With trade tensions between the world’s two largest economies waging and the global economy slowing, Wall Street is indicating more interest rate cuts from the Federal Reserve, and Morgan Stanley says it will return to zero interest-rate policy (ZIRP).

Economists are pointing to three quarter-point reductions by the end of this year in addition to more cuts in 2020, according to CNBC.

Goldman Sachs just slashed its U.S. GDP projections by 0.2% and Merril Lynch is now pointing to a greater than 30% chance of a recession beginning in the next 12 months.

Meanwhile, when the Fed cut rates by a quarter-point at the end of July, it was the first rate cut in 11 years and the central bank called it a “mid-cycle adjustment.”

But things are starting to sound more and more like it won’t be a simple “adjustment,” and greater steps are needed.

“Slower growth and rising risks will likely impel the Fed to cut rates further,” UBS economist Seth Carpenter wrote in a note to investors. “Although we saw little support from the (Federal Open Market) Committee for further cuts at the July meeting, trade developments should provide enough justification to cut in September.”

Carpenter projected another cut in December and then a final cut in March of 2020 to complete a full 1% cut, bringing rates down to the 1% to 1.25% range.

The September cut would come with more language framing it as an insurance policy against a slowdown. However, Carpenter said, a December cut would prove the cuts are in response to weakness in the economy.

Morgan Stanley: Back to ZIRP

Morgan Stanley, on the other hand, is predicting cuts in September and October, and four more cuts 2020 to move the rate close to zero, where it was for seven years during the financial crisis.

“Taking a walk through Chair Powell’s checklist of factors the FOMC will be looking at when deliberating policy adjustments going forward, it seems to us there is already a clear need to cut rates further,” Morgan Stanley’s Ellen Zentner wrote in a note to clients, pointing out a big reduction in hours worked for July, which usually portends layoffs.

The cuts will be the standard 25 basis points, however, Zentner said, a bigger move “cannot be ruled out, especially if policymakers see convincing enough evidence in the data that their baseline outlook for the economy has been disrupted, and a pronounced downturn has become more likely.”

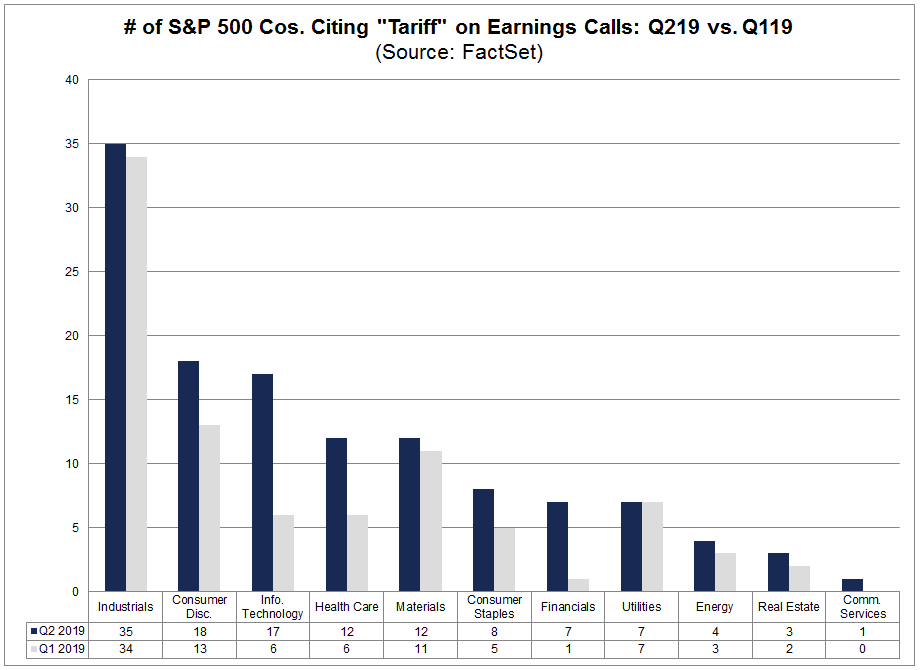

The economy slipping into a full-blown recession, the experts said, will be due in large part to the trade war with China. About 28% of company officials mentioned tariffs during Q2 earnings calls, a 41% increase from Q1.

No one yet is predicting negative yields, but that could change. Three years ago the Fed told banks to prepare for a negative-yield situation during mandated stress tests.

A “more aggressive Fed would have had a better chance of convincing investors that it had things under control and that, due to its actions, would need to ease less in the future. In addition, a more aggressive Fed would have a better chance of boosting inflation expectations,” Zentner wrote. “However, based on our economists’ forecasts for Fed policy, we don’t have an aggressive Fed today. Instead, we have a Fed that is easing policy almost as gradually as it tightened it.”

The latest predictions came as the yield on the 10-year and 2-year Treasurys were separated from inversion by a single basis point on Tuesday. An inversion of the 10-year/2-year has correctly predicted recessions for the past 50 years.