Growing up in the 1970s in war-torn Vietnam, Pham Nhat Vuong didn’t have an easy life.

His father served in the Vietnamese Army’s air defense service while his mother operated a small tea shop in Hanoi.

But what he did over 50 years reversed his family’s fortunes and turned him into the first Vietnamese billionaire and one of Forbes’ top 30 richest people in the world.

I bring up Vuong because one of his companies has just done something no one would have expected.

Today, I’ll tell you what made him rich and use Adam O’Dell’s Green Zone Power Ratings system to show you why his latest venture may help you follow suit.

How Vuong Went From Rocks to Noodles

After he graduated high school, Vuong studied geology both in Hanoi and at the Moscow Geological Prospecting Institute.

It seemed life was going to be that of studying rocks … until he married and moved to Ukraine in 1992.

But Vuong’s passion dwindled, so he took the next logical step … making instant noodles.

Using money borrowed from friends and family, Vuong opened an instant noodle restaurant. It became so popular he started producing and selling instant noodles en masse at grocery stores around Ukraine.

By 2009, his venture — which grew to be one of the largest dehydrated culinary products manufacturers in Ukraine — received a lot of attention. He sold the company to Nestle for $150 million.

He used proceeds from that sale to dive into commercial real estate — starting Vingroup, which now operates everything from supermarkets to luxury resorts to hospitals.

And now Vingroup is the largest conglomerate in Vietnam.

But he wasn’t finished yet.

The Massive Rise of VinFast Stock (VFS)

In 2017, Vuong launched VinFast, a new venture within the exciting electric vehicle market.

The goal was to be a major player on the international stage, rivaling Tesla Inc. (Nasdaq: TSLA) and other massive automakers.

VinFast produces electric cars, bikes and buses.

Pretty normal fare for a burgeoning electric vehicle company, until it surprised everyone on Wall Street earlier this month.

VinFast went public on the Nasdaq via a reverse merger on August 15. On its first day, VinFast Auto Ltd. (Nasdaq: VFS) stock was about $19 per share. By Monday, VFS was trading at more than $87 per share at one point — a 357% increase in only two weeks.

Of course, the rally is rapidly losing steam. As I write, VFS is back to trading around $49.

The company’s $106.1 billion market cap makes it the third-largest automaker by market cap in the world and even bigger than Uber Technologies Inc. (NYSE: UBER) and CVS Health Corp. (NYSE: CVS).

But you may want to avoid jumping into Vuong’s latest venture right now if you follow Green Zone Power Ratings.

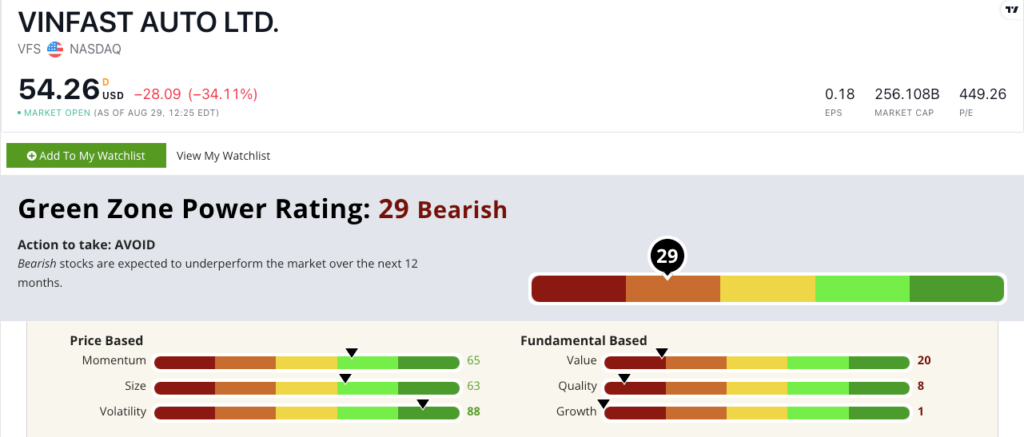

Adam’s proprietary system rates VinFast at 29 out of 100, meaning we are “Bearish” on the stock and expect it to underperform the broader market over the next 12 months.

Its upward rise since launching a few weeks ago put VinFast’s price-based factor scores in the green, however, its fundamentals tell a different story.

VFS rates a 1 on our Growth factor with little to no sales and negative earnings-per-share growth.

It rates 8 on our Quality factor. Despite having slightly positive returns on assets, equity and investments (and by slightly, I mean around 2%), because it hasn’t turned any profit, it has no gross, net or operating margins.

The stock’s meteoric rise in price has pushed its value metrics through the roof (which is why it rates a 20 on our Value factor). It trades with a price-to-earnings ratio of 252.3. For reference, Tesla’s P/E ratio is 73.

Bottom line: Vuong has a great story to tell … one of true rags to riches. And everything he’s touched has seemingly turned to gold.

However, the meteoric rise of VinFast stock may be too good to be true.

With exorbitant value ratios, no growth and little returns, VFS is one of those stocks that might have potential, but now is not the time to find out.

Stay Tuned: What’s Next for the Cannabis Market

Cannabis stocks soared after more positive news on Wednesday.

But our managing editor, Chad Stone, is wondering how sustainable this pot stock rally is…

He’ll show you what Green Zone Power Ratings has to say.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets