As you might already know, I worked as a professional trader and financial advisor before joining up with Money & Markets…

I even ran my own hedge fund.

So I’ve been on both sides of the fence.

I’ve been on high-level conference calls and email chains — private conversations with extremely successful Wall Street traders.

I’ve also seen what those same traders turn around and tell the public!

The difference is night and day, to say the least.

As a rule, almost all of those traders were using the SAME kind of investment to lock in their biggest, fastest-moving gains without ever buying a single bond or trading a single share of stock.

It was like a $7 trillion “Old Boys’ Club” dominated exclusively by mega-firms and massive investors.

Meanwhile, these very same experts and insiders told Main Street investors something else entirely …

They spent years pushing mutual funds as great investments.

But mutual funds haven’t cut it for years. A recent study found that not a single mutual fund outperformed the stock market in the five years leading up to 2022. Not one — out of 2,132!

Then they fell back on the traditional advice that Americans should diversify with a “60-40” portfolio of stocks and bonds.

This is the same “60-40” approach that just delivered its worst annual performance in all of recorded stock market history (going back over 150 years).

It’s all terrible advice!

And this bad advice is a big part of the reason why most people, even after working 40 years or more, still don’t have enough to retire on.

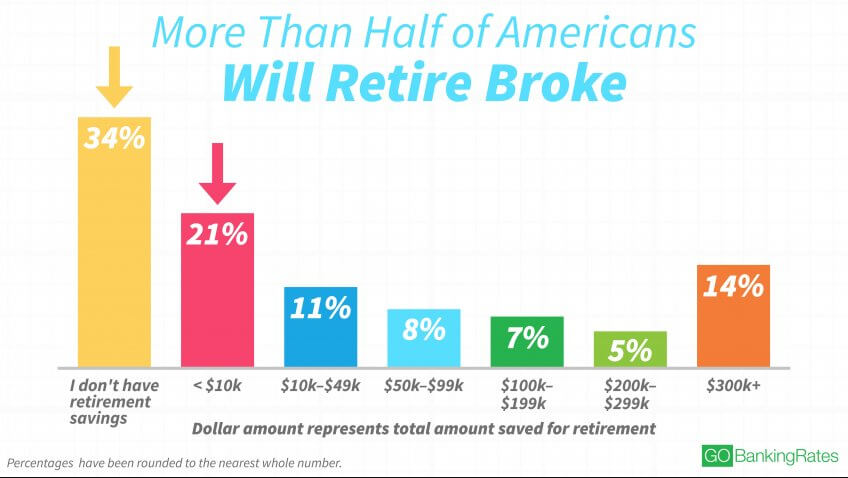

It’s the reason why more than half of Americans are expected to have less than $10,000 in the bank when they reach retirement age:

As a result, about two-thirds of Americans over age 55 say plan to delay retirement.

And even more people are now saying they’ll never be able to afford to retire.

We’re talking about good, hard-working people here too.

People who followed Wall Street’s advice … and ended up with little (if anything) to show for it.

The simple fact is this;

Wall Street’s boilerplate mix of stocks and bonds is NOT cutting it anymore.

And it’s not just falling a few percentage points short, either.

This cookie-cutter retirement strategy is currently failing millions of real-world Americans.

Which is why I’m inviting YOU to start tapping into Wall Street’s favorite moneymaking investment…

Use the “Money Code” to Beat Wall Street at Their Own Game

Over the last 13 years, I’ve been developing, refining and sharing a system designed to tap into this new $7 trillion asset class…

I call it “The Money Code.” And it’s delivered some of the largest and fastest-moving gains of my entire career…

Gains like 154%… 225%… 271%… even 430% in less than 90 days.

I’ve even locked in gains of as much as 400% and 500% in just a few days!

These huge profits came from a market that’s almost entirely controlled by large financial institutions. And it’s just a tiny fraction of the billions these firms lock in each year for themselves.

But these returns are often five, six, seven, even eight times bigger than the stock market.

Which is why I’ve chosen TODAY as the day to release something special…

At 1:00 p.m. Eastern time today, I released a special video update on how I cracked Wall Street’s “Money Code” to cash in on gains upwards of eight times bigger than the stock market.

As a Money & Markets Daily reader, you’ve got priority access to this presentation, just go HERE to see it for yourself.

This special video update will only be available for a limited time, so make sure you take a look as soon as possible.

To good profits,

Adam O’Dell

Chief Investment Strategist