There are as many theories about what happened this week between the U.S. and Iran as there are people online. But the one thing that markets seem to be thinking today is that the U.S. and Iran avoided open war for the foreseeable future.

The one thing that markets seem to be thinking today is that the U.S. and Iran avoided open war for the foreseeable future.

I wouldn’t be sanguine about that assessment, even though I’m a big believer in the philosophy that “The Market is Always Right.”

The market is always right based on the information it is given. And U.S. President Donald Trump’s unwillingness to answer Iran’s missile strikes on two U.S. bases in Iraq, the first state-based attack on U.S. military targets since World War II, is an enormous sign that something significant has changed.

Iran’s response to the U.S.’s killing of Gen. Qassem Soleimani left Trump a difficult set of options. By not killing any Americans, or by allowing time for the U.S. to get to safety, Iran accomplished its goal of sending a message to the U.S. acceptable for domestic consumption to calm things down.

But at the same time, there are serious implications as to Iran’s missile and electronic warfare capabilities the strike exposes. I’m not going to list them here, but I want to make you aware they exist because they inform the market’s assessment of what happened and, more importantly, what happens next.

Today the situation in gold and oil, the two most important “war-in-the-Middle-East markets” look like we’re headed for a quiet period for the next couple of weeks.

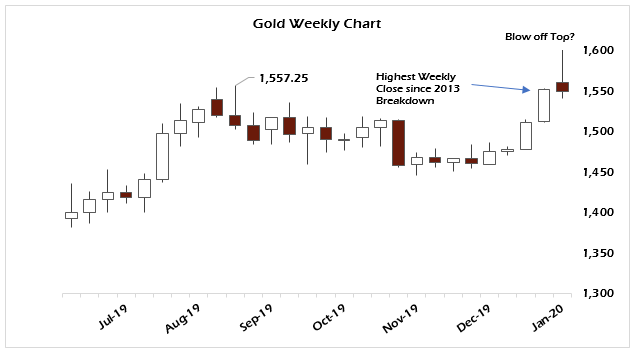

Gold spiked above $1,600 the night of the attack while oil pushed up $2 per barrel. The move in gold was far more significant than that of oil. Once the confusion lifted over what actually happened, gold relaxed back toward the $1,575 area awaiting President Trump’s press conference.

Because of that we’re looking at gold closing this week around $1,550 (as of the Friday New York open). And $1,550 is evidence that gold is not ready to build the next big leg higher. With these events, gold needed a close above last year’s high in of $1,557 (cash market basis, not futures price) to signal a significant change in the gold market.

I’ve been watching gold daily for over 15 years and I’m not surprised by this at all. I would be looking for a retrace from gold here back to the previous resistance level of $1,515.

Potential for war with dramatic events and headlines is almost always a sell signal for gold. And in the case of the U.S./Iranian conflict, neither side is committed to a wider war or we’d already have one.

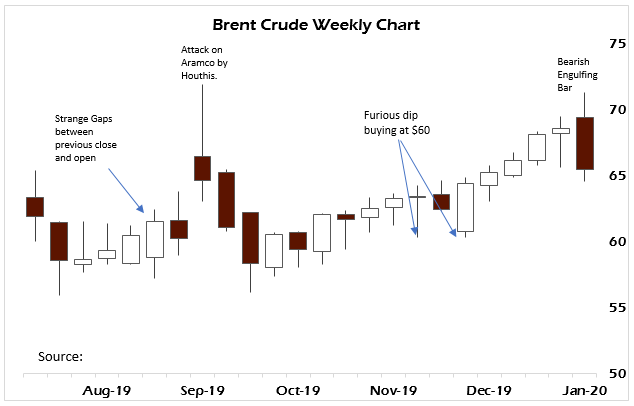

The same is even more true for oil. And oil’s subdued response to Iran’s attack should have been an even bigger warning to investors that events weren’t spiraling out of control.

Oil’s retracement this week was even more dramatic (and technically significant) than gold’s. I’ve noticed for months that oil’s price action (Brent Crude, futures price) has been very odd (see chart below). And all of that “oddness” has been in support of pushing prices higher.

In my estimation it has been to keep oil prices from outright collapsing.

And I remind you that in the grand scheme of things, there are powerful actors in the oil space that can’t see sub-$50-per-barrel oil. Two of them are Saudi Arabia and the majority of U.S. shale oil drillers.

These are the areas of the oil market most exposed to low prices. Russia doesn’t care, it sells most of its oil outside of dollars anyway. Moreover, the average cost of production for Russian oil firms is around $20 per barrel with the Russian ruble trading above RUB60 versus the U.S. dollar. That number would be far higher if the ruble was trading at its pre-2014 oil collapse rate at around RUB32.

China is moving to need fewer dollars to import oil by cutting deals with Middle East producers, like Iran and Iraq, as well as having a successful oil futures platform that is settled in yuan.

This is why the Saudis are in trouble. They are hampered by the peg of its currency, the Riyal, to the dollar. They need much higher oil prices or to break their peg to the dollar to solve their persistent budget problems.

This week’s price action in oil is clear that prices near $70 per barrel are unsustainable and the market is primed to re-test support near $60.

And the reason for this is the real net effect of this week’s fireworks, a resumption of the U.S. dollar rally which was forestalled by a big liquidity push by the Federal Reserve through the repo markets and end of the year effects in foreign markets.

My read on this is that the global demand for dollars just got a kick from behind and a wake-up call that events could spin out of control quickly. In that scenario no one wants to carry a big dollar short into the weekend.

So the move up this week in the US Dollar Index (USDX) is likely the beginning of something bigger. Oil and gold will both struggle in a strong dollar environment without the imminent threat of further hostilities between the U.S. and Iran.

We may have dodged a bullet on bombs dropping from the sky and that’s a very good thing, but that threat isn’t gone, just receded for a time. In that environment it will be difficult for the Fed to maintain control over short-term interest rates.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.