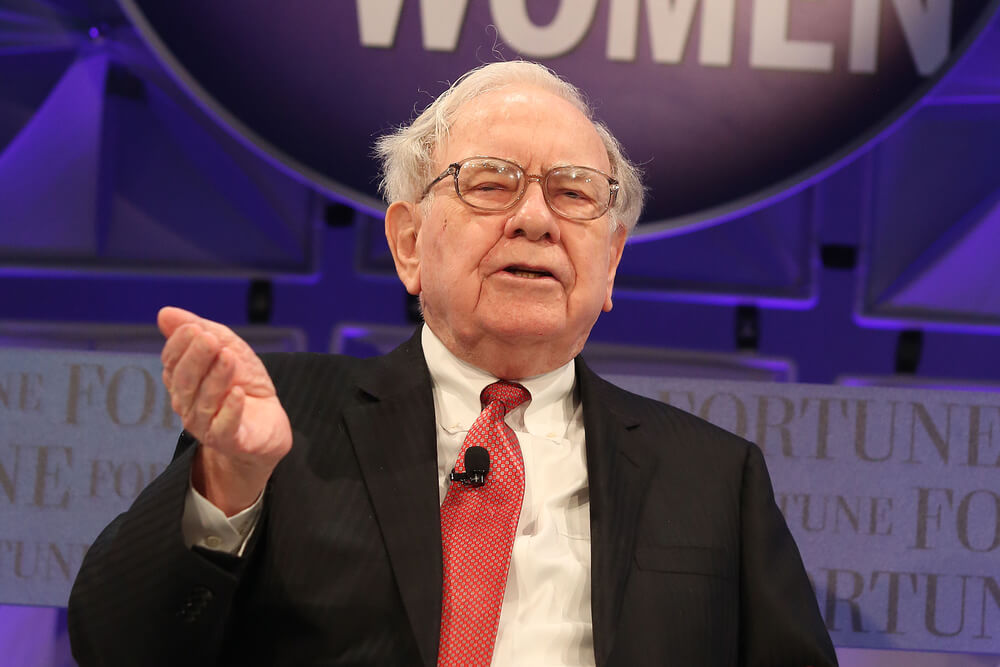

Warren Buffett’s Berkshire Hathaway will finance a bid by Occidental Petroleum for Anadarko Petroleum, potentially upending Chevron’s $33 billion offer for the energy company.

At stake are choice oil and gas fields spread across Texas and New Mexico, including a 75-mile-wide corridor across the Delaware Basin, a region bountiful with natural gas.

Anadarko accepted a buyout bid from Chevron earlier this month, but it’s now considering Occidental’s offer worth about $57 billion in cash and stock, including debt and book value of non-controlling interest. Chevron’s offer would be worth about $50 billion by the same metric.

While Chevron maintained Tuesday that its signed agreement with Anadarko is still superior, with Buffett stepping in, many saw the advantage swing decidedly toward the much smaller Occidental and its CEO, Vicki Hollub.

When Chevron announced the deal for Anadarko on April 12, it came as a surprise to Hollub. She had been pursuing Anadarko for two years and was in what she considered to be friendly negotiations, although she was aware there was interest elsewhere in Anadarko.

“We are thrilled to have Berkshire Hathaway’s financial support of this exciting opportunity,” Hollub said Tuesday in a prepared statement. “We look forward to engaging with Anadarko’s board of directors to deliver this superior transaction to our respective shareholders.”

When Anadarko said Monday that despite its agreement with Chevron, it was reviewing Occidental’s bid, it set up the rare possibility of a bidding war in the oil patch.

“Even if we look back at two decades of history, this is virtually unprecedented,” said Pavel Molchanov, senior vice president and equity research analyst at Raymond James & Associates.

If Anadarko does walk away from Chevron, it would have to pay a $1 billion breakup fee under its agreement.

Yet the entry of Buffett’s Berkshire Hathaway could lead to Chevron’s exit. That was the perception on Wall Street Tuesday.

Shares of Chevron rose 3% with many investors believing it would choose not to escalate the fight for Anadarko.

In his annual letter to shareholders this year, Buffett said he was having difficulty finding large-scale investments with which to plow a portion of his roughly $130 billion pile of cash and short term investments.

It appeared Tuesday that he found at least a partial solution in backing Occidental’s quest for Anadarko.

Berkshire will invest $10 billion in Occidental. It would receive 100,000 preferred shares plus a warrant to purchase up to 80 million shares of common stock at an exercise price of $62.50 each. The preferred stock will accrue dividends at 8% per year. Occidental shares traded at around $58, down 2%, Tuesday morning.

The investment is contingent on Occidental’s acquisition of Anadarko.

Berkshire Hathaway Inc., based in Omaha, Nebraska, owns a range of businesses including insurance, railroads, jewelry stores as well as major investments in American Express, IBM and Wells Fargo & Co.

Berkshire also holds interests in the energy sector. Berkshire owns several major utilities, including PacifiCorp, MidAmerican Energy and NV Energy. It also owns Northern Natural Gas and AltaLink energy transmission.

Besides utilities, Berkshire owns special chemical maker Lubrizol and holds nearly 12 million shares in Phillips 66.

It’s not Berkshire’s track record in the energy sector, however, that would be the most valuable asset to Occidental. It’s Buffett’s ability to make deals happen. The Occidental financing is similar to several deals Berkshire has made since the financial crisis.

Berkshire helped Mars acquire Wrigley, and Burger King to acquire Tim Hortons. Buffett also helped Dow Chemical buy Rohm and Haas.

There have also been several other deals where Berkshire offered financing on preferred terms to companies that weren’t associated with a deal. Those include Goldman Sachs, General Electric, Harley Davidson and Bank of America.

© The Associated Press. All rights reserved.