I’ve spent the last few days poring over Warren Buffett’s latest annual letter to shareholders.

If for no other reason than to gain insights from one of the foremost investing minds of our time.

In Saturday’s letter, Buffett discussed the sheer size of Berkshire Hathaway Inc. (NYSE: BRK.B), mentioning that the company’s $894 billion market cap now occupies 6% of the total S&P 500 companies.

By that accounting, Buffett noted, there are not many companies left in the market with the ability to “move the needle” at Berkshire.

Buffett’s company needs to invest massive capital to see meaningful returns, and that means avoiding almost all stocks with smaller market caps. He’s not looking to acquire every company under the sun.

This philosophy gives us smaller investors a clear advantage over Buffett and Berkshire Hathaway.

He’s picked through everything, but we haven’t.

Adam O’Dell’s proprietary Green Zone Power Ratings system helps you cut through the noise and find stocks that could move your needle… or ones to steer clear of.

I thought it would be an interesting exercise to run Berkshire’s top three holdings through the system and see what it tells us about Buffett’s investment decisions.

While the Oracle of Omaha admits his company is kind of stuck looking for the right investment, you can be nimble and find stocks that are best suited for today’s market.

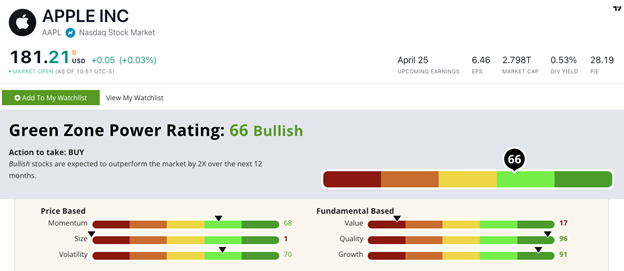

Buffett Top Stock No. 1: Apple Inc.

By far, the largest position in the Berkshire portfolio is Apple Inc. (Nasdaq: AAPL).

More than 50% of the portfolio is occupied by the technology giant — $174.3 billion, to be exact.

And Adam’s system points to a solid year ahead for AAPL.

Apple stock rates 66 out of 100 on Adam’s Green Zone Power Ratings system. That means we are “Bullish” on the stock and expect it to outperform the broader market by 2X over the next 12 months.

The stock’s overall rating is buoyed by its 96 on Quality. That is thanks to its strong returns on assets, equity and investment.

Apple has a return on equity of 154.3%, compared to the communication equipment industry average of just 2.5%.

Its 91 on Growth comes from a 15.8% jump in earnings per share quarter over quarter.

Overall, AAPL is a strong stock with excellent quality and growth.

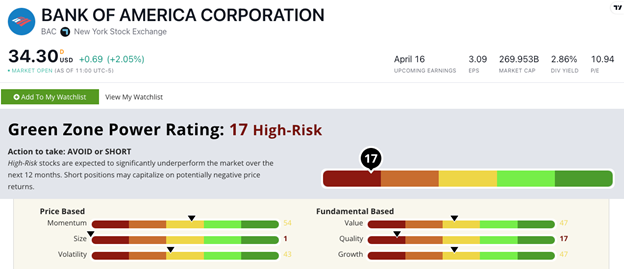

Buffett Holding No. 2: Bank of America Corp.

The second-largest holding in Buffett’s portfolio is Bank of America Corp. (NYSE: BAC).

This Charlotte-based global banking stalwart makes up 10% of Buffett’s overall portfolio — or $34.8 billion.

And Adam’s system points to a rough road ahead for America’s second-largest bank.

BAC stock scores 17 out of 100 on our system. That means we consider the stock “High Risk” and expect it to significantly underperform the broader market over the next 12 months.

In addition to its 1 on Size, BAC is hit hard with its 17 on Quality. Its quality score comes in part from its operating margin of 16.7%, compared to its industry average of 27.4%.

BAC’s remaining ratings are in line with the rest of the industry, meaning it neither over- or underperforms its peers.

But if there’s a top holding in the Berkshire portfolio that could drag its performance down over the next year, BAC fits the bill.

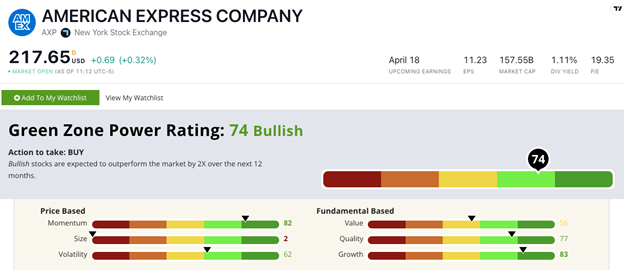

Buffett Holding No. 3: American Express Co.

Buffett’s third-largest holding in his portfolio is American Express Co. (NYSE: AXP).

AXP makes up 8.2% of his total holdings — or $28.4 billion.

And if Buffett is following Green Zone Power Ratings, he may want to up that position.

At a 74 out of 100 on our system, AXP also rates as “Bullish.”

The stock’s 83 on Growth stands out due to a one-year annual sales growth rate of 21.1% and an earnings growth rate of 14%.

AXP earns an 82 on our Momentum factor as the stock has jumped more than 24% in the last year.

Its $157 billion market cap does make it one of the larger companies we rate (2 on Size) and its price-to ratios vary little from the specialty finance industry averages — earning it a “Neutral” 56 on Value.

Bottom line: Whether you invest like Buffett or not, you can’t argue with his results.

However, because Berkshire Hathaway is now so large, its pool of investment opportunities is considerably smaller than it was even just five years ago.

You don’t have to worry about being a smaller and nimbler investor. Your pool is as deep and wide as you want it to be.

And Adam’s Green Zone Power Ratings system is the perfect tool to help you jump into the deep end and invest like a pro.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets