Earnings are a quirky thing.

In 1934, Congress passed the Securities and Exchange Act, which mandated public companies to issue periodic business disclosures.

It was following the 1929 stock market crash, and the idea was to promote transparency among public companies.

By 1970, quarterly reporting was standardized, which remains a requirement today.

Now, earnings have grown from an instrument of transparency born from the depths of the Great Depression into figurative crystal balls that Wall Street uses to peer into the future of a company … accurate or not.

We had a perfect example of this “reading the tea leaves” just this week.

Let me explain…

The Oracle of Oracle

We’ve entered what I would call the “ho-hum” period of the earnings season.

This is when most major companies have already reported their quarterly numbers, and the market has had time to digest the data before cycling into the next round.

It’s not that Wall Street doesn’t pay attention, but since most of the big dogs have posted, the focus tends to shift to something else.

That’s why Tuesday, after the market closed, was such a shock to investors.

Oracle Corp. (ORCL), the cloud computing giant that is going full throttle into artificial intelligence (AI), released its quarterly earnings.

Let me preface by saying that no one was expecting a surprise … not even Oracle’s executives. Heck, it didn’t even make our “bullish” or “bearish” earnings list last week.

But that’s precisely what happened.

Oracle reported a 12% increase in quarterly revenue, but a 2% decline in earnings per share. Both targets missed analyst’s expectations.

Seems pretty cut and dry.

Wrong…

Oracle Shares Soar 36% Higher After Earnings

The minute the market opened on Wednesday, shares of ORCL shot 36% higher than Tuesday’s close.

The move was so profound that Oracle’s founder, Larry Ellison, became the second-richest person in the world, surpassing Tesla Inc. (TSLA) CEO Elon Musk.

It was that big.

The biggest question is why ORCL shares soared so much despite mediocre earnings.

It’s a good question… and one that is easy to answer.

Wall Street’s Crystal Ball

Remember when I mentioned that earnings reports have grown from simple transparency tools to forecasting instruments for Wall Street?

That’s because institutional investors like to see what executives have to say about the company’s forward guidance.

This guidance is basically the company’s forecast of what it “expects” to do for the rest of the year.

Sometimes companies give these projections, and sometimes they don’t.

Oracle reported one number that caused this entire stir … $455 billion.

That’s what it calls its “RPO,” or remaining performance obligations. It’s the amount of revenue Oracle expects to earn from its current customer contracts.

Most of that comes from Oracle’s Cloud Infrastructure business, which is projected to grow 77% to $18 billion by the end of this fiscal year.

More importantly, it’s a 360% jump from the previous quarter as, according to Ellison, Oracle signed four multibillion-dollar contracts with three different companies… all related to, you guessed it … AI.

The bottom line is that Oracle has established itself as a significant provider of AI infrastructure. While the names of the companies Oracle has signed contracts with were withheld, the Wall Street Journal reported one was with ChatGPT parent OpenAI, worth $300 billion over five years.

This is why Wall Street rewarded ORCL with a significant pop in its share price post-earnings.

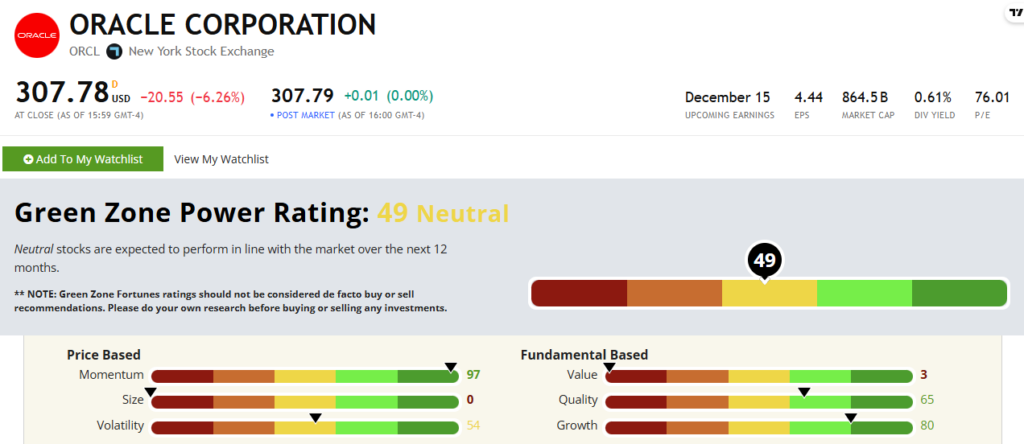

The price jump will help ORCL’s “Neutral” overall rating on our Green Zone Power Rating system.

However, the stock is already rated in the green on Momentum so that the impact may be subdued.

Oracle grew its revenue, but its EPS shrank, so its Growth factor score will also be minimally impacted. These new deals should bolster its bottom line, so I could see that 65 rating on Quality improve a good amount.

Time will tell…

Enjoy your weekend, and until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets