It’s still only January, and yet Wall Street’s top experts have already made a critical mistake in judging where the market’s headed this year.

(Spoiler alert: things are looking far better than expected).

Watch my video below for the full story:

Video Transcrpt:

Welcome to Moneyball Economics. I’m Andrew Zatlin.

As I look out at 2025, I want to lay the groundwork, create a framework, so to speak, of what I expect to see going forward. And ultimately, it’s all going to come back to the economy, right?

Because the economy is reflecting business activity, and that means that whatever we see in the economy should be reflected in earnings, right? And earnings are going to drive the stock market. So it always comes back to the economy, and you’ve got to read the economic data, you got to read those tea leaves correctly.

And folks, the experts have been misreading it, and I have been reading it correctly. So I would like to share my framework. As we came into the end of last year, a lot of the economic data was slowing down.

And by that I mean when you look at core things like hiring, manufacturing, activity, they were slow, slow, slow.

And a lot of the experts were reading this to mean we have now entered a classic economic decline. That down cycle that comes from an up cycle, I read it entirely different. I read it as simply the pause button had been hit.

And by that I mean last year was not a typical year for an economic cycle. It was very atypical.

First, we had interest rates coming in that were expected to be lower, but that was teased all year. And so companies sort of sat on the sidelines waiting for interest rate cuts and they didn’t come for a long time. And then we had the election and a lot of anxiety because it looked like it could have been Kamala, could have been Trump.

The thing is most, experts are backwards looking. They’re kind of trying to extrapolate based on what was, and they’re unable to see what is and what’s going to happen.

So my interpretation of the data was no, once we get past the election, which was last quarter, we would see a resumption of business activity. And that in fact is what we are seeing. We’re going to see a resumption of business activity and we’re already seeing it.

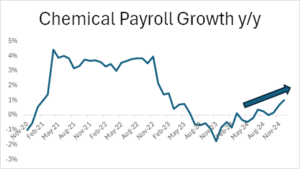

Okay, let’s take a look at, for example, chemical payroll hirings. Now this sounds obscure. Who cares about the chemical industry and their hiring? Well, I do because time and time again, the chemical industry leads every economic inflection up and down. Because let’s face it, if you’re making something, if you’re actually producing something, you need the basic inputs. And those basic inputs tend to be in the chemical sector.

So take a look at this chart:

This is showing you the chemical payrolls over time, the growth. And do you notice how starting basically as we came into the second half, we started to inflect back up chemical payrolls stopped just being crushed entirely.

They were still very weak. They were still very negative until we get to the post-election point, and all of a sudden we see positive growth in chemical payrolls. Lemme distill that down.

Basically, the chemical industries are responding to new orders coming from their end customers, the manufacturers, the factories, the factories are starting to pick up as we left the election period. And that pickup, well, it’s just going to continue because take a look at this other chart.

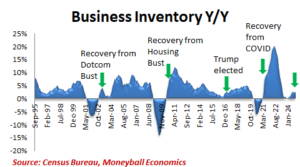

Now, this is a chart showing you business inventories:

This is kind of taking that chemical industry situation where they’re starting to see a rise in activity only. Now we’re going to expand it across everything, every business out there.

So what you’re seeing is that every time we’ve had an economic slowdown, a recession, basically, whether it’s the dotcom bust, real estate collapse, the great recession, covid or whatever, every single time it’s followed by an uptick in economic activity.

And that uptick in economic activity is reflected in inventories. Hey, if I see my consumers coming in and wanting more, I better have some stuff on the shelves to sell them, right? So the business inventory leads the sales activity, so to speak.

So take these two. You take the chemical payroll uptick, you take the inventory uptick and what you’re seeing, let’s face it, they’re both stockpiling people and things growing those stockpiles. That means commercial activity is about to hit. So take a look at the earnings season, right?

We’re a few weeks into it and already massively positive results. We’ve got 80% of reports coming in with earnings surprises. In fact, at this point, the earnings growth is now at 12.7% for last quarter. Now, let’s take a look at that. 12.7% would be the best result in almost four years since 2021. This is amazing.

Let me give you my framework.

Once again, companies hit the pause button, which meant they were bleeding off inventories, they stopped hiring. They did a lot of layoffs. Bottom line, 2024 was the year when companies were leaning up and look at the results in the fourth quarter. Again, we’re looking backwards now in the fourth quarter, even with that revenue growth being moderate, they are coming out with massively positive earnings.

Now look at today’s quarter, okay?

Going forward, we still have sort of a restrained level of inventory, restrained level of hiring and revenue’s about to take off because again, commercial activity is taking off. This is a spring, titan spring that’s going to unwind. We’re going to see a lot more commercial activity. We’re going to see a mini boomlet adding to this mini boomlet. We’ve got the tariffs. Companies are nervous, right?

So they’re buying a lot more in stockpiling it.

So again, this creates a lot more activity. In any case, we’ve got a mini boomlet.

If earnings were great Q4, they’re just going to get even more positive this year. On top of that, we got Trump. Trump wants to make a mini boomlet, a major boomlet, right? He wants to turn this into a golden age for the American economy, and he’s going to throw everything he can at this to make that happen.

So you and I, we’re forward looking. We see the writing on the wall. We see that we are going to see a very dynamic economy. We see that companies see it too, and yet that’s the opportunity.

So-called experts don’t see it yet. They’re kind of late to this game, late to this party.

Our job right now is take advantage of them missing out on this huge opportunity. Economic activity is going to continue to pick up, we’re going to continue to monitor it. It’s going to translate into massively positive earnings, and you and I, since we’re in it to win it, are going to reap the benefits.

So what you want to do is you want to play this market long, and you also want to play the volatility because you can see the market is ready to swing up and down on its long March up.

Zatlin out. Speak with you soon.

Andrew Zatlin

Editor, Superforecast Trader & Moneyball Economics