One of the things good stock trading will teach you is patience.

Stocks often step through semi-predictable patterns, much like salsa dancers hit the marks of the basic eight-step pattern. But there’s also a good degree of leeway and improvisation, both in salsa dancing and stock trading.

That’s why in salsa dancing, there’s always a leader and a follower. The leader leads … deciding when and how to implement an improvisational move. And the follower follows, as not to steps on his toes!

So it is with stock trading, too, where the market is always the leader … And we traders are the followers.

And as the followers, while we may be able to loosely anticipate the next likely move of the market, most of the time it’s best to wait patiently for the market to make its move before following along with that next “step” of the dance.

This salsa dancing analogy is the premise of the new “Waaaait for it…” segment I’m sharing with you.

Each “Waaaait for it…” segment will highlight one stock or ETF that’s on my “radar,” but not quite a “buy” just yet.

It will be a potential trade I’ve identified … one that could trace out an exciting and lucrative series of dance steps … though we must wait patiently to see if the market makes the move I’m anticipating, before making the move ourselves.

Let’s jump right into our first one …

Waaaait for Johnson Outdoors (JOUT) to Breakout

Wisconsin-based Johnson Outdoors (Nasdaq: JOUT) operates in the consumer discretionary sector as a manufacturer of outdoor sporting equipment. It’s primary product lines include small watercrafts, camping supplies and fishing and SCUBA gear.

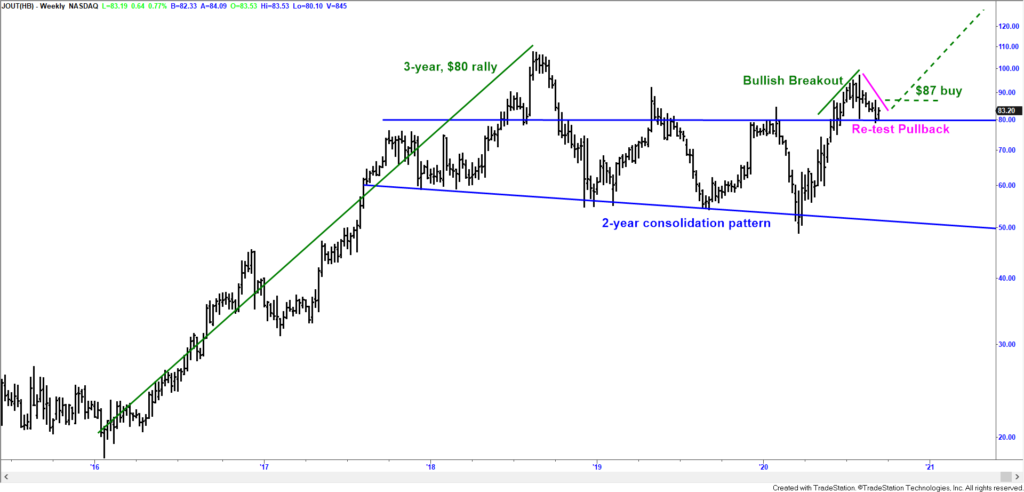

The stock had a nice run between 2016 and late 2018. Shares climbed from $20 to a high of $107, propelled by an impressive annual earnings growth rate of 41% since 2015.

Since topping out at $107 in September 2018, Johnson Outdoors’ stock has traced a typical consolidation pattern, trading roughly in the range between $60 and $80, with multiple ups and downs between those levels.

More recently, during the broad-market recovery that followed the coronacrash lows of late March, shares of Johnson Outdoors made a bullish breakout above the $80 “ceiling” of its consolidation pattern. In fact, the stock reached a breakout high of $97 on July 31, minting a new two-year high.

The next step in this stock’s “dance” was a pullback. The company’s July 31 quarterly earnings report showed some expected contractions in sales and earnings, owed to the near-total lockdown of the U.S. economy in April. A strong bounce-back in sales were reported for May and June, as the country reopened timidly. But it wasn’t quite enough to make up for the lost business in April, nor to entice new investors to buy shares north of $90.

Folks got a bit timid and the stock pulled back from around $90 to $80, where it trades now. Have a look:

Johnson Outdoors Is a Buy if it Breaks Above $87

The thing is … this pullback could turn out to be a good thing for patient buyers.

2 Buy Triggers for JOUT

It’s very typical for a stock to make a “retest” of a significant bullish breakout level. In this case, Johnson Outdoors’ stock finally broke above that $80 ceiling during the coronacrash recovery. And after running up to $97 during that breakout, the stock is now retesting this $80 breakout level.

Patient potential buyers of JOUT will wait for a sign that shows the shares are successful at maintaining the bullish breakout through this retest. We need two things to happen before buying:

- We need to see JOUT hold above the $75 to $80 range. It would be great if shares never fell below $80. But as long as they hold above $75 and then begin to bounce higher, we can consider the bullish breakout intact.

- We need to see JOUT trade above $87. This will confirm the retest is complete and show that new buyers are willing to bid the stock back above its latest earnings-report prices.

In summary, I’m not a buyer of Johnson Outdoors (JOUT) just yet. But if, or when, the stock is able to close above $87 a share, I’ll be ready to pull the trigger on this trade.

I estimate the stock could make a $60 run, from $90 to north of $150, over the next couple of years.

But first, we’ll need to see this stock take its next “step,” to $87 or higher. Until then, we’ll simply be patient and Waaaait for it!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets

P.S. I should mention Johnson Outdoors is rated 99 out of 100 on the stock ranking system I created for my Green Zone Fortunes newsletter, where I identify high-conviction stock trades I expect to outperform the market at least 3-to-1 over a one- to three-year period. See how August’s recommendation rated now.