On March 13, 1986, a little-known tech company based in Washington launched its initial public offering on the Nasdaq exchange.

By December 30, 1999, that company — Microsoft Corp. (MSFT) — had jumped 60,393%, from a split-adjusted IPO price of $0.10 to nearly $59 per share:

Its rise started in 1990 when the company’s total annual sales eclipsed $1 billion for the first time. That followed the release of Windows 3.0, a long-term partnership with computer giant IBM and the first Office for Windows software bundle.

Microsoft was a hot stock on Wall Street. It had cornered the market on computer software.

And outside of a few bumps in the road — like its $8 billion deal to buy Finnish smartphone maker Nokia — Microsoft remains a stalwart stock that has now jumped an incredible 442,721% since its IPO!

It beat out competition like Intel Corp., Qualcomm and Cisco because it didn’t rest on its laurels … it disrupted its own software business.

And now, another company is using that same blueprint to dominate the tech market…

The Rise of 3D Graphics … and AI

Noting a rise in the computer gaming industry, Jensen Huang, Chris Malachowsky and Curtis Priem had a vision.

They wanted to introduce 3D graphics to video games — games were built in 2D prior to that.

In 1993, they formed Nvidia to accomplish that vision. By 1999, they had created the first graphics processing unit (GPU). These GPUs render smooth graphics at a faster rate, giving a more realistic and immersive visual experience.

Business chugged along, and, like Microsoft, Nvidia Corp. (NVDA) became a leader in its industry…

NVDA stock soared 73,336% from its IPO in 1999 to 2022!

During that time, developers were working on a new technology that would propel NVDA to its elite status on Wall Street today…

We’re talking about artificial intelligence (AI), of course!

Because Nvidia’s innovative GPUs can perform thousands of operations simultaneously, they are critical to neural networks, aka deep learning … a type of AI.

So, NVDA started cranking out GPUs for companies like Google and Microsoft In the race for AI disruption. But that work was behind the scenes. Unless you had a computer engineering background, you knew little, if anything, about it.

It wasn’t until November 2022 that the hype of AI took off with the release of ChatGPT, an AI-based chatbot and virtual assistant.

That’s when Nvidia became a household name … and a stock market darling.

NVDA Stock Soars 765% Since ChatGPT Public Launch

Since ChatGPT hit the open market, NVDA’s stock has jumped 765.6%! The company’s market cap has grown from $4.1 billion in 2009 to $3.5 trillion in February 2025.

Now, the demand for NVDA’s chips is becoming greater than the company can handle.

During last week’s earnings call, Huang told analysts that as many as 20,000 generative AI startup companies are standing in line and waiting for NVDA’s AI chips.

At the same time, the company recorded a 262% jump in revenue year-over-year and, due to its expanding stock price, a 10-for-1 stock split.

NVDA’s Green Zone Power Ratings Journey

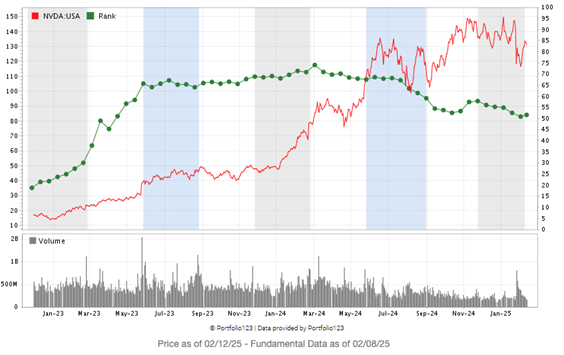

You can track NVDA’s path to becoming a Wall Street darling using Adam O’Dell’s powerful Green Zone Power Ratings system.

The chart below shows its “ratings journey.”

NVDA Falls Into “Neutral” Territory

When ChatGPT was released in November 2022, NVDA stock was actually in “Bearish” territory — which seems hard to believe now.

But once news started to spread about how its GPUs powered the AI revolution, that quickly changed.

NVDA’s rating spiked, and soon after, shares started to climb. The Green Zone Power Ratings system told us the stock would beat the broader market by 2X over the next 12 months, and that was clearly an understatement looking back.

After a broader Big Tech sell-off anchored by a decline in NVDA share price, the stock has now fallen into a “Neutral” rating.

Bottom line: NVDA was once the darling of tech stocks… everyone wanted a piece.

While the AI revolution is still happening, there are more and more players joining the game.

But NVDA’s monopoly on AI GPUs may now be coming to an end.

Regardless, the Green Zone Power Ratings system currently tells us to sit on the sidelines and wait when it comes to NVDA stock.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets