have a look at how these two ETFs rate on our Green Zone Ratings model …

Small-Cap Value (SLYV) vs. Large-Cap Growth (SPYG)

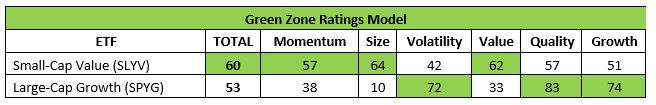

I’ve put each of the individual stocks held in these two ETFs through my Green Zone Ratings Model. I then averaged the scores for each of the six factors, as well as the TOTAL score.

This gives us an average rating for each ETF, shown here:

Green Zone Ratings pulled on April 9, 2021.

As you can see, the small-cap value ETF (SLYV) lives up to its name: It earns a higher “size” score (meaning the companies are smaller) and a higher “value” score (meaning the stocks are cheaper). It also earns a superior “momentum” rating … which reflects the superior returns since the March 2020 bottom, as I showed above.

Meanwhile, the large-cap growth ETF (SPYG) earns a higher “growth” score (no surprise) … a higher “quality” rating … and a superior “volatility” rating (meaning the stocks are less volatile).

You get two very different “flavors” of stock with these two ETFs. And while neither is always “right” or “wrong” for every investor, SLYV is currently coming out on top, with an overall Green Zone rating of 60, versus 53 for SPYG.

The Best Small-Cap Value Stocks

Of course, ETFs always give you exposure to the full spectrum of stocks in a particular category — the “good, bad and ugly,” so to speak. And that’s why you’ll rarely — if ever — see a Green Zone Rating above 70 for a diversified ETF like SLYV or SPYG.

There are, naturally, individual stocks within each ETF that rate far better than 70, 80 or even 90 on our Green Zone Ratings model.

I ran each stock within SLYV through Green Zone Ratings, and the results were spectacular! More than 30 of the individual companies rated a 95 or greater.

Charles and I share an especially high conviction for two of these stocks. We’ve already added one to our Green Zone Fortunes model portfolio, and we’re adding another this week!

Again, I’ll say that Charles and I are not tee-totally against the technology space.

In fact, I’ve just released a special presentation on a particular “science-based” technology that is poised to be bigger than electric vehicles, artificial intelligence and the internet-of-things … a technology that stands to have as big an impact as the internet has over the past 20 years! And we’re taking advantage of this mega trend in Green Zone Fortunes. Watch my presentation here to find out how you can join us.

Charles and I are also prudent investors … who know that you don’t put all your eggs in one basket. And we know a good value when we see it.

Right now, small-cap value stocks are a great place to be — particularly if you find your portfolio a little too tech-heavy at the moment.

The SPDR S&P 600 Small-Cap Value ETF (SLYV) is one easy way to play that trend.

So too are any of the 95-or-better Green Zone Ratings stocks you can find within the ETF.

And if you want access to Charles’ and my latest small-cap value recommendation, we’d love to have you in our Green Zone Fortunes service!

To good profits,

Adam O’Dell

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.