So far, the S&P 500 is up more than 17% in 2024.

That might not sound like jaw-dropping news … until you realize that the historical average annual return on the S&P 500 is just 10%.

In other words, if the market keeps up this pace in the second half of the year, it will deliver more than triple the average return across the last 100 years!

Now I know what you’re thinking: “This surely doesn’t feel like an outstanding year for stocks.”

And you’re right.

America is currently staring down a chaotic presidential election along with the potential for a long-delayed recession. Elsewhere in the world, conflict rages on from Ukraine to the Gaza Strip.

It’s getting harder and harder to find a “bright spot” for the global economy outside of the fast-growing AI sector. We’re also seeing signs that certain stocks are beyond overstretched at today’s valuations.

I’m not predicting a major correction in stocks (at least not yet).

You’ll be the first to know when I do.

But we’re likely in for a particularly brutal “September Effect,” with post-summer selling knocking down numerous share prices by a substantial amount.

As always, I’m urging you to keep a close eye on your investments. And the Green Zone Power Ratings system can help you do exactly that…

Optimize Your Stocks and Beat the Market 3-to-1 (in just FIVE Minutes)

The Green Zone Power Ratings system targets anomalies within stocks.

You can think of an anomaly as a certain “characteristic” — a favorable characteristic that some stocks have … a characteristic that most “ordinary” stocks don’t have.

You may look at the S&P 500 and see it’s up 4% over a month. But then you see “Stock A” has gained 8% in the same amount of time. You can bet your bottom dollar that “Stock A” possesses one or more of the anomalies that lead to above-average performance.

We call these anomalies “factors.” Within my ratings system, I track six of these factors and rank all stocks according to those characteristics.

These factors are responsible for driving the outperformance of market-beating stocks.

My system breaks a stock down into six simple factors:

- Momentum.

- Size.

- Volatility.

- Value.

- Quality.

- Growth.

These six factors are equally weighted and then combined to give us a stock’s overall Green Zone Power Rating.

By using these ratings, you can effectively “shortcut” hours upon hours of research and see within seconds whether a stock is actually worth owning.

This Stock’s Rating Bucks the “Bullish” AI Tech Trend…

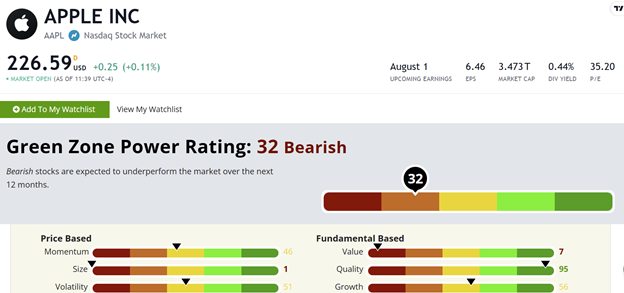

To see the system in action, let’s take a glance at Apple Inc’s (Nasdaq: AAPL) Green Zone Power Ratings:

This snapshot probably comes as a surprise to you. “Apple … bearish?”

But that’s what my system is saying based on existing technical and fundamental data for the stock.

AAPL shares have soared more than 345% over the last five years, but that momentum has decidedly slowed in the last year. Volatility is likewise unfavorable, with multiple extended declines over the last year.

AAPL still scores off the charts on Quality, and rightly so. Apple’s return on equity (ROE) — the measure of the financial performance of a company by dividing its net income by shareholder equity — is particularly strong. AAPL’s current ROE is 147.3%, compared to the communication equipment industry average of negative-1.5%.

But like the other mega-cap tech stocks, AAPL struggles with extreme low scores on Value (due to its premium valuation) and Size (due to its $3.4 trillion market cap). There’s very little room for AAPL to grow in either regard.

By referencing this score against our universe of back-tested stock data, Green Zone Power Ratings estimates AAPL will underperform the market over the next 12 months.

What should you do if you already own shares?

Which Action to Take on Ratings

It’s always great news to see a “Bullish” or “Strong Bullish” rating for a stock in your portfolio. That’s a strong confirmation that you’re on the right track, and it’s only a matter of time before the gains start stacking up.

But when a Green Zone Power Rating is “Bearish,” you still have a few critical options that can limit your losses and maximize your bottom line:

First, it’s important not to panic or start worrying.

Green Zone Power Ratings are based on existing data that could change tomorrow or even later today. One great quarterly report or a landmark product announcement could instantly improve the company’s score.

And all a bearish rating means is that the stock is likely to underperform from here … not necessarily post a loss. Year to date, AAPL‘s 21% gain has a slight edge on the S&P 500. It’s going to take a massive sell-off to erase those gains.

At the same time, a bearish rating still means you should start paying closer attention to the position.

For many investors, AAPL has been a serious long-term winner. So why not take some of that cash off the table when there’s a pullback? Set a stop-loss on a small portion of your position. That way, you’re effectively cashing out some of your gains before you’re forced to give them back to the market.

Or if you’re especially bullish on the stock over the long term, you could look at a lower rating as something of a “dinner bell” and start setting aside cash to buy up shares when they pull back.

The choice is always yours. So make the most informed choice you possibly can. After all — knowing is half the battle. And Green Zone Power Ratings gives you a massive (and easy-to-digest) edge there.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets