I’m not a shopper.

In fact, anytime it’s suggested we go to the store, I start looking for any random excuse.

“I don’t want to go to war for a parking spot.”

“Do we really need to be miserable fighting crowds to save a few bucks?”

Sometimes it works…

At this point, we do most of our shopping online anyways.

Whether I’m buying groceries for the week or my next Lego set, it’s hard to beat how convenient online shopping has become.

That’s why a small line in a recent earnings report caught my eye…

Walmart’s Earnings and the Market

Yesterday was rough for U.S. markets as all three major indexes took a hit.

One main reason was that Wall Street didn’t like what retail giant Walmart Inc.’s (WMT) leadership had to say as it reported quarterly earnings.

It should be noted that Walmart reported a 4% increase in quarterly revenue, and it beat earnings per share estimates.

But that’s not what Wall Street didn’t care for. It was the forward guidance of 3% to 4% revenue growth for the rest of the year.

Walmart is known for its more conservative guidance, but the market felt this was a little too conservative.

However, I looked past all of that…

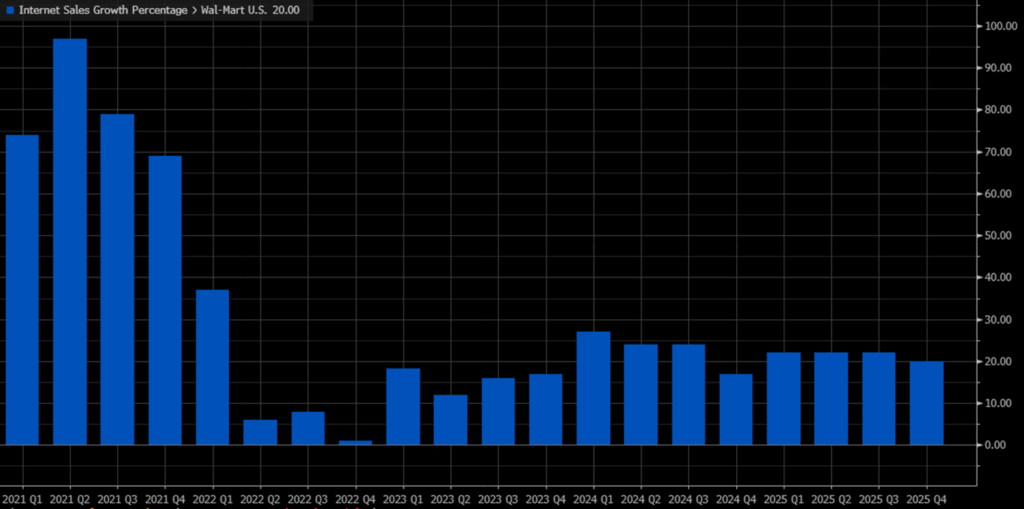

What I took note of was this: Walmart grew its quarterly e-commerce sales by 20% year-over-year.

WMT’s 12-Quarter Online Sales Growth Streak

It marks the 12th consecutive quarter the company has reported online sales growth.

I bring this up because one of the largest e-commerce platforms in the world also smashed its earnings and revenue.

It speaks to the growth of a particular segment of the retail industry: e-commerce.

Alibaba Group Holdings Ltd. (BABA) beat its earnings per share expectations by 10.4% and its revenue by 0.5%. Revenue for 2024 topped $131 billion after dropping slightly in 2023.

As if that wasn’t enough, the largest e-commerce platform in the world, Amazon.com Inc. (AMZN), reported an 11% year-over-year growth in its revenue in 2024. Amazon’s $187.8 billion in quarterly sales surpassed Walmart’s $180.5 billion, the first time that has ever happened.

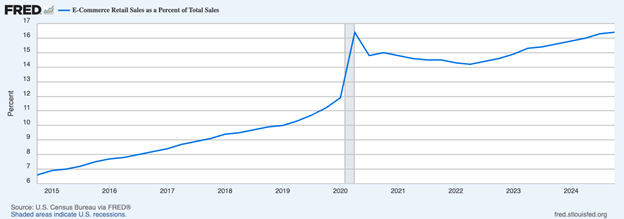

Here’s something else that speaks to the growing e-commerce trend:

We’re Shopping Like It’s Covid Again

According to the U.S. Census Bureau, the percentage of e-commerce retail sales in the fourth quarter of 2024 was equal to its highest mark during the Covid-19 pandemic — 16.4%.

It means we are shopping just as much online now as we did when we were prohibited from going to a store.

This trend of e-commerce growth is only going to continue, so I started to wonder how other e-commerce stocks have responded to it.

What I found might surprise you.

E-Commerce ETF X-Ray

To get a comprehensive look at e-commerce stocks, I performed an x-ray on the Amplify Online Retail ETF (IBUY).

I ran all of IBUY’s holdings through Adam’s Green Zone Power Ratings system to get the average ratings on all six factors and also overall.

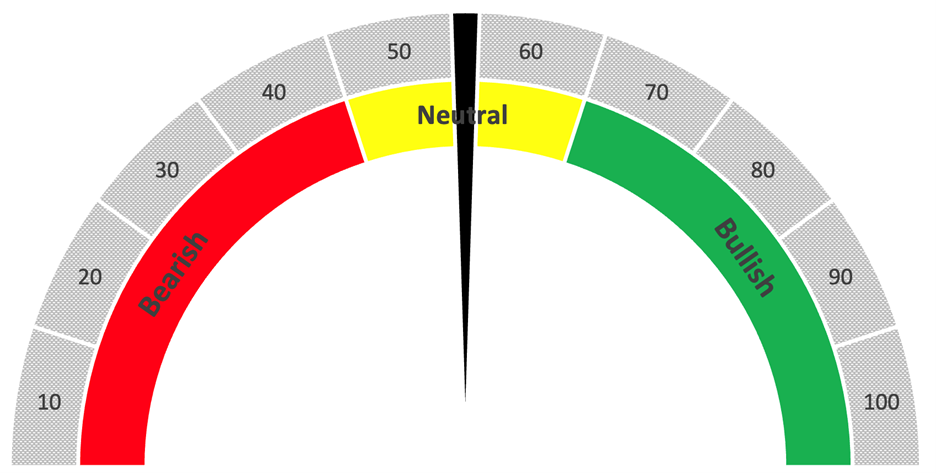

IBUY Rates “Neutral”

The average of the 55 ratable stocks was right down the middle, putting it in “Neutral” territory.

Of those 55 stocks:

- 19 rated above 60, putting them in “Bullish” or better territory.

- 18 rated below 40, which lands them in the “Bearish” or “High-Risk” zone.

- The other 18 rated right in the middle, aka “Neutral.”

Breaking it down by individual factors … IBUY gets hit the hardest on size (23) because most of its holdings have large market capitalizations.

However, it excels in Momentum (60), Growth (68) and Quality (73).

While it rates “Neutral” on the Green Zone Power Ratings system, if the trend of increasing e-commerce sales relative to overall retail sales continues, this rating will only get higher.

Have a great weekend, everyone!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets