Not every stock can belong to an exciting industry like AI or robotics.

But sometimes, boring is profitable.

Case in point: packaging.

Nothing gets my blood up about the packaging industry.

But the chart below shows the projected five-year growth of the global packaging market.

You can see that analysts expect the market to grow 27.4% by 2026.

Today’s Power Stock is a leader in global packaging solutions: Veritiv Corp. (NYSE: VRTV).

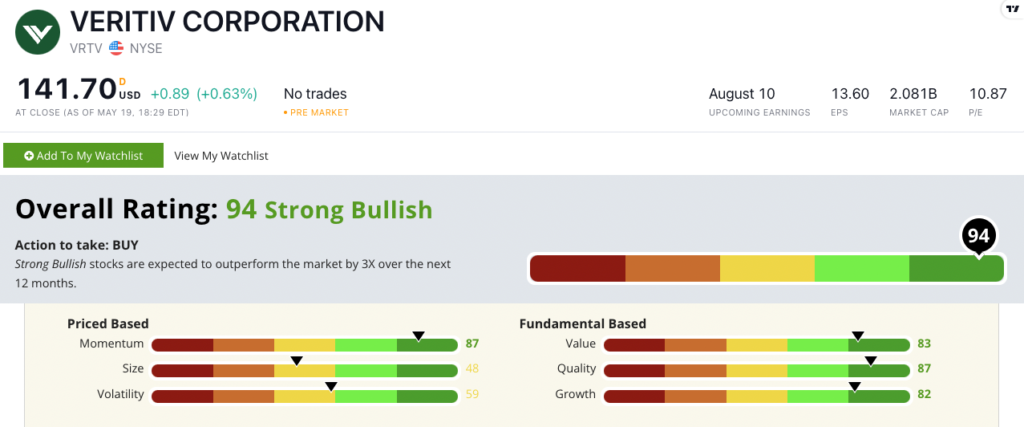

VRTV Stock Power Ratings in May 2022.

Veritiv is well known for providing traditional and recyclable packaging for businesses.

It also provides cleaning products as well as printing and publishing services, so this is a diverse business.

Veritiv stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

VRTV Stock: Top Quality + Bear-Busting Momentum

My deep dive into VRTV uncovered two items of note:

- In the first quarter of 2022, the company increased its net sales by 19.2% over the prior year to $1.9 billion — a record quarter!

- Despite inflation and market pressures, VRTV issued guidance for the full year that increases its net income by at least 87.5% over 2021.

VRTV is a one-stop shop. It supplies several crucial needs for businesses: packaging, printing, publishing and even cleaning supplies.

The company’s returns on assets, equity and investments are at least double its container and packaging industry peers.

That earns VRTV a “Strong Bullish” 87 on our quality metric.

VRTV also excels in value and growth. It trades at a discounted price-to-earnings ratio of 10.9 — two-thirds the value of its pricey industry peers, which average 15.9.

Its one-year annual earnings-per-share growth rate is a massive 334.2%, and it increased its sales by 19.2% in the first quarter of 2022.

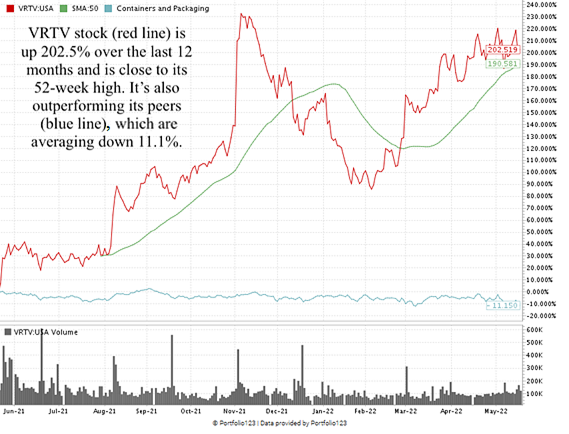

Since reaching a 52-week high in November 2021, VRTV stock slid 44.1%.

However, in February, it started to rebound, gaining 62.8%.

For the last 12 months, VRTV is up 202.5% and trades above its 50-day moving average — a bullish indicator.

It’s demolishing its industry peers, which average negative 11.1% over the same time.

Veritiv Corp. stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

While packaging is this company’s bread and butter, its solutions for publishing, printing and even cleaning supplies make VRTV a terrific investment.

Stay Tuned: Organic Grocer Set for Success

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent organic grocery store that I think you need to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me at Feedback@MoneyandMarkets.com!