With 2026 just around the corner, we’re already looking for that next big trade.

As I wrote yesterday, skeptical calls for the “death” of the AI revolution have come too early. For all the hype, we’ve still barely scratched the surface of what AI can do… and how it will transform the economy.

That said, some of the early AI trades are long in the tooth, and investors are right to look at the Mag 7 with a skeptical eye. Valuations are rich by any traditional metric, the profit model is still unproven, and the major competitors are highly dependent on one another in a way that stands to make the entire AI ecosystem fragile.

None of this suggests that investors are running for the hills, however. Many of us are rightly still ready, willing and able to take risk. We just think it’s wise to do some looking outside of the tech sector and suggest turning your sights to cyclical sectors like materials.

As we covered yesterday, materials were the best-performing sector last week. Was this just random market noise… or could it be the start of broader rotation?

Let’s do a deeper dive into the sector to find out.

You Need to Pick and Choose

I’ll start with one cold, hard truth.

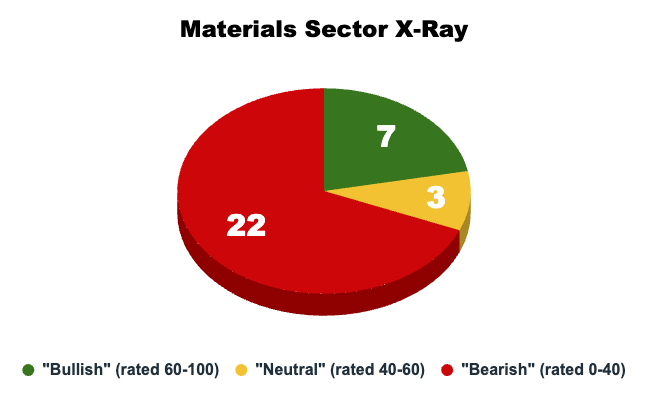

As a whole, the materials sector does not rate well on my Green Zone Power Ratings system. Of the 32 stocks in the sector, 22 rate as “Bearish” and another three rate as “Neutral.” Only seven rate as “Bullish.”

So, while investors might be warming to the sector, my system is telling us to be selective.

Remember, materials stocks tend to be highly cyclical. The stocks tend to really do well in the early stages of an economic recovery, coming out of a recession, and tend to maintain that performance through mid-cycle. But they often perform poorly at the tail end of the expansion and during recessions.

Of course, the challenging part is that it’s not super clear to most people where exactly we are in the economic cycle today.

Ever since the end of the pandemic, the data has been messy and year-over-year comparisons have been mostly useless. And President Trump’s tariffs have added yet another wrinkle. For instance, the changes in imports made GDP growth look artificially low in the first quarter and artificially high in the second quarter.

Moody’s puts the odds of a recession in 2026 at about 42%, but we should take that with a major grain of salt. The Conference Board, which publishes a widely followed index of leading economic indicators, forecasts sluggish growth of about 1.8% in 2025 and 1.5% in 2026.

So, with the economy as a major question mark, it makes sense to be cautious and really pick and choose our materials-sector exposure carefully.

Where Do Materials Stocks Pick Up Points?

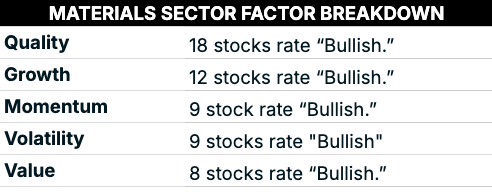

The stocks in the materials sector score well on my quality factor, with 18 out of the 32 rated as “Bullish” on the factor. (Ratings of 60 or higher are “Bullish.”)

This is largely because profit margins have been particularly strong in recent years. Commodities-related businesses tend to be capital-heavy. They require massive amounts of ongoing capital spending, which lowers their capital efficiency and actually punishes their quality score. So, the high quality ratings we see really are driven by strong profitability.

After quality, the number of “Bullish” factor ratings really drops off. Only 12 rate as “Bullish” on growth, nine on momentum and volatility, and eight on value.

Growth at a Discount

Investors remain hungry for growth right now. But they’re also becoming more sensitive to value.

So, let’s dig even deeper into the sector. I ran a screen for all materials stocks that rate as “Bullish” on both their growth and value factors.

Some of these stocks will look familiar. Both Newmont (NEM) and Nucor (NUE) made yesterday’s list of big movers.

With gold being in high demand these days, it’s not at all surprising to see Newmont rating a “Strong Bullish” 88 on growth. It also rates a very solid 67 on value, meaning it’s still trading at a very reasonable price.

As I mentioned yesterday, I recommended Newmont earlier this year to my paid subscribers in Infinite Momentum. Given its “Strong Bullish” rating, I expect more gains to come.

Meanwhile, given the massive amount of capital spending on datacenters and other AI infrastructure, large swaths of “old economy” stocks like materials have become de facto AI plays.

Well, CF Industries (CF) is an interesting play if you’re looking for something completely unrelated to tech. CF makes hydrogen and nitrogen products for fertilizers, clean energy and other industrial applications. It rates a “Bullish” 67 on growth, a “Strong Bullish” 89 on value and a “Bullish” overall rating.

Before I sign off, I want to make sure I get something on your radar. I’m putting together a workshop for you on choosing best-in-class Nasdaq 100 stocks … ones that can, I’ve found, beat the so-called “Mag 7” in 2026 and beyond. I’ll be giving you 100%-actionable steps to take if you’re up for the challenge.

More on all this soon … stay tuned!

To good profits,

Adam O’Dell

Editor, What My System Says Today